Chinese e-commerce giant Alibaba (BABA) has surged more than 110% year-to-date, fueled by strong growth in its AI-powered cloud business and rising demand for instant delivery services. The company has been stepping up its push into artificial intelligence to enhance both its e-commerce and cloud operations. Alibaba is expected to report its Q2 FY26 earnings next month. Ahead of the results, Wall Street analysts remain upbeat, with the average price target suggesting about 13% upside potential in the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street analysts expect Alibaba to report earnings of $0.85 per share for Q2 on revenues of $34.36 billion, according to the TipRanks Analyst Forecasts Page.

Analysts Remain Optimistic Ahead of BABA’s Q2 Earnings

Ahead of the Q2 earnings report, Top Jefferies analyst Thomas Chong reiterated a Buy rating on Alibaba stock with a price target of $230, calling the stock a “Top Pick for 2026.” The 5-star analyst said Alibaba’s growth remains strong, backed by rising demand for AI and cloud services and improving performance in e-commerce and quick commerce.

The analyst expects cloud revenue to rise about 30% year-over-year, driven by wider use of GPU chips, more AI training needs, and higher demand for custom data models across industries.

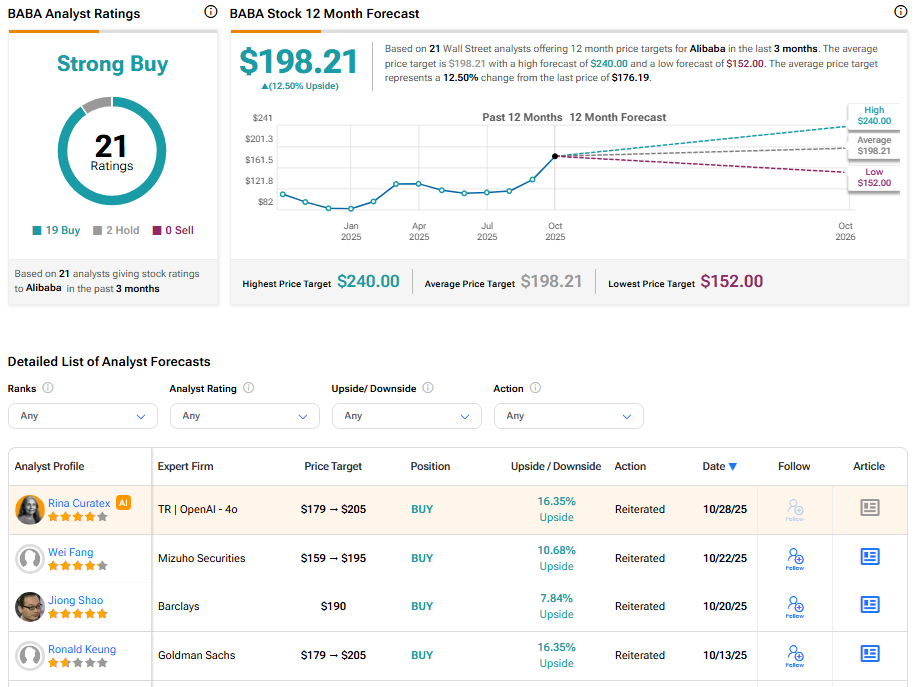

Similarly, Mizuho analyst Wei Fang raised his price target on Alibaba to $195 from $159 and kept an Outperform rating on the stock. The firm said its checks show strong delivery order growth in the summer quarter, helped by higher incentives. Mizuho added that Alibaba is likely to gain more share in the banking sector through its full-stack AI tools and open-source strategy.

Is Alibaba Stock a Good Buy Right Now?

Analysts remain highly bullish about Alibaba’s stock trajectory. With 19 Buy ratings and two Hold ratings, BABA stock commands a Strong Buy consensus rating on TipRanks. Also, the average Alibaba price target of $198.21 implies about 12.94% upside potential from current levels.