Chinese electric vehicle (EV) maker XPeng’s (XPEV) U.S.-listed shares rose 2.4% on Friday (5% in Hong Kong) after Morgan Stanley added the company to its Global Emerging Markets and Asia Pacific excluding Japan (APxJ) Focus Lists, replacing rival BYD (BYDDF) in both. Morgan Stanley analyst Tim Hsiao reiterated a Buy rating on XPEV stock with a price target of HK$108 (28). The analyst cited XPeng’s robust model pipeline and its position as a “leading AI adopter” as the reasons for adding the company to Morgan Stanley’s Focus Lists.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley Is Confident About XPeng’s Prospects

Hsiao expects XPeng to deliver solid monthly sales in 2025 and continue to expand in 2026, driven by the successful launches of several models, a strong pipeline, and its new super electric hybrid system. He expects notable margin improvement when the company starts seeing benefits from scaling its new models.

The analyst believes that XPeng’s announcement of a strategic partnership with Volkswagen (VWAGY) could be a critical step for vehicle makers to move beyond the traditional business model and generate a new revenue stream mainly from higher-margin and recurring software and services.

The two companies recently signed an agreement to expand their technical cooperation. They will jointly develop a technology architecture that will not only be integrated into Volkswagen’s BEV (battery electric vehicle) platform, but also deployed on its gasoline and plug-in hybrid platforms in China.

Is XPEV Stock a Good Buy?

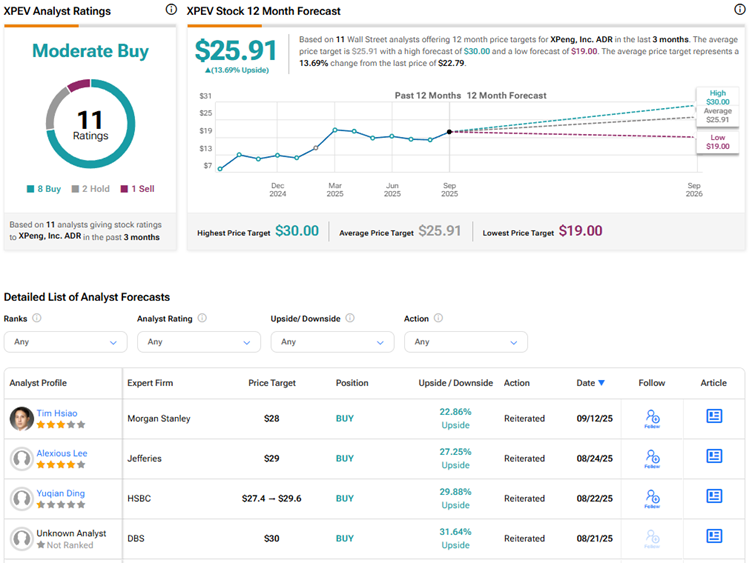

Currently, Wall Street has a Moderate Buy consensus rating on XPeng stock based on eight Buys, two Holds, and one Sell recommendation. The average XPEV stock price target of $25.91 indicates 13.7% upside potential. XPEV stock has rallied 93% year-to-date, driven by the company’s impressive deliveries despite intense competition in the Chinese EV market.