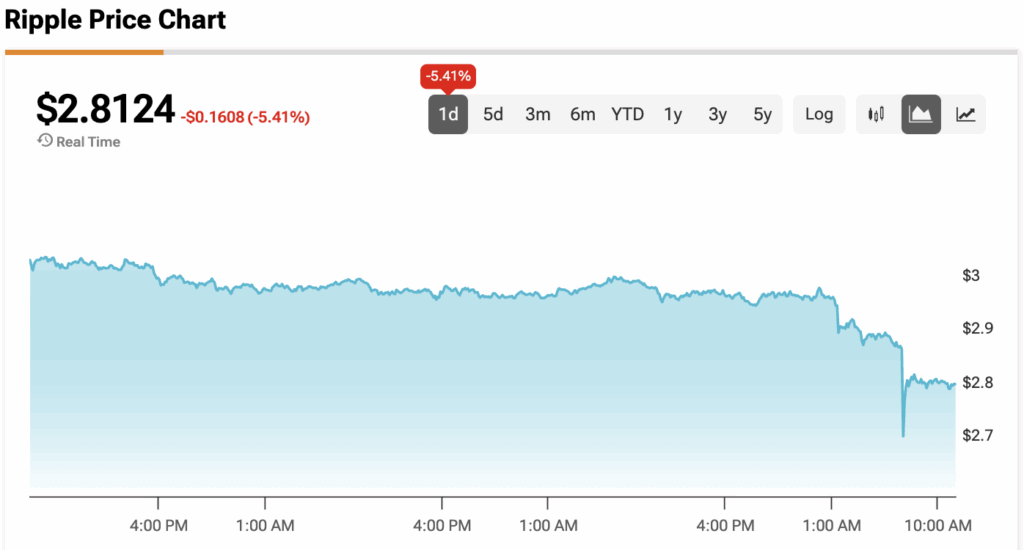

XRP’s (XRP-USD) highly anticipated ETF launch turned into a mixed blessing. The token briefly held above $3.00 on September 21 before tumbling to $2.91 in the overnight hours. The drop came even as the XRP ETF set a record with $37.7 million in opening-day volume, the biggest debut for any ETF in 2025.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The sudden reversal was tied to institutional profit-taking. Analysts said the sheer size of the sell-off showed that some large players used the ETF excitement as a chance to exit positions. This triggered cascading liquidations, wiping nearly $8 million in longs and accelerating the decline.

Midnight Crash Shakes Confidence

The steepest part of the decline happened during the midnight session, when XRP dropped from $2.97 to $2.91 in a matter of minutes. More than 261 million tokens changed hands, quadruple the daily average, confirming that the move was large-scale institutional selling.

While XRP clawed back slightly to $2.94 before closing at $2.92, it could not reclaim the $3.00 mark. Traders said the failed rebound leaves a “resistance cluster” just below that level, which may keep a lid on price action until new catalysts appear.

Technical Picture Points to Stalemate

Charts now show a narrow but important battleground. Resistance has hardened at $2.98–$3.00, where repeated rejections have capped rallies. Support is holding at $2.91–$2.92, the zone tested repeatedly during the overnight crash. For now, XRP looks set to consolidate in that tight band.

Volume remains the critical signal. The overnight explosion to 261 million confirmed that sellers are still in control. Unless buying flows from the ETF or broader crypto sentiment pick up, analysts warn that XRP could retest the $2.90 or even $2.85 levels before attempting another breakout.

What Are Traders Are Looking Out For?

The key question is whether XRP can turn $3.00 into a sustainable floor. This will likely depend on whether the ETF sees steady inflows in the coming days or if its record-breaking debut was a one-off spike.

Macroeconomic forces also loom. The Federal Reserve’s September rate cut is expected to support risk assets, but rising exchange reserves for XRP hint at an overhang of supply waiting to be sold. For bulls, this means patience and conviction will be tested in the coming weeks.

At the time of writing, XRP is sitting at $2.8124.