After IBM’s (IBM) upbeat third-quarter earnings signaled that corporate tech spending is holding firm, attention now shifts to the next major test, Microsoft (MSFT). The company reports results on Oct. 29, and investors are asking whether Microsoft stock can extend its lead or if IBM’s rebound has started to close the gap.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IBM Raises the Bar on AI Execution

IBM, long known on Wall Street by its nickname “Big Blue,” exceeded expectations with its third-quarter report. The company posted $16.3 billion in revenue, up nearly 9% year over year, powered by strong gains in both software and infrastructure. Its AI business climbed to around $9.5 billion, as clients moved from experimenting with AI tools to adopting them across their operations.

IBM also raised its free cash flow forecast to $14 billion and reaffirmed its 5% annual growth target. The results show that CEO Arvind Krishna’s turnaround plan, focused on automation, hybrid cloud, and artificial intelligence, is starting to deliver.

Even so, analysts were cautious. Growth in IBM’s cloud division slowed to 14% from 16% in the prior quarter, hinting that momentum could ease as the company heads into 2026. IBM shares rose slightly after the results but face questions about whether the recovery is already priced in.

Microsoft Stock Eyes the Next Big Test

Wall Street analysts expect another strong quarter from Microsoft next week. Wedbush’s Daniel Ives called for “robust results,” reaffirming his Outperform rating and $625 price target, saying, “Microsoft is in the midst of hitting its next phase of monetization on the AI front.”

Consensus forecasts project earnings per share of $3.67 on revenue of $75.4 billion, up from $3.30 EPS and $65.6 billion a year earlier. This represents solid double-digit growth in both measures.

Morgan Stanley’s Keith Weiss added that Microsoft “remains best positioned as chief investment officers prioritize generative AI,” pointing to its integration of AI across Azure, Office, and enterprise software as a long-term advantage.

Two Tech Leaders with Different Paths

IBM’s growth story is steady and disciplined, built on refocusing the business and improving margins. Microsoft’s trajectory, by contrast, is about scale and speed, expanding its AI products across every part of its ecosystem.

If IBM’s latest results prove that enterprise demand for AI is real, Microsoft’s upcoming earnings will show who is capturing the most of it. For now, analysts agree that Microsoft still sets the pace.

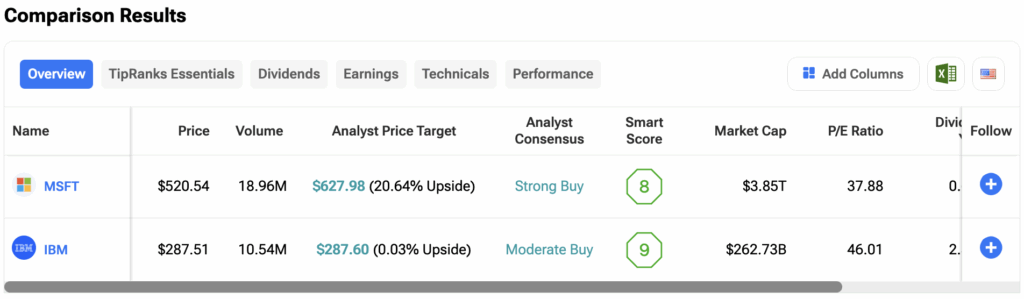

Investors can compare both stocks side-by-side based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to find out more.