Global advisory, brokerage, and solutions company Willis Towers Watson (WLTW) reported strong second-quarter results, driven by increased consulting, new business generation, strong renewals, and an overall improving economy. Shares popped 4.4% to close at $212.94 on August 3.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Adjusted earnings for the quarter stood at $2.66 per share, up 48% compared to the prior-year period, and outpaced analysts’ estimates of $2 per share. (See Willis Towers Watson stock charts on TipRanks)

What’s more, revenue grew 8% year-over-year to $2.29 billion and beat the Street’s estimate of $2.21 billion. For full year 2021, the company has guided for mid-single-digit revenue growth.

Encouragingly, John Haley, the CEO of the company, said, “We are well-positioned to compete vigorously and independently across our businesses around the world and will continue to innovate and adapt to address evolving client needs.”

Concurrent with the earnings release, the company announced a 13% increase in its quarterly cash dividend to $0.80 per common share.

Following the Q2 earnings release, Wells Fargo analyst Elyse Greenspan assigned a Buy rating with a price target of $266, implying 24.9% upside potential to current levels.

Greenspan said, “While we recognize there is some uncertainty (loss of talent, Willis Re being shopped, CEO succession) we think this is all factored into where the shares are trading today…We believe the valuation of shares should close the gap with their peers as Willis executes as a stand-alone entity following pulling the merger with AON.”

Furthermore, the analyst believes that the insurance brokerage sector stands to gain from the strong economic backdrop and favorable Property & Casualty (P&C) insurance pricing, which should boost WLTW’s revenue growth in 2021.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating, based on 4 Buys versus 4 Holds. The average Willis Towers Watson price target of $255.50 implies 20% upside potential to current levels.

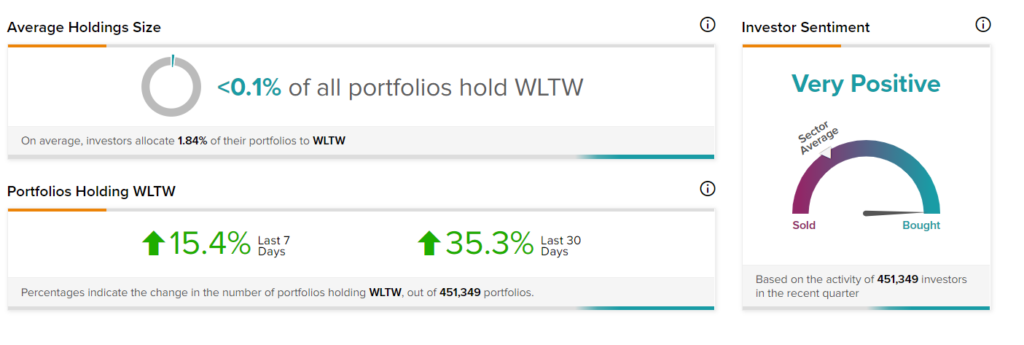

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Willis Towers Watson, with 23.1% of portfolios tracked by TipRanks increasing exposure to WLTW stock over the past 7 days.

Related News:

Parker Hannifin Inks $8.8B Deal to Buy Meggitt

Global Payments Plunges 11% Despite Upbeat Q2 Results

ON Semiconductor Delivers Blowout Quarter; Shares Soar 11.7%