Oil giant ExxonMobil’s (NYSE:XOM) $60 billion takeover of Pioneer Natural Resources (PXD) has run into trouble. The U.S. Federal Trade Commission (FTC) has sent a second request for more information about the deal as part of its regulatory review process. The companies still hope the takeover will be approved by June next year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In November, the U.S. Senate Majority Leader, Charles Schumer, and 22 other Democratic senators wrote to the FTC. They stated that big-ticket acquisitions by major oil and gas companies like Exxon and Chevron (CVX) could result in higher oil prices that could hamper consumers.

According to a Reuters report, Schumer reiterated that the Exxon deal “has all the hallmarks of harmful, anticompetitive effects.” He added, “If this merger were to go through, it would most certainly raise gas prices for families across the country.”

ExxonMobil Boosts Share Buybacks

Meanwhile, ExxonMobil also announced an update to its Corporate Plan through 2027. The oil giant plans $17.5 billion in share repurchases in 2023. After the closing of the Pioneer merger, ExxonMobil is targeting over $20 billion in stock buybacks annually through 2025, “assuming reasonable market conditions.”

The company intends to grow its earnings and cash flow annually by $14 billion from the end of this year through 2027. Exxon’s optimism arises from the company continuing to lower its structural costs and improve its business mix.

The firm intends to deliver cost savings of $6 billion by 2027, bringing the total structural cost savings to around $15 billion compared to 2019.

Regarding XOM’s upstream capital investments, 90% is expected to yield over 10% returns at a Brent price of $35 per barrel. The company anticipates oil and gas production in 2024 to be 3.8 million oil-equivalent barrels per day, rising to 4.2 million by 2027, driven by growth in the Permian and Guyana basins.

The company foresees annual capital expenditures in the range of $23 billion to $25 billion in 2024 and between $22 billion and $27 billion from 2025 through 2027. The increase in capex from 2025 is due to the rise in opportunities for Low Carbon Solutions to reduce emissions.

ExxonMobil is looking at “pursuing more than $20 billion of lower-emissions opportunities through 2027, which represents the third increase in the last three years, from an initial $3 billion in projects identified in early 2021.”

Is XOM a Buy or Sell?

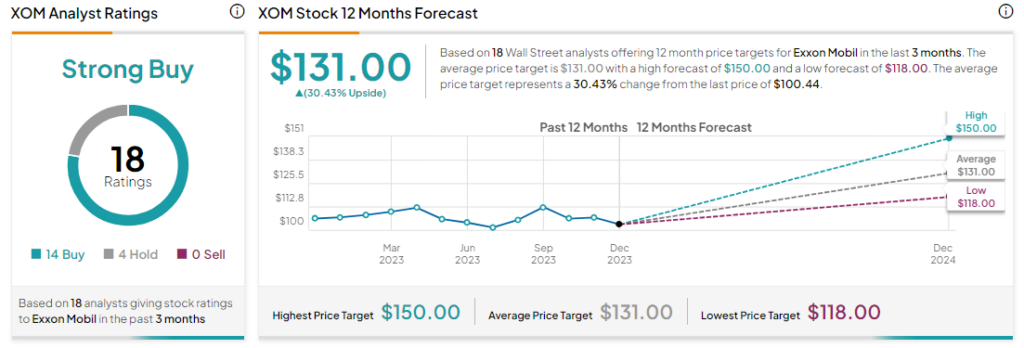

Analysts remain bullish about XOM stock with a Strong Buy consensus rating based on 14 Buys and four Holds. Over the past three months, XOM has slid by more than 10%, and the average XOM price target of $131 implies an upside potential of 30.4% at current levels.