Energy stocks have been surging in the past few months. Here are three great energy ETFs that you can invest in to gain exposure to one of the market’s hottest sectors: the Energy Select Sector SPDR Fund (NYSEARCA:XLE), the Vanguard Energy ETF (NYSEARCA:VDE), and the Fidelity MSCI Energy ETF (NYSEARCA:FENY).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on all three of these ETFs, as they give investors exposure to top oil and energy stocks, feature a bevy of top holdings with strong Smart Scores, and pay attractive dividends. Importantly, all three also feature low fees, which help investors save money and preserve their capital as their portfolios grow.

Let’s take a look at the overall setup for energy stocks and a closer look at each of these ETFs below.

Energy Bull Market Picks Up Steam

Energy stocks have been red hot in 2024, as crude oil prices have surged to a 19% gain year-to-date.

Oil prices are climbing higher for a number of reasons. OPEC+ countries are keeping production cuts in place at least through the end of the second quarter at a time when demand seems to be picking up. Further, demand for gasoline in the U.S. is moving higher ahead of what is expected to be a busy summer travel season, and European countries are moving to replenish their energy reserves.

Meanwhile, geopolitical tensions have added further fuel to the fire. Ukraine has attacked Russian oil facilities, while the escalating conflict in the Middle East hasn’t helped matters, as this region accounts for a huge amount of the world’s oil production.

In the longer term, oil could have plenty of upside amid sustained demand and a lack of investment in new oilfield projects, a well-documented setup that could lead to lower supply in the future. Contrary to the belief that oil demand will recede over time, JPMorgan (NYSE:JPM) analysts forecast that world demand for oil will increase by 5.5 million barrels per day to 106.9 million by 2030 due to population growth and increasing energy usage in developing markets.

Late last year, these analysts explained that due to “robust global demand and tight supply, we could be entering the next wave of the energy supercycle.” The increasing demand and supply constraints could lead to a 1.1 million barrel per day shortfall in 2025 and a much greater 7.1 million barrel per day deficit by 2030.

In addition to these short-term and long-term catalysts, another thing I like about energy stocks is that, overall, they are still fairly cheap, even after their strong runs in 2024. For example, XLE and VDE (discussed further below) have average price-to-earnings ratios of just 13.2x and 11.5x, respectively, versus a significantly higher average P/E multiple of 23x for the S&P 500 (SPX).

Energy Select Sector SDPR Fund (NYSEARCA:XLE)

With $42.1 billion in assets under management (AUM), XLE is by far the biggest and best-known energy ETF. And it’s a pretty good one too. The popular Select Sector SPDR ETF has gained 15.6% year-to-date. Not only that, but it sports an attractive 3.06% dividend yield and charges a very favorable expense ratio of just 0.09% (meaning that an investor in the fund will pay just $10 in fees on a $10,000 investment annually).

XLE invests in the energy sector of the S&P 500 Index and “seeks to provide precise exposure to companies in the oil, gas and consumable fuel, energy equipment and services industries.”

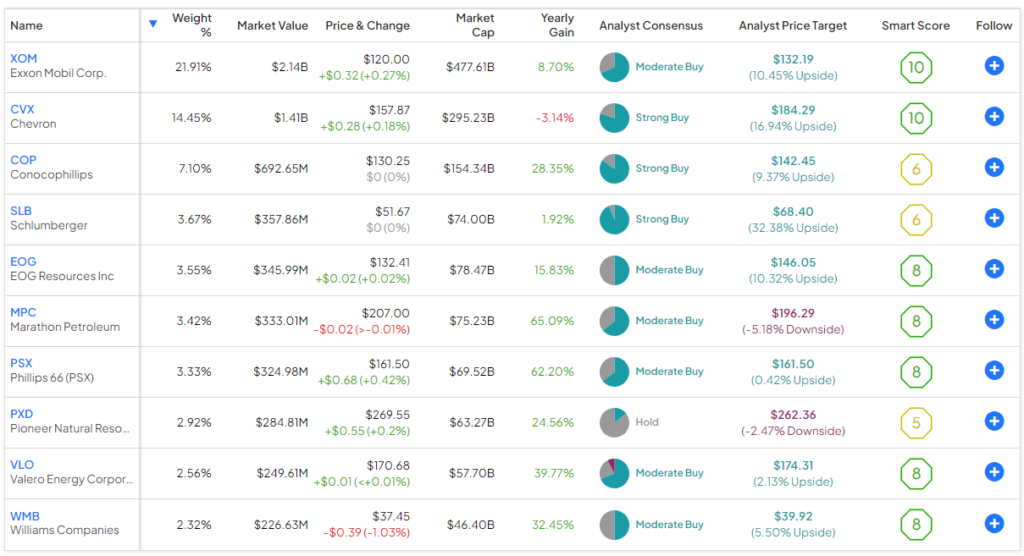

It owns 24 stocks, and its top 10 holdings account for a rather high 76.3% of the fund. Below, you’ll find an overview of XLE’s top 10 holdings using TipRanks’ holdings tool.

One thing to note here is that ExxonMobil (NYSE:XOM) makes up nearly a quarter of the fund, while Chevron (NYSE:CVX) makes up 16.3%. Together, the two supermajors combine to make up nearly 40% of XLE’s assets. This isn’t a bad thing per se, but it means investors should be aware that XLE isn’t that diversified and features a lot of concentration towards these two stocks.

That said, these look like two pretty good stocks to have large allocations toward, as both earn ‘Perfect 10’ Smart Scores from TipRanks’ Smart Score system.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. In addition to the perfect 10 Smart Scores posted by ExxonMobil and Chevron, other top 10 holdings, including EOG Resources (NYSE:EOG), Marathon Petroleum (NYSE:MPC), Valero Energy (NYSE:VLO), and Williams Companies (NYSE:WMB) all feature Outperform-equivalent Smart Scores of 8 or better.

