For those not familiar with Dollarama (TSE:DOL), it’s a Canadian dollar store chain. This means it shouldn’t come as much of a surprise to hear that it did well with its latest earnings report. It might be more of a surprise, though, to find it did so well it gained 6% in Thursday morning’s trading session.

Dollarama killed it by pretty much any metric. It turned in C$1.64 billion in revenue, which nicely beat analyst projections looking for C$1.61 billion. It’s even better when you consider that, this time last year, Dollarama posted revenue of only—if you can call that “only”—C$1.47 billion. Better yet, earnings per share came in at a win as well.

Dollarama posted earnings of C$1.15 per share, against projections of C$1.06 per share and last year’s figure of C$0.91 per share. Those are solid gains, and Dollarama notes that it wasn’t so much a matter of a lot more shopping as a lot more stores. Dollarama opened over 70 stores this year, going from 1,486 to 1,551. Still, there was more shopping in general as comparable store sales growth increased 8.7%.

Not All Good News

If that weren’t good enough, then Dollarama had more good news in store. Dollarama announced it was raising its quarterly dividend, going from C$0.0708 per share to C$0.092 per share. There was one down note, however, as Dollarama will be losing at least one store in the near term. The Gerrard and Carlaw shopping plaza in Toronto will be closing as the entire plaza is set to be razed and converted into the Gerrard Ontario Line station. Every other business—including a No Frills location that was known for “rare affordable groceries in Leslieville”—will close alongside it.

Is DOL a Good Buy Right Now?

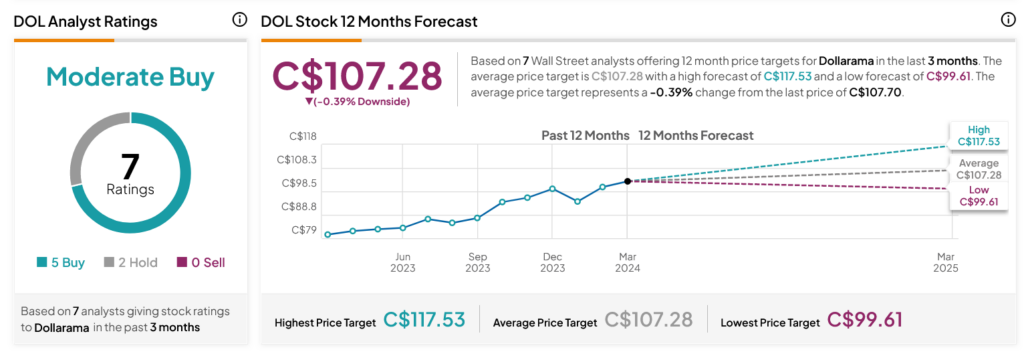

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DOL stock based on five Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 30.3% rally in its share price over the past year, the average DOL price target of C$107.28 per share implies 0.39% downside risk