Alphabet, Inc.’s (GOOGL) Google stated that its YouTube Shorts were gaining momentum akin to rival TikTok’s viewership. GOOGL stock closed up 2.9% at $2,195.29 on June 15.

Launched two years ago, YouTube Shorts are just 60-second videos that aim to garner the same attraction from younger audiences as TikTok’s appeal. As per a WSJ report, Google disclosed that more than 1.5 billion viewers watch YouTube Shorts every month.

Google’s YouTube was one of the pioneers of video streaming, but lately, it has been caught up in a heated race to reach the number one spot. YouTube contributed around $28 billion in advertising revenue for Google in 2021. However, its ad revenue, which grew 14% year-over-year in the first quarter of 2022, missed analysts’ expectations and also came in lower than Q4’s growth.

Since the onset of YouTube Shorts in India in 2020 and the U.S. in 2021, officials have been promoting the platform as a multiformat channel to engage in both long-form and short form videos to attain “fame or fortune or creative expression, or ideally all three.” Furthermore, Google intends to include YouTube Shorts in advertising plans and allow companies to make their ads “shoppable.”

Notably, TikTok, which belongs to Chinese internet giant ByteDance Ltd., is currently at the top with about 1.6 billion viewers at the end of March, as per third-party estimates. ByteDance’s domestic app, Douyin, also garners a huge fanbase in China.

Similarly, Meta Platforms’ (META) social media platform, Instagram, also competes in the short video space in the form of Reels and makes up about 20% of the time people spend on Instagram. Although accurate viewership stats are not available, according to a CNBC report, Instagram surpassed 2 billion monthly active users last year.

Wall Street’s Take

According to a recent Reuters report, Google might allow rival ad intermediaries to place ads on YouTube in an attempt to settle an ongoing EU antitrust investigation.

Following that, Wells Fargo analyst Brian Fitzgerald stated that the step “would materially expand the “open Internet” ad inventory opportunity available to independent advertising technology platforms.” This step could also mean that, as more advertisers come knocking on YouTube’s door, the ad revenue could increase materially.

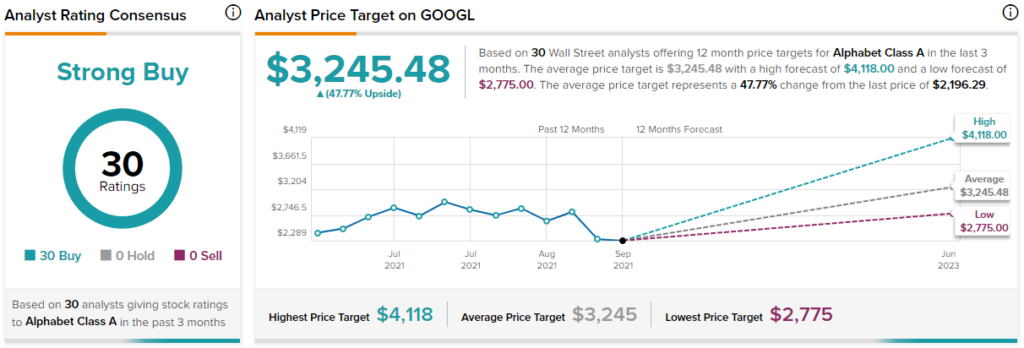

GOOGL stock commands a Strong Buy consensus rating with 30 unanimous Buys. The average Alphabet price forecast of $3,245.48 implies 47.8% upside potential to current levels. Meanwhile, the stock has lost 24.3% year to date amid the broader tech sell-off.

Ending Thoughts

The need for attention and garnering “Likes” is gaining heightened momentum these days, which works very well for social media apps like YouTube. How soon will it be able to beat rival TikTok? Only time will tell.

Read full Disclosure