When even Walmart (NYSE:WMT) comes out and says that the consumer may not be quite so resilient in the months ahead, it’s a reason to get very concerned. However, some analysts aren’t so sure that Walmart—and those like it—won’t get a tailwind from deflation going into 2024. Indeed, a new report from Goldman Sachs, the Americas Retail report, detailed that Walmart and stores like Target (NYSE:TGT) stood to benefit from improvements in the macroeconomic picture.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, price deflation has been seen in some key sectors like toys, though not so much in food and energy. With consumer spending trends set to improve in 2024, based on the report’s findings, that should make a turnaround much more likely and visible.

Walmart is Gathering Support from Other Analysts

Granted, the idea of a suddenly-improved macroeconomic environment for next year may seem a bit unlikely. But Walmart is gathering support behind just that. For instance, TD Cowen, via analyst Oliver Chen, declared Walmart “a new retail nexus” and one of its best ideas for 2024. Moreover, Walmart has a new strategy in place to take on the likes of Amazon (NASDAQ:AMZN), using its retail storefronts as a fulfillment space for its e-commerce orders. Walmart actually got the idea from Target, which should help both companies as they work to secure market share in an Amazon-driven market.

Is Walmart a Good Stock to Buy?

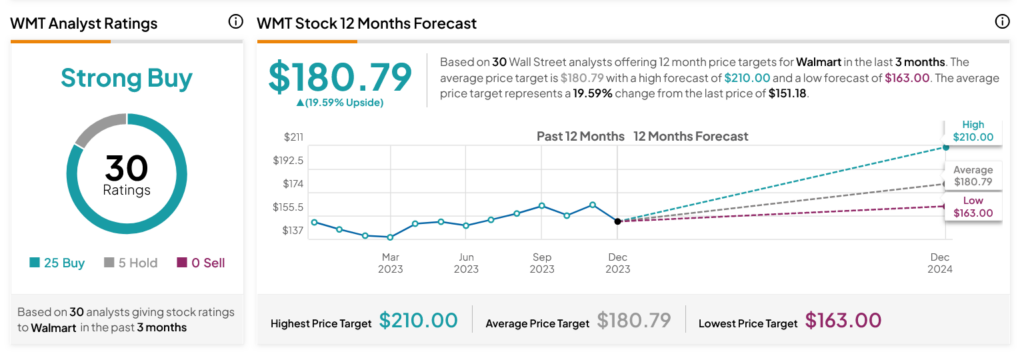

Turning to Wall Street, analysts have a Strong Buy consensus rating on WMT stock based on 25 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 3.97% rally in its share price over the past year, the average WMT price target of $180.79 per share implies 19.59% upside potential.