As a member of the consumer discretionary sector, gym franchisor and operator Planet Fitness (NYSE:PLNT) has seen how macroeconomic pressures can impact its business. Sticky inflation and elevated interest rates were a big reason why membership growth slowed from 1.8 million in 2022 to 1.7 million in 2023. But according to analysts, a healthier economy and a leadership transition could put Planet Fitness in better shape by the end of 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Like a committed New Year’s resolution maker, the Wall Street community has kept its bullish lean on Planet Fitness stock. Since the year began, 11 firms have maintained Buy ratings and four have reiterated Hold ratings. This gives Planet Fitness a Strong Buy rating and one of the most bullish consensus opinions in the leisure facilities space.

At the end of 2023, the New Hampshire-based company had 2,575 locations across all 50 U.S. states and a handful of international markets. Aided by the addition of 165 new fitness centers, Planet Fitness entered 2024 with 18.7 million members willing to pay $10 a month for a “no-frills” workout experience.

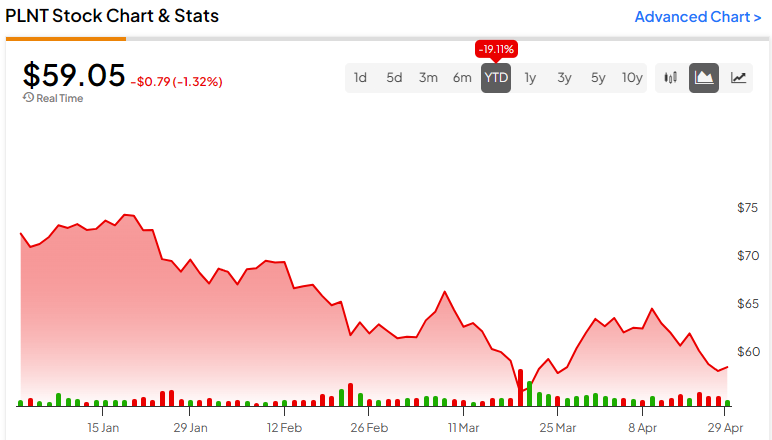

Despite growing its 2023 revenue and adjusted earnings per share (EPS) by 14% and 37%, respectively, the market has turned negative on Planet Fitness stock in 2024. Year-to-date, the mid-cap stock is down approximately 19%, while the S&P MidCap 400 Index is up about 2.5%. A big reason for this is slowing growth; management expects top and bottom-line growth to be 6% to 7% and 10% to 11%, respectively, this year.

Although I appreciate that slowing growth is cause for concern, I think the market has overreacted in dumping Planet Fitness stock. First, double-digit profit growth in a challenging consumer spending environment is no small feat. Second, growth is likely to reaccelerate as inflation moderates and highly-anticipated Fed rate cuts finally happen. Along with company growth initiatives like new digital marketing campaigns, this is why the 2025 consensus EPS estimate implies 14% growth.

Yes, 2024 could be a weak year for Planet Fitness, but stronger gains may lie ahead as 1) macro pressures ease and 2) a leadership shake-up takes effect. I am bullish on PLNT stock.

Housing Industry Veteran to Become New Planet Fitness Leader

Planet Fitness will soon have a new group fitness class instructor in the form of incoming CEO Colleen Keating. On June 10, 2024, Ms. Keating will take over Craig Benson’s role, who is currently serving as interim CEO. Former CEO Chris Rondeau was asked to step down in September 2023, a move that sunk Planet Fitness stock to a three-year low of $44.13.

While the stock recovered to a high of $75.86 in January 2024, leadership uncertainty has weighed on market sentiment. Fortunately, the introduction of Ms. Keating as CEO on April 16 has helped stabilize Planet Fitness shares. The former CEO of property management company FirstKey Homes, Ms. Keating also held executive roles at InterContinental Hotels Group (NYSE:IHG) and Starwood Hotels & Resorts Worldwide. She recently highlighted “sustainable growth and value creation” as goals for Planet Fitness.

Macquarie analyst Paul Golding reiterated his Buy rating on Planet Fitness stock following the CEO announcement. Mr. Golding believes Ms. Keating’s background and track record make her a good fit for the fitness chain’s franchised-based business model. Bank of America analyst Alexander Perry also expressed a vote of confidence in the new hire by reiterating his Buy rating on April 16 and giving PLNT a $90.00 price target.

Seeing a pair of Wall Street analysts remain bullish on Planet Fitness following a pivotal C-Suite appointment reinforces my own bullish stance on a stock that came within $0.40 of hitting $100.00 in November 2021. Currently trading around $60.00, the next key event could be the upcoming earnings release.

Key ‘Resolution’ Period Results Await

Before the market open on May 9, Planet Fitness will report financial results for the quarter ended March 31, 2024. Since this captures the winter months when New Year’s resolutions run rampant, the release could really set the tone for the year.

Wall Street anticipates that Planet Fitness will post first-quarter EPS of $0.50 on revenue of $249.8 million. This would represent a 22% improvement from the same quarter last year and a solid start to what’s expected to be a soft year. If the company can outperform the consensus EPS forecast (as it has in each of the last three quarters), Planet Fitness shareholders could get a much-needed rally.

Not all analysts seem convinced that the stock is a pre-earnings Buy, though. TD Cowen analyst Max Rakhlenko reiterated a Hold rating on April 22. Interestingly, though, Mr. Rakhlenko’s $66.00 price target still points to roughly 10% upside.

What Is the Consensus Price Target for PLNT Stock?

Based on analysts’ refreshed opinions over the past three months, the average Planet Fitness stock price target is $73.50. This implies 25.06% upside potential over the next 12 months. Furthermore, the stock is rated a Strong Buy based on 11 Buys and three Holds assigned in the past three months.

The Bottom Line on PLNT Stock

Planet Fitness is on pace for a third straight down year due to leadership turmoil and slowing membership growth. Nevertheless, the leading U.S. fitness center chain has several potential catalysts — including a new CEO, bullish analysts, and a first-quarter earnings update — that could get its stock back in shape.