Shares of finance and human resources-focused cloud solutions provider Workday (NASDAQ:WDAY) soared nearly 9% in the early session today after the company’s robust third-quarter performance was followed by positive analyst reactions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue jumped by nearly 17% year-over-year to $1.87 billion, exceeding estimates by $20 million. EPS of $1.53 also outpaced expectations by $0.12. Subscription revenues increased by 18.1% year-over-year to $1.69 billion, and the total subscription revenue backlog jumped by 30.9% to $18.45 billion.

Driven by this positive momentum, the company also raised its outlook for Fiscal Year 2024. Subscription revenue for the year is anticipated to rise by 19% to $6.6 billion, and the operating margin is anticipated to be 23.8%.

What is the Target Price for WDAY?

Impressed with this performance, Robert W. Baird’s Mark Marcon has reiterated a Buy rating on Workday while increasing the price target to $277 from $260. Noting the 23% jump in the company’s 24-month subscription revenue backlog “for the third consecutive quarter,” Oppenheimer’s Brian Schwartz also reiterated a Buy rating on the stock and increased the price target to $275 from $255.

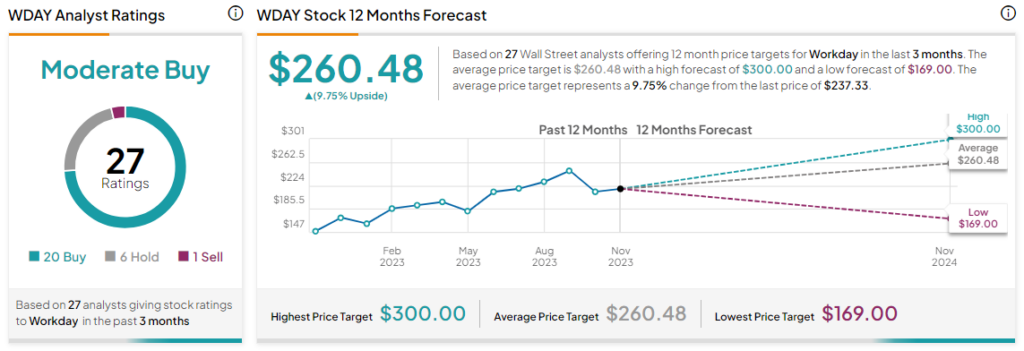

Overall, the Street has a Moderate Buy consensus rating on Workday. Following a nearly 63% rally in the company’s share price over the past year, the average WDAY price target of $260.48 points to a modest 9.75% potential upside in the stock.

Read full Disclosure