Shares of DocuSign (NASDAQ:DOCU) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $0.65, which beat analysts’ consensus estimate of $0.52 per share. Sales increased by 13.6% year-over-year, with revenue hitting $659.6 million. This beat analysts’ expectations of $639.49 million.

DocuSign reported a substantial increase in its subscription revenue. That figure hit $643.7 million, which was up 14% against this time last year. Meanwhile, professional services and other revenue came in at $15.9 million. That was down 5% versus the year-ago quarter. DocuSign’s total billings came in at $739 million, which was up 10% in year-over-year comparisons.

Looking forward, management now expects revenue for Q1 2024 to be in the range of $639 million to $643 million. For reference, analysts were expecting $639.77 million in revenue. Meanwhile, for the full year, total revenue is expected to be between $2.695 billion and $2.707 billion. Analysts had forecast $2.69 billion in revenue.

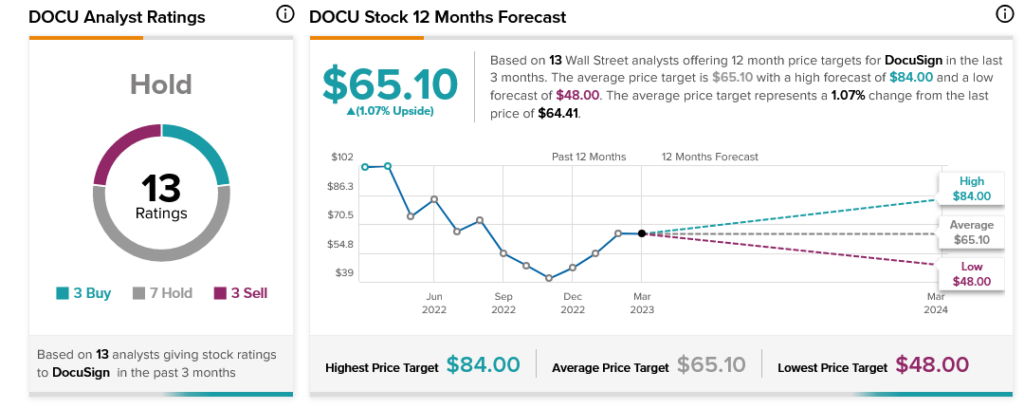

Overall, Wall Street has a Hold consensus rating on DOCU stock based on three Buys, seven Holds, and three Sells assigned in the past three months. In addition, it comes with an average price target of $65.10, which is virtually identical to DocuSign’s current value, as indicated by the graphic above.