In the aftermath of Carrefour’s (FR:CA) (OTC:CRRFY) decision to halt the sales of PepsiCo’s (NASDAQ:PEP) food and beverage products from its shelves, the pushback from retailers against exorbitant price hikes seems to be snowballing. Carrefour is the second-largest grocery retailer in Europe. The company operates nearly 12,000 outlets in over 30 countries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For now, it is removing PepsiCo products from its shelves across its stores in France, Italy, Spain, Poland, and Belgium. Some may have seen this move coming, as Carrefour displayed signs calling out “Shrinkflation“ on some of PepsiCo’s products back in September 2023. Alongside shrinking the sizes of its packets, PepsiCo has also raised prices multiple times.

Carrefour is also delisting PepsiCo products from its online platforms. Adding to this, E. Leclerc, another French supermarket major, has supported Carrefour’s move. E. Leclerc’s Chairman has urged major consumer goods providers to scale back their prices. Notably, annual price negotiations between retailers and suppliers are set to end on January 31 in France. While E. Leclerc continues to sell PepsiCo products, the company is pushing for price cuts with another food major, Danone (FR:BN) (OTC:DANOY).

By revenues, Europe is the biggest geographical market for PepsiCo. While negotiations between PepsiCo and Carrefour are ongoing, the former noted that it stopped supplying to the latter at the end of 2023. Carrefour, however, maintains that the decision to split was made by itself.

Earlier, PepsiCo had noted that it would undertake modest price increases this year. Over the past two years, multiple food giants went for successive and successful price increases while cautiously gauging consumers’ ability to digest price hikes. However, soaring inflation and wage uncertainty are now leading to pushback, and more supermarkets, retailers, and governments in Europe could join in on the trend.

While PepsiCo shares have remained largely unchanged so far this month, the company’s fourth-quarter results are coming up on February 9. Analysts expect the company to post an EPS of $1.72 on revenue of $28.43 billion for the quarter.

Is PEP Stock a Buy Now?

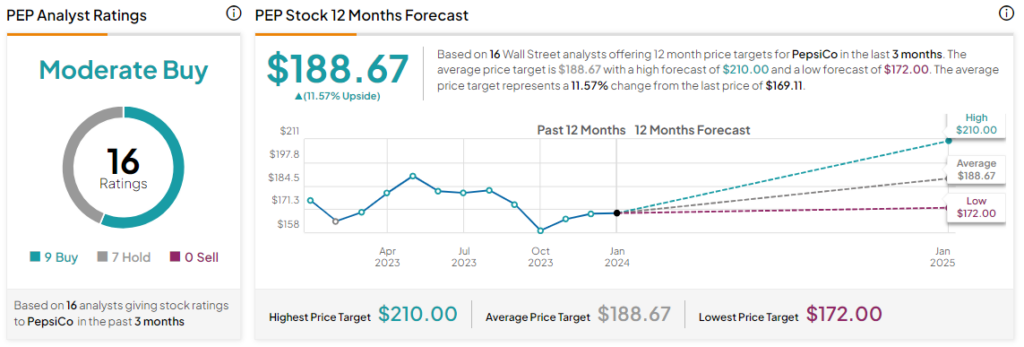

Overall, the Street has a Moderate Buy consensus rating on PepsiCo, and the average PEP price target of $188.67 points to a modest 11.6% potential upside in the stock.

Read full Disclosure