Shares of toy manufacturer Mattel (NASDAQ:MAT) are rising steadily as the release date of the live-action movie Barbie approaches. The Barbie movie hits cinemas tomorrow, July 21. The success of the first-of-its-kind movie based on Mattel’s popular toy, Barbie, is expected to push MAT shares higher. Meanwhile, analysts believe that the combination of the movie’s success and a boost from a jump in toy sales should continue to improve the stock’s performance. Further, Mattel is believed to make decent revenue from Barbie’s IP-related businesses. MAT stock is up 22.7% in the past three months, thanks to the hype surrounding the movie.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mattel also has tie-ins with clothing retailers like Gap (NYSE:GPS), which sells Barbie-branded apparel, including pink hoodies and clothes. Similarly, fashion house Forever 21 has turned pink with a range of Barbie-inspired clothing on display. A successful hit at the box office could encourage Mattel’s production arm since it already has a slate of other movies planned based on its toy brands. The company’s second half of 2023 is expected to do better owing to the Barbie movie’s success.

Wall Street is Bullish About Mattel

On July 18, Stifel Nicolaus analyst Drew Crum revisited his view on Barbie’s movie release. Crum now believes that the movie’s opening weekend could rake in $90 to $100 million, up from his previous estimate of $50 million. This would, in turn, help the movie make roughly $450 to $550 million at the box office worldwide. Plus, the five-star analyst believes the movie’s sales, along with the sales of partner merchandise, could help lift earnings by 10 cents per share for FY23. Crum has a Buy rating and a $26 (23.6% upside) price target on MAT stock.

Similarly, on July 17, D.A. Davidson analyst Linda Bolton Weiser reiterated a Buy rating on MAT and maintained the price target at $23, implying 9.3% upside potential. Weiser believes that Barbie’s movie craze and the fact that the retail inventory of toys has come down have boosted MAT’s share price. Further, the analyst acknowledged that Mattel has suggested a solid sales recovery in the second half of 2023. Weiser also believes that Mattel’s IP business could solidify based on the movie’s success. Finally, Weiser has kept the price target under review until Mattel’s Q2FY23 results are due on July 26.

Is MAT a Good Stock to Buy?

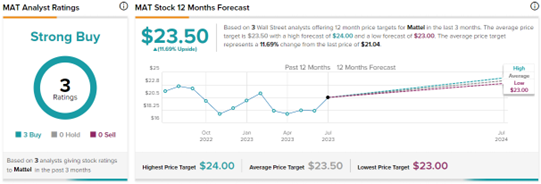

With three unanimous Buys, MAT stock commands a Strong Buy consensus rating. On TipRanks, the average Mattel price forecast of $23.50 implies 11.7% upside potential from current levels. Meanwhile, MAT stock has gained 17.6% year-to-date.