WTI Crude Oil (CM:CL) closed lower in Wednesday’s trading, falling $1.79 to settle at $81.68 per barrel. This comes despite some positive news. Indeed, the Energy Information Administration (EIA) released its weekly Crude Oil Inventories report, which measures the weekly change in the number of barrels of commercial crude oil held by U.S. firms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Compared to last week, inventories decreased by -1.952 million barrels. For reference, economists were expecting a decrease of 0.9 million barrels week-over-week. This means that demand was stronger than anticipated. However, the U.S. dollar (DXY) saw some strength ahead of the Federal Reserve’s interest rate decision, which likely put pressure on oil.

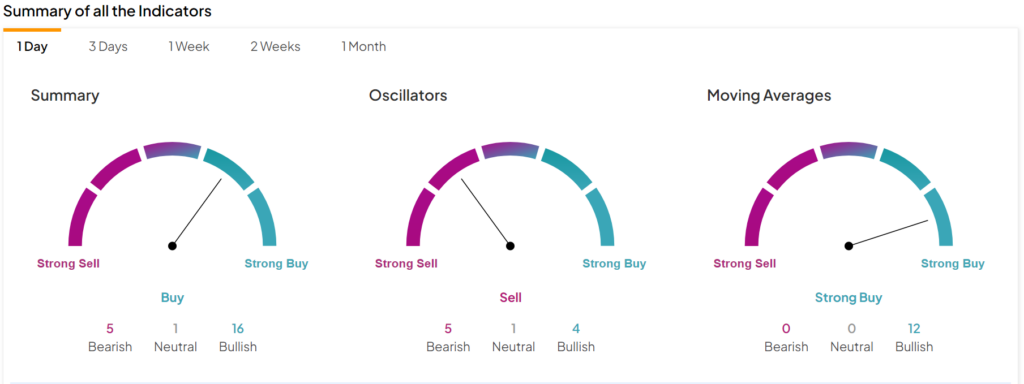

Oil Technical Analysis

Using TipRanks’ technical analysis tool, the indicators seem to point to a positive outlook. Indeed, the summary section pictured below shows that 16 indicators are Bullish, compared to one Neutral and five Bearish indicators.