Chinese EV major, XPeng (NYSE:XPEV) slid in pre-market trading after the company reported an adjusted diluted net loss of $0.44 or RMB3.23 per ADS as compared with a loss of RMB2.59 per ADS in the same period last year. This loss was narrower than analysts’ expectations of a loss of $0.47 per share.

The company’s total revenues increased by 25% year-over-year to $1.17 billion or RMB8.53 billion in the third quarter but fell short of consensus estimates of $1.2 billion. XPeng’s total vehicle deliveries hit 40,008 in Q3, indicating a sequential rise of 72.4%.

He Xiaopeng, Chairman and CEO of XPENG commented, “In 2023, XPENG was the first mover in reaching the inflection point for both the development and mass adoption of ADAS [Advanced Driver Assistance System] technologies. I believe that over the next five years, ADAS technologies will experience increasing and massive acceptance by consumers.”

Looking forward, in the fourth quarter, the company anticipates total vehicle deliveries to be between 59,500 and 63,500, indicating a year-over-year increase in the range of 101.2% to 114.7%. The company has projected Q4 revenues to be between RMB12.7 billion and RMB13.6 billion.

Is XPEV Stock a Good Buy?

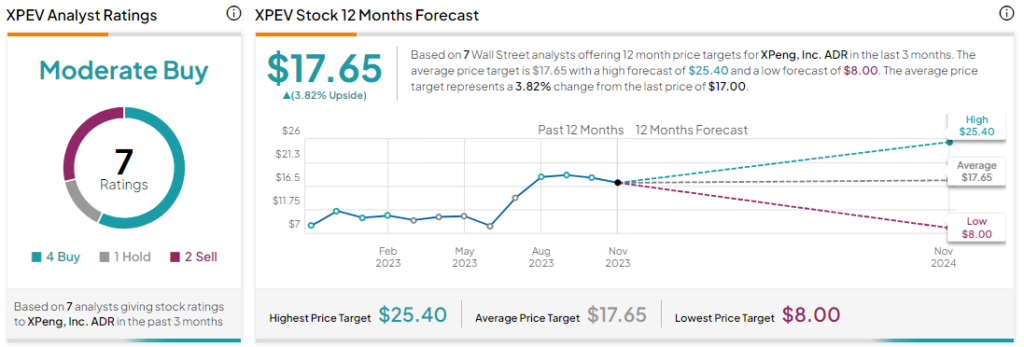

Analysts are cautiously optimistic about XPEV stock with a Moderate Buy consensus rating based on four Buys, one Hold, and two Sells. XPEV stock has rallied more than 65% year-to-date with the average XPEV price target of $17.65 implying an upside potential of 3.8% at current levels