Broadcom (AVGO) stock has risen about 50% year-to-date and more than 100% over the past year, driven by the demand for the semiconductor giant’s custom application-specific integrated circuits (ASICs) or custom chips and networking solutions amid the ongoing artificial intelligence (AI) wave. The company’s recent deal with OpenAI (PC:OPAIQ) also lifted investor sentiment. Wall Street is bullish on AVGO’s prospects, given its massive deals with major hyperscalers and tech giants and continued demand for AI infrastructure. With a favorable demand backdrop, it’s worth taking a closer look at who owns AVGO stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

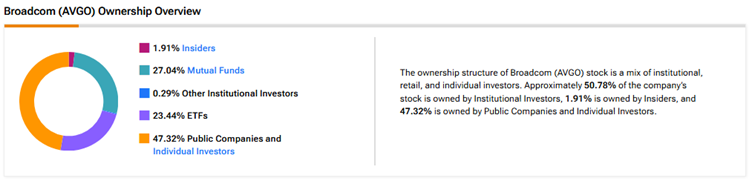

Now, according to TipRanks’ Ownership Tool, public companies and individual investors own 47.32% of Broadcom stock. They are followed by mutual funds, ETFs, insiders, and other institutional investors at 27.04%, 23.44%, 1.91%, and 0.29%, respectively.

Digging Deeper into AVGO’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in AVGO at 8.75%. Next up is Vanguard Index Funds, which holds a 7.17% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 3.13% stake in Broadcom, followed by the Vanguard S&P 500 ETF (VOO) with a 2.49% stake.

Moving to mutual funds, Vanguard Index Funds holds about 7.17% of Broadcom. Meanwhile, Fidelity Concord Street Trust owns 1.73% of the semiconductor company.

Is AVGO Stock a Good Buy?

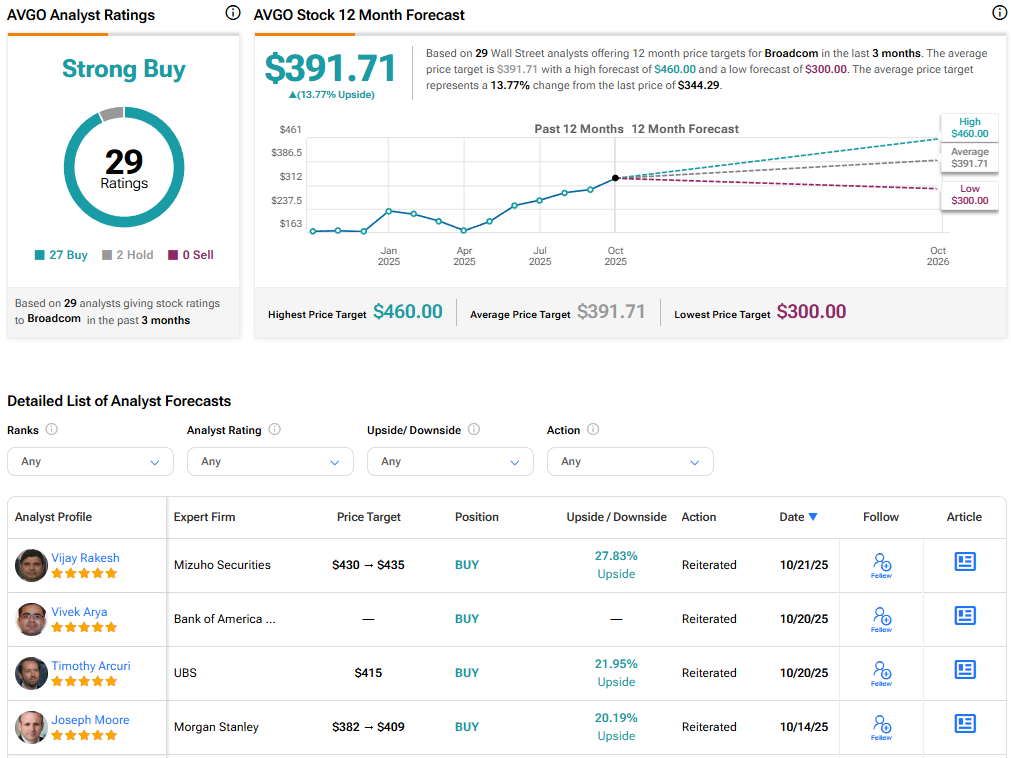

Currently, Wall Street has a Strong Buy consensus rating on Broadcom stock based on 27 Buys and two Holds. The average AVGO stock price target of $391.71 indicates 13.8% upside potential from current levels.