Shares of specialty retailer Williams-Sonoma (NYSE:WSM) surged nearly 5% at the time of writing after its third-quarter EPS of $3.66 comfortably outpaced expectations by $0.33. However, its revenue of $1.85 billion missed estimates by $90 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

During the quarter, comparable brand revenue declined by 14.6%. Further, net revenue at Pottery Barn declined by 16.6% year-over-year to $778 million, and net revenue at West Elm dropped by 22.4% to $466 million.

Importantly, the company delivered an operating margin of 17% despite a pullback in high-ticket discretionary furniture spending and higher promotional activity.

Furthermore, driven by promising early seasonal trends, Williams Sonoma raised its operating margin outlook for Fiscal Year 2023. It expects revenue growth for the year to be between -10% and -12% with an operating margin range of 16% to 16.5%. Over the long term, WSM continues to expect mid-to-high single-digit annual revenue growth.

Is WSM a Good Investment?

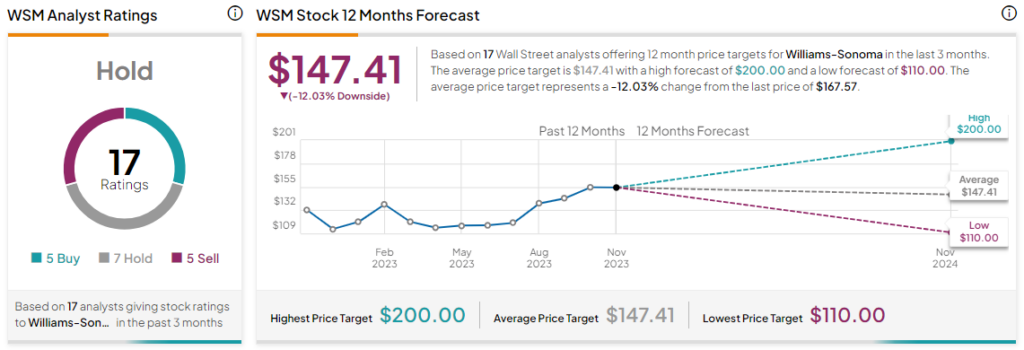

Overall, the Street has a Hold consensus rating on Williams-Sonoma. Following a nearly 39% surge in the company’s shares over the past six months, the average WSM price target of $147.41 implies a 12% potential downside in the stock.

Read full Disclosure