Alphabet (GOOGL) is expected to report its third-quarter results on October 29, and ahead of the earnings print, top BofA Securities analyst Justin Post raised his price target on the stock to $280 from $252, while keeping a Buy rating. The new price target implies an 11% upside from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that Post ranks 32 out of more than 10,000 analysts tracked by TipRanks. He has a success rate of 69%, with an average return per rating of 24% over a one-year timeframe.

Ad Strength Supports Steady Growth

Post believes Alphabet’s core ad business remains strong, with third-quarter spending trends improving across key categories. This strength, he said, should help offset a slowdown in organic search visits and support steady growth.

As a result, the analyst raised his Q3 revenue estimate to $86 billion, slightly above Wall Street’s $85 billion forecast. He now expects