United States Steel Corporation (NYSE:X), or U.S. Steel, provided better-than-expected second-quarter adjusted net earnings guidance. However, the weak sector outlook could continue to restrict the upside in the stock, so the higher guidance might not reflect in a rise in stock price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The integrated steel producer expects its Q2 adjusted earnings to be in the range of $1.81 to $1.86 per share. This compares favorably to the Street’s forecast of $1.76. However, EPS guidance reflects a steep decline from the prior year due to the year-over-year drop in the prices of sheet and tubular steel products.

However, the company’s earnings will improve sequentially due to favorable demand and pricing impacts on a quarter-over-quarter basis.

U.S. Steel expects its second-quarter adjusted EBITDA to be approximately $775 million, which is within its prior guidance range of $750 million to $800 million. The company expects the Mini Mill and Flat-Rolled segments to see a sequential increase in pricing.

Analysts Expect Steel Sector to Remain Under Pressure

On June 15, Morgan Stanley analyst Carlos De Alba reiterated a Hold rating on the stock, as the analyst believes that steel prices will remain under pressure.

Ahead of U.S. Steel’s Q2 print, Wolfe Research analyst Timna Tanners downgraded the stock to Sell from Hold. In a note to investors dated June 1, Tanners said that falling sheet, tubular, and European product prices would hurt the company’s performance. The analyst expects the company to disappoint with its earnings.

Meanwhile, on May 23, Bill Peterson of J.P. Morgan initiated coverage on United States Steel Corporation stock with a Hold rating. The analyst takes a cautious near-term outlook due to the weakness in the construction industry and an expected cyclical downturn in the auto sector.

Is It Time to Buy U.S. Steel?

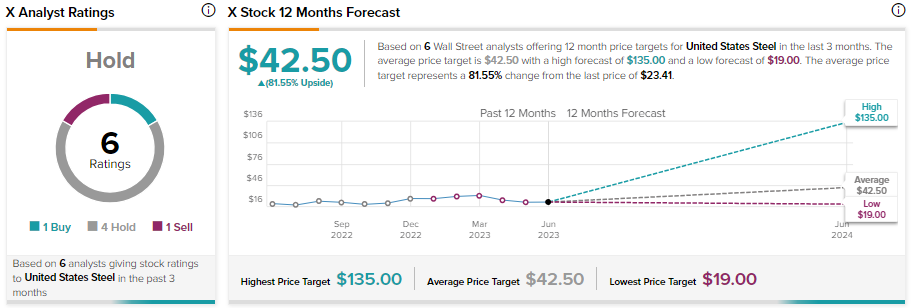

The U.S. Steel stock is trading in the red on a year-to-date basis. However, the stock sports a Hold consensus rating on TipRanks, based on one Buy, four Hold, and one Sell recommendations. Further, analysts’ average price target of $42.50 implies 81.55% upside potential.