Biopharmaceutical New Technologies, or BioNTech (NASDAQ:BNTX), stock closed nearly 5% higher on Thursday on anticipation that the sales of Comirnaty, its COVID-19 vaccine developed in partnership with Pfizer (NYSE:PFE), could reaccelerate. Although rising COVID-19 infections suggest a potential rise in company sales, accurately predicting demand remains challenging.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this backdrop, let’s dig deeper.

COVID-19 Vaccine Sales Have Dipped

COVID-19 vaccine sales for BioNTech have dropped significantly. The company reported COVID-19 vaccine revenue of €1.42 billion in the six months of 2023, down from €9.51 billion in the prior-year period.

Despite the drop in revenues, BNTX’s management reiterated full-year COVID-19 vaccine sales guidance. It projects COVID-19 vaccine revenue to be approximately €5 billion in 2023.

Given the massive drop in sales, it remains to be seen whether BioNTech can achieve its outlook. However, the rising COVID-19 cases could lift its revenue. Notably, the new COVID variant Eris is spreading across the world.

According to the CDC’s (Centers for Disease Control and Prevention) data tracker, COVID-led hospitalizations in the U.S. have increased by 14% in recent weeks. Moreover, as COVID infections are again rising, Pfizer announced on Thursday that Comirnaty’s updated shot is effective against Eris. This indicates that both PFE and BNTX could witness an increase in vaccine sales.

Is BioNTech’s Stock Expected to Rise?

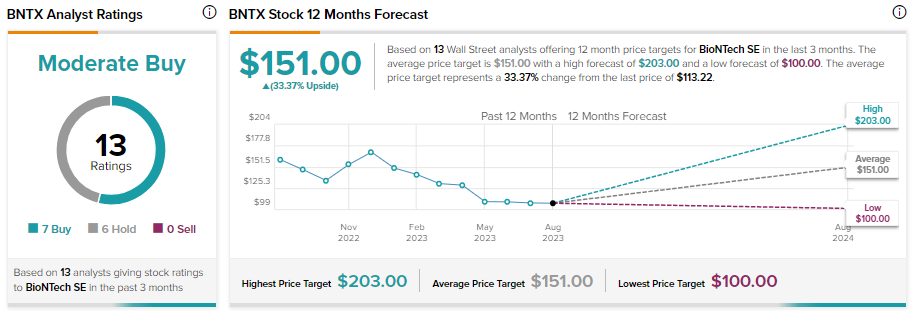

BioNTech stock has underperformed the broader markets over the past year and is down more than 29%. However, analysts’ average 12-month price target of $151 implies 33.37% upside potential from current levels.

Wall Street analysts remain cautiously optimistic about BNTX stock due to the uncertainty around COVID-19 vaccine demand and sales. It has received seven Buy and six Hold recommendations for a Moderate Buy consensus rating.