The year 2023 was marred with the spectacle of elevated inflation, an ever-hawkish Fed, and concerns about consumers tightening their purse strings. Yet, the recent fourth-quarter performance from restaurant operator Shake Shack (NYSE:SHAK) has induced a pleasant bout of optimism for investors. The company delivered a 20% year-over-year jump in Q4 revenue and a nearly 80% growth in its adjusted EBITDA for 2023. SHAK’s results also boosted optimism around Wingstop (NASDAQ:WING), another restaurant operator. The company is slated to report its fourth-quarter results on Wednesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To be fair, investors in Wingstop are already sitting on investment gains of nearly 85% over the past year. It has outpaced analysts’ expectations for five consecutive quarters. Impressively, Wingstop has seen same-store sales grow for 19 consecutive years and was included in Entrepreneur Magazine’s Fastest-Growing franchises list for 2023.

On Wednesday, analysts expect Wingstop to deliver an EPS of $0.57 on revenue of $120 million for the quarter. In the comparable year-ago period, Wingstop’s EPS of $0.60 had smashed estimates by a wide margin of $0.19.

Is WING a Good Stock to Buy?

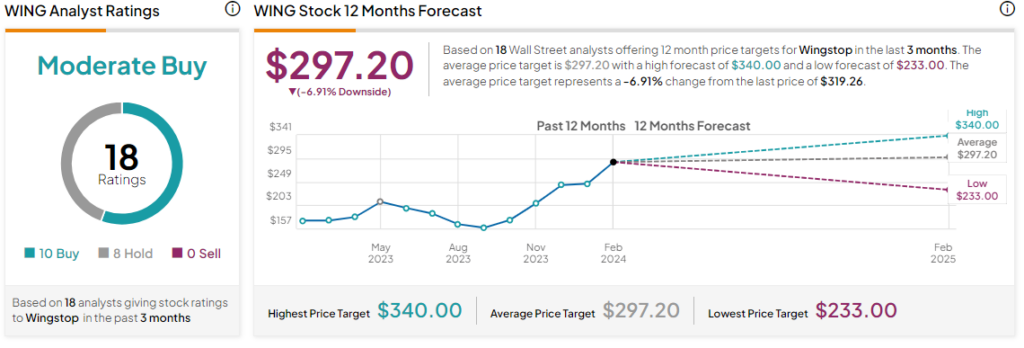

Shares of the company have run up by nearly 25% year-to-date. Overall, the Street has a Moderate Buy consensus rating on Wingstop alongside an average price target of $297.20.

Read full Disclosure