Spirit Airlines (SAVE) (S64) (OL8U) yet again decided to postpone the shareholder vote, which was scheduled for today during the Special Meeting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The raging war between JetBlue (JBLU) (DE:JAW) (GB:0JOT) and Frontier Group Holdings (ULCC) (OVN) to win over Spirit shareholders thus took yet another turn.

Spirit Airlines cited that it is buying more time to enable the Spirit Board of Directors to hold further discussions with both suitors of the deal as well as to continue to solicit proxies from its stockholders with respect to the Special Meeting.

In the early trading session today, shares of Spirit Airlines were up almost 3%, with Frontier shares up 2.5%, while JetBlue shares were down 2%, following the news.

The Turn of Events

Since February 2022, when the talks of a Frontier-Spirit deal first surfaced, both JetBlue and Frontier have consistently raised their bids for Spirit Airlines. Both suitors aspire to acquire Spirit to bolster their domestic portfolio and become the fifth largest airline in the U.S.

As a matter of fact, this is not the first time that Spirit Airlines has postponed the Special Meeting. It has been postponed twice already (from June 10 to June 30 to July 8), and is now scheduled for the fourth time to be held on July 15. Perhaps the Spirit Airlines Board perceived that it did not have enough shareholders to support the Frontier deal, leading to the postponement.

Earlier last week, JetBlue further sweetened its $3.7 billion, all-cash offer for Spirit Airlines. However, Spirit Airlines continues to resist JetBlue’s superior cash offer compared to Frontier’s stock-cum-cash deal worth $2.6 billion, citing that a deal with the latter is less likely to be disapproved by the antitrust regulators.

Meanwhile, JetBlue is currently facing a lawsuit with the U.S. Justice Department that is challenging its partnership with American Airlines Group Inc. (AAL).

While both Spirit and Frontier claimed that the deal with JetBlue has a strong likelihood of being rejected by the regulators, JetBlue opines that the allegations are false and the lawsuit with American Airlines will not impact the potential merger with Spirit.

JetBlue’s Views

Responding to Spirit’s adjournment of the special meeting, JetBlue management stated in a press release, “We are encouraged by our discussions with Spirit and are hopeful they now recognize that Spirit shareholders have indicated their clear, overwhelming preference for an agreement with JetBlue.”

They further added, “We strongly recommend that Spirit shareholders continue to let the Spirit Board know they want to receive the superior value JetBlue has proposed, by voting AGAINST the Frontier transaction.”

Wall Street’s Take on Spirit

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys and three Holds. The average Spirit Airlines price target of $26 implies 6.04% upside potential to current levels.

Hedge Funds Jump in on the Action

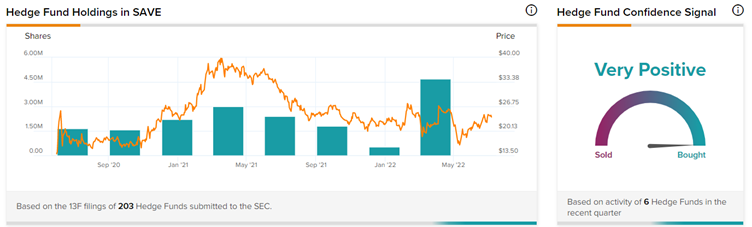

Interestingly, the TipRanks database indicates Hedge Funds are Very Positive about Spirit and have increased holdings in the stock by 4.2 million shares in the last quarter.

Notably, there are numerous new entrants now owning Spirit, with Paul Reeder’s Par Capital Management Inc being a new entrant with shares bought worth a whopping $89.3 million.

Bottom-Line

With an aim to tap the opportunity to become the fifth-largest U.S. airline, especially when the airline industry is fraught with labour and aircraft shortages, JetBlue and Frontier‘s rivalry continues to grow.

Is it possible that the antitrust scrutiny will reject both the deals? Will Frontier now come back with a better deal to woo the Spirit Airlines Shareholders? Investors will wait and watch.