Archer Aviation (ACHR), an air taxi company, has jumped 288% in the past year. The company is emerging as a strong contender in the urban air mobility space, fueled by technical and regulatory progress in the development of its aircraft designed for urban air taxis. The company recently completed the first public flight of its Midnight aircraft, a key step toward FAA certification and commercial service. Supported by its partnership with Stellantis (STLA) and expansion initiatives in Japan and the U.S., Archer is steadily advancing toward commercial passenger service. Given these tailwinds, it’s a good time to see who owns shares of ACHR.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

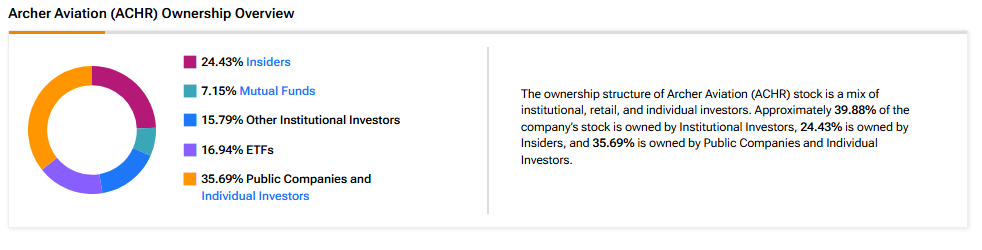

Now, according to TipRanks’ ownership page, public companies and individual investors own 35.69% of ACHR. They are followed by insiders, ETFs, other institutional investors, and mutual funds at 24.43%, 16.94%, 15.79%, and 7.15%, respectively.

Digging Deeper into ACHR’s Ownership Structure

Looking closely at top shareholders, Stellantis N.V. owns the highest stake in ACHR at 9.38%. Following that is Marc E. Lore, who owns about 8.70% of the company.

Among the top ETF holders, the ARK Innovation ETF (ARKK) owns a 3.91% stake in Archer Aviation stock, followed by the Vanguard Total Stock Market ETF (VTI), with a 2.15% stake.

Moving to mutual funds, Vanguard Index Funds holds about 4.68% of ACHR. Meanwhile, Fidelity Concord Street Trust owns 0.60% of the company.

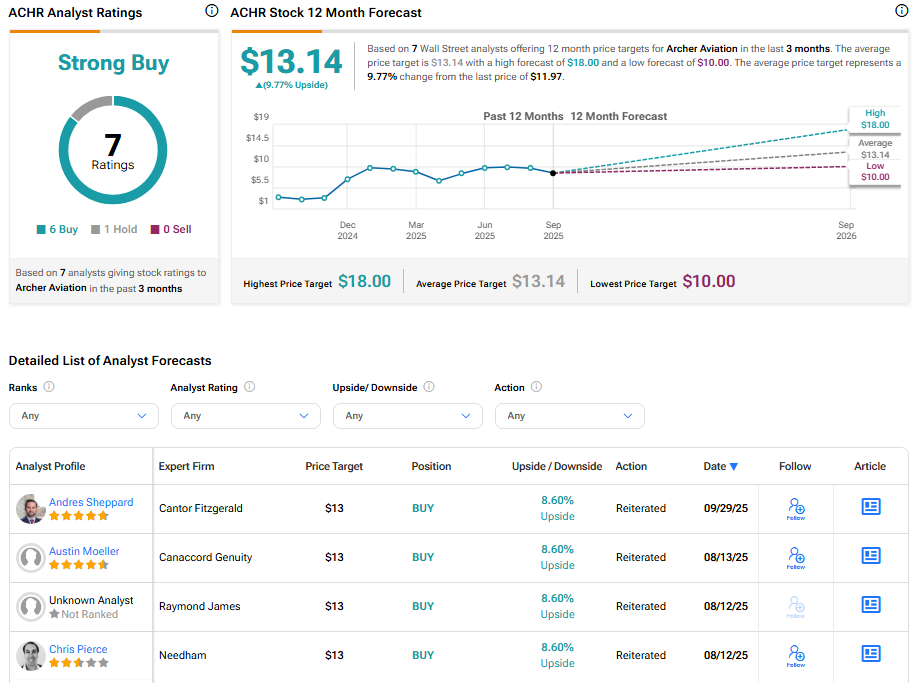

Is ACHR Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Strong Buy consensus rating on Archer Aviation stock based on six Buys and one Hold recommendation. The average ACHR stock price target of $13.14 implies about 9.77% upside potential.