Wynn Resorts, Limited (WYNN) has posted better-than-expected results for the third quarter of 2021. The casino and resorts operator has reported an adjusted loss of $1.24 per share, narrower than analysts’ expectations of a loss of $1.36 per share. The company had registered a loss of $7.04 per share in the same quarter last year.

Revenue of $994.6 million increased substantially from $370.5 million a year ago and surpassed the Street’s estimate of $942.6 million. The upside was primarily due to higher revenue across all units, especially casino, rooms and food & beverage. (See Wynn stock chart on TipRanks)

Adjusted Property EBITDA at the company’s integrated resort properties increased $89.8 million, $32.5 million, $163.2 million and $38.6 million, year-over-year, at Wynn Palace, Wynn Macau, Las Vegas Operations and Encore Boston Harbor, respectively.

Wynn’s CEO, Matt Maddox, said, “With our recent investments in innovative food and beverage offerings, a new convention facility in Las Vegas and a revamped casino loyalty program, the best days are ahead for our business in North America. And while there have been some fits and starts along the road to recovery in Macau, we are confident that Macau will benefit from the return of consumer demand as we progress through 2022.”

Price Target

Following the release, Deutsche Bank analyst Carlo Santarelli maintained a Buy rating on Wynn and reduced the price target to $131 from $140. The new price target implies 39.2% upside potential from current level.

Based on 3 Buys and 7 Holds, the stock has a Moderate Buy consensus rating. The average Wynn price target of $105.75 implies 12.4% upside potential from current levels. (See Analysts’ Top Stocks on TipRanks)

Website Traffic

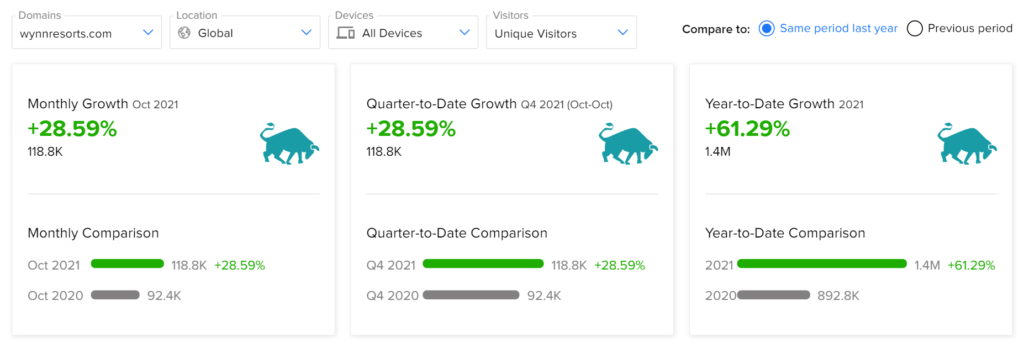

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Wynn’s performance.

According to the tool, the number of total unique visitors for October 2021 on all devices increased 28.6% year-over-year. On a year-to-date basis, the number of total unique visitors to the company’s website increased 61.3% from the comparable period last year.

Related News:

Lemonade Declines 5% on Quarterly Loss

Editas Rises 8.2% on Narrower-Than-Expected Q3 Loss

Two Harbors’ Q3 Earnings Exceed Street’s Expectations