UnitedHealth Group (UNH) stock has gained 18% over the past three months, as optimism builds around its recovery outlook. In a new report, the health insurance giant received a price target boost from Wells Fargo analyst Stephen Baxter, who raised his target to $400 from $267, implying about 9% upside from current levels. He maintained an Overweight rating on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Baxter said the higher target reflects growing confidence in UnitedHealth’s long-term earnings recovery and improving Medicare Advantage (MA) margins, which remain key to the company’s overall profitability.

Analyst Highlights Margin Recovery as Key Catalyst

Baxter sees UnitedHealth as one of the stronger companies in managed care, backed by steady earnings across its main businesses and room for margin growth. He said the company’s focus on improving margins is starting to show results, with further gains expected in its Medicare Advantage and Optum divisions.

The analyst added that Optum, which includes Optum Health, Optum Insight, and Optum Rx, continues to perform well across its health services, data, and pharmacy businesses. Baxter expects both Optum and Medicare Advantage to play a key role in driving UnitedHealth’s earnings recovery in the coming years.

For context, in its last reported Q2 results, UnitedHealth posted revenue of $111.62 billion, slightly above the expected $111.59 billion. The company’s health services arm, Optum, brought in $67.2 billion in revenue for the quarter, up 6.8% year over year.

He also pointed to a strong outlook for 2027 star ratings, which measure the quality of Medicare Advantage plans and influence how much insurers are reimbursed by Medicare. He noted that higher ratings would support better payments and improve UnitedHealth’s profit margins in the coming years.

Is UNH a Good Buy Right Now?

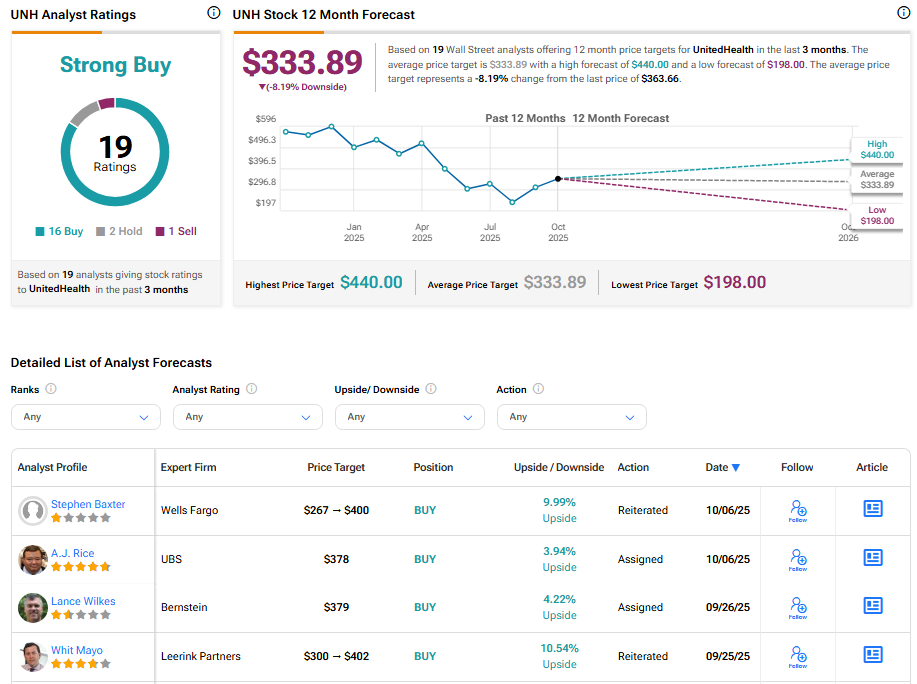

Overall, Wall Street analysts also remain bullish on UNH stock. According to TipRanks’ consensus, UNH stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and one Sell assigned in the last three months. At $333.89, the average UnitedHealth stock price target implies an 8.19% downside potential.