Shares of apparel and accessories provider Wolverine World Wide (NYSE:WWW) are tanking today after the company’s big third-quarter miss.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

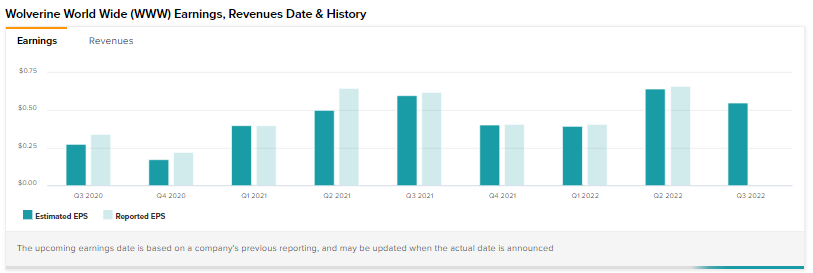

Revenue increased 8.6% year-over-year to $691.4 million but lagged estimates by ~$18.3 million. EPS at $0.48 too, fell short of consensus by $0.07.

The company is witnessing supply chain challenges coupled with worsening macro conditions. Further WWW is seeing congestion in its own logistics while shipping delays impact the performance of brands.

During the quarter while Merrell registered a 33.6% growth, other brands of the company saw declines ranging from marginal to double digits.

For the full-year 2022, the company now sees revenue landing between $2.670 billion and $2.695 billion, implying growth between 10.6% and 11.6%.

EPS is seen hovering between $1.41 and $1.51. This indicates a decline in the range of 24.1% and 18.7%.

Read full Disclosure