Updated on July 28, 5.50 PM

Spirit indeed said yes to JetBlue’s offer as expected!! JetBlue will now acquire Spirit in an all-cash deal worth $3.8 billion, or 33.50 per share, which includes a prepayment of $2.50 per share upon approval by Spirit stockholders and a ticking fee of $0.10 per month starting in January 2023 till the completion of the deal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Spirit Airlines and Jet][‘Blue could finalize their agreement today, which is much superior to the Frontier deal, according to a Wall Street Journal report.

Putting an end to the months-long bidding war between JetBlue Airways (JBLU) and Frontier Group Holdings (ULCC), takeover candidate Spirit Airlines (SAVE) finally announced the termination of the merger deal with Frontier.

JetBlue had offered to pay in cash $3.7 billion, or about $33.50 a share, for the entire stake in the company.

Following the news, shares of Spirit Airlines jumped 5%, while shares of Frontier Group Holdings were down 1.3% during the extended trading session yesterday. Meanwhile, JetBlue shares remained flat.

Notably, the decision comes after months of persuasion by Spirit’s Board to its shareholders to vote in favor of the deal with Frontier Group Holdings. In fact, it had postponed the special meeting seeking the shareholders’ vote five times already.

Yesterday, the Spirit Airlines Board perceived that it did not have enough shareholders to support the Frontier deal valued at $2.9 billion, or $25 a share. It adjourned the meeting till the end of the day before announcing the final termination.

Spirit Airlines CEO’s Comments

Expressing his views, Spirit Airlines CEO, Ted Christie, stated, “While we are disappointed that we had to terminate our proposed merger with Frontier, we are proud of the dedicated work of our Team Members on the transaction over the past many months.”

Reaffirming the ongoing talks with JetBlue, he further added, “Moving forward, the Spirit Board of Directors will continue our ongoing discussions with JetBlue as we pursue the best path forward for Spirit and our stockholders.”

Wall Street’s Take on Spirit

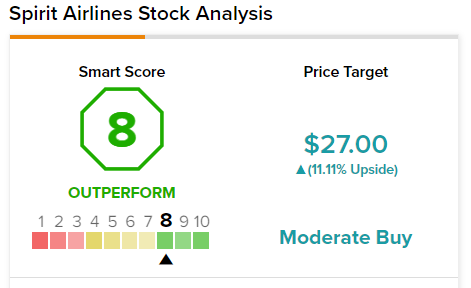

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys and three Holds. The average Spirit Airlines price target of $27 implies 11.11% upside potential to current levels.

Spirit’s High Smart Score on TipRanks

Spirit Airlines scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Key Takeaway

With one major hurdle crossed, JetBlue still has to get approval from the anti-trust regulators, which could prove to be another uphill task.

Assuming it does get approval and completes the merger, Spirit Airlines will cease to exist. Notably, JetBlue will emerge as the fifth-largest airline carrier in the U.S. after American Airlines (AAL), Delta Air Lines (DAL), Southwest Airlines (LUV), and United Airlines (UAL).