Wolfspeed (WOLF) stock soared over 1,700% on Monday following the company’s move to reincorporate from North Carolina to Delaware and execute a reverse stock split. The legal changes are part of Wolfspeed’s plan to emerge from bankruptcy. WOLF stock is up another 13% in pre-market trading on Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wolfspeed is a semiconductor company specializing in silicon carbide (SiC) and gallium nitride (GaN) technologies, which power next-generation electric vehicles, renewable energy systems, and advanced electronics.

What’s Happening with Wolfspeed?

In June, Wolfspeed grabbed attention after filing for Chapter 11 to implement a creditor-backed reorganization plan. The plan is set to reduce the company’s debt by roughly 70% and cut annual cash interest payments by about 60%.

For context, Chapter 11 is a section of the U.S. Bankruptcy Code that allows a company to restructure its debts and operations while continuing to operate.

Earlier this month, Wolfspeed received court approval for its plan. Following the approval, WOLF stock surged, signaling renewed investor confidence in the company’s ability to repair its balance sheet and move forward.

Wolfspeed’s Recent Updates

On September 29, Wolfspeed executed its restructuring, canceling all existing common shares and exchanging them for new stock. Existing shareholders received 1,306,903 new shares at an exchange ratio of roughly 1 new share for every 120 old shares. Shareholders may receive additional pro rata Wolfspeed shares if the company meets specific regulatory milestones.

In effect, this move represents a massive reverse stock split and equity recapitalization.

What’s Next for Investors?

After the recent surge triggered by the reverse stock split and the bankruptcy milestone, Wolfspeed is likely to experience significant volatility in the near term. In the short term, trading may be driven more by market sentiment and investor excitement than by the company’s underlying fundamentals.

Looking ahead, if Wolfspeed completes its reorganization, it could become a stronger, more efficient company. Long-term investors might benefit from its healthier finances and growth opportunities in semiconductors and silicon carbide.

Is WOLF a Good Stock to Buy?

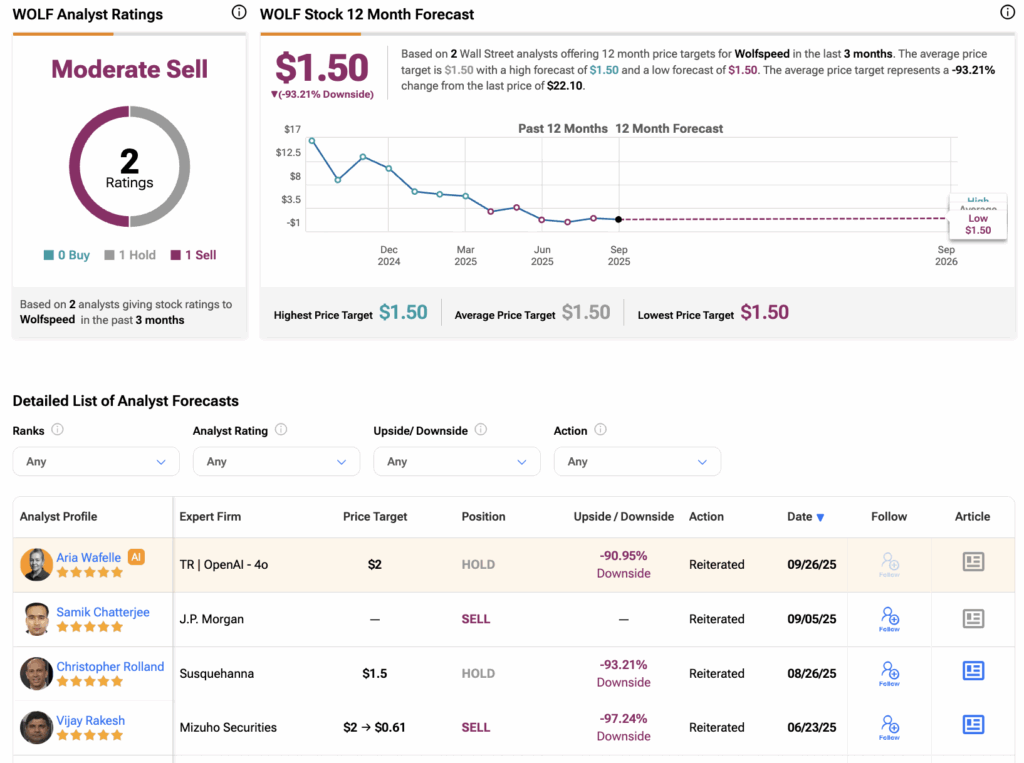

Turning to Wall Street, analysts have a Moderate Sell consensus rating on WOLF stock based on one Hold and one Sell assigned in the past three months. Furthermore, the average stock price target for Wolfspeed is $1.50 per share, which implies a 93.21% downside risk.