Shares of hotel franchisor Wyndham Hotels & Resorts (NYSE:WH) surged by nearly 10% in the morning session today after Choice Hotels International (NYSE:CHH) proposed to acquire the company at $90 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The $9.8 billion proposal (including net debt) is a mix of cash and stock, consisting of $49.50 per share in cash and 0.324 shares of CHH for each WH share held by investors. The proposal also includes a cash-or-stock election mechanism, allowing WH shareholders to choose either cash, stock, or a combination of both.

With over 9,300 hotels, WH is a larger player than CHH, which operates nearly 7,500 locations. The two companies had engaged in discussions for nearly six months. Today’s public proposal from CHH comes after WH disengaged from discussions.

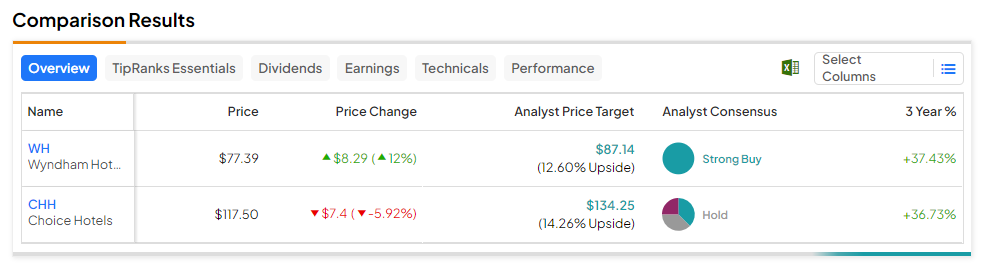

The proposal offers a 30% premium over WH’s latest closing price, and CHH expects annual run-rate synergies of $150 million between the two companies. Amid robust travel trends, shares of both companies have risen by over 35% over the past three years.

What is the Target Price for CHH?

The offer has sent CHH shares nearly 6% lower today. Overall, the Street has a Hold consensus rating on Choice Hotels. Nevertheless, the average CHH price target of $117.50 implies 14.3% potential upside.

Read full Disclosure