AngioDynamics (NASDAQ:ANGO) stock lost nearly one-fifth of its value on Thursday after the medical devices maker reported a wider-than-expected loss for the first quarter of Fiscal 2023. Further, its stock is trading in the red during the pre-market session on Friday.

AngioDynamics reported an adjusted loss of $0.06 a share, three times wider than the Street’s loss projection of $0.02 per share. Further, its net sales of $81.5 million also fell short of analysts’ estimate of $82.6 million.

The issues stemming from labor shortages and higher costs (labor, raw materials, and freight) weighed on the company’s margins and bottom line. Further, its investments in business will support its long-term growth but hurt near-term margins.

Nevertheless, AngioDynamics’ management reiterated its Fiscal 2023 guidance and expects its net sales to be in the range of $342 to $348 million. Meanwhile, it projects its adjusted EPS to be in the range of $0.01 to $0.06.

Is AngioDynamics Stock a Buy, Sell, or Hold?

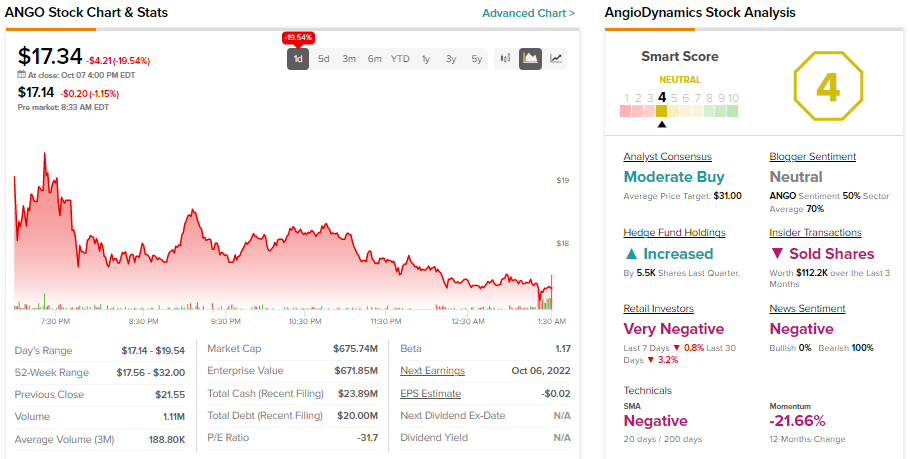

On TipRanks, AngioDynamics stock has a Moderate Buy consensus rating based on two Buy recommendations. Further, the average price target of $31 implies 78.8% upside potential.

ANGO stock has a negative signal from insiders. Per TipRanks’ data, insiders sold ANGO stock worth $112.2K last quarter. Meanwhile, 3.2% of TipRanks’ investors have lowered their exposure to ANGO stock in 30 days.

ANGO stock has a Neutral Smart Score of four out of 10 on TipRanks.