Lastly, XLE itself features an Outperform-equivalent ETF Smart Score of 8 out of 10.

Is XLE Stock a Buy, According to Analysts?

Turning to Wall Street, XLE earns a Moderate Buy consensus rating based on 20 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average XLE stock price target of $105.01 implies 10.3% upside potential.

Vanguard Energy ETF (NYSEARCA:VDE)

According to Vanguard, VDE “seeks to track the performance of a benchmark index that measures the investment return of stocks in the energy sector.” It “includes stocks of companies involved in the exploration and production of energy products such as oil, natural gas, and coal.”

Like XLE, the VDE ETF invests in U.S. energy stocks, but its expense ratio is slightly higher at 0.10%. It also has a similar dividend yield of 2.91%.

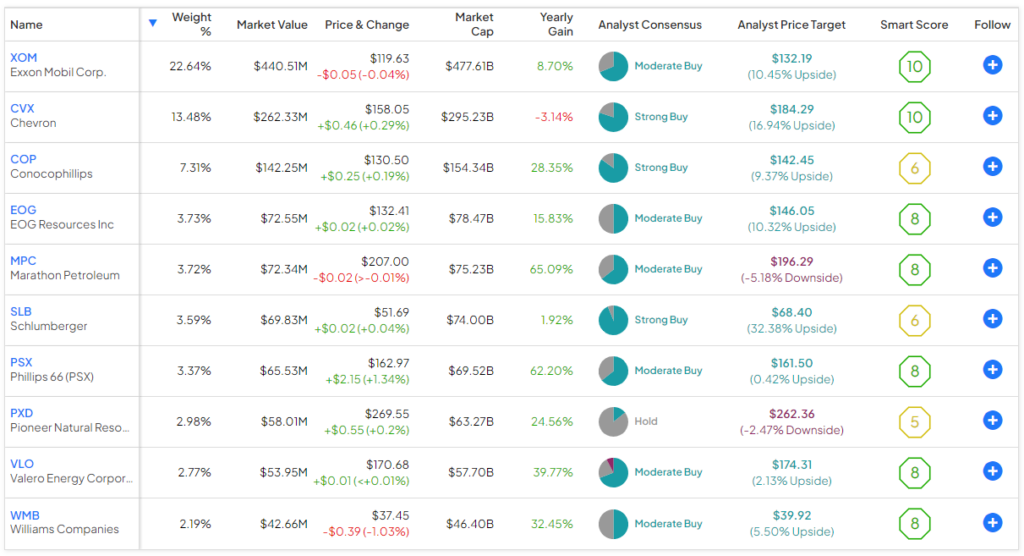

VDE is more diversified than XLE and a bit less concentrated. It owns 116 stocks, and its top 10 holdings make up a slightly lower 65.2% of assets. VDE’s top 10 holdings are identical to those of XLE’s, although with different weightings, as you’ll see below.

ExxonMobil and Chevron combine to make up a slightly lower (but still relatively high) 36.4% of the fund. Because they feature an identical group of holdings, like XLE, seven of VDE’s top 10 holdings feature Outperform-equivalent Smart Scores.

VDE itself features an Outperform-equivalent ETF Smart Score of 8.

Is VDE Stock a Buy, According to Analysts?

Turning to Wall Street, VDE earns a Moderate Buy consensus rating based on 92 Buys, 23 Holds, and two Sell ratings assigned in the past three months. The average VDE stock price target of $147.97 implies 11.5% upside potential.

Fidelity MSCI Energy ETF (NYSEARCA:FENY)

Finally, let’s take a look at asset management giant Fidelity’s entry into the space: the Fidelity MSCI Energy Index ETF. Like XLE and VDE, FENY is an index fund. It invests “at least 80% of assets in securities included in MSCI USA IMI Energy 25/50 Index,” according to Fidelity. This is a modified market cap-weighted index investing in large-, mid-, and small-cap U.S. energy stocks.

FENY is constructed in a fairly similar manner to VDE. In fact, they both own 116 stocks, and FENY’s top 10 holdings make up a remarkably similar 65.8% of its assets. Below, you’ll find an overview of FENY’s top 10 holdings.

Like the other two funds discussed above, FENY has a fairly high exposure to ExxonMobil and Chevron (36.1%).

Its top 10 holdings are identical to the other two funds, except with slightly different weightings. As such, the ETF has an Outperform-equivalent ETF Smart Score of 8 out of 10.

FENY yields 2.8%, and it is actually slightly cheaper than the already-inexpensive XLE and VDE, with a paltry expense ratio of just 0.08%.

Is FENY Stock a Buy, According to Analysts?

Turning to Wall Street, FENY earns a Moderate Buy consensus rating based on 94 Buys, 21 Holds, and two Sell ratings assigned in the past three months. The average FENY stock price target of $29.05 implies 11.8% upside potential.

The Takeaway: Three Great ETFs

In conclusion, these ETFs are great ways to invest in the red-hot energy sector. I’m bullish on these ETFs due to their exposure to leading energy stocks, strong Smart Scores of their holdings, attractive dividend yields, and favorable expense ratios. These elements make them appealing to investors looking to benefit from the current positive trends in energy stocks.

There isn’t much separating the three as they share identical top 10 holdings, feature similar dividend yields, and similar expense ratios. I like all three, but if I had to narrow it down to one choice, I’d go with FENY, as it is slightly cheaper than the other two (although just by a hair) and because it offers a bit more diversification than XLE (and a similar amount to VDE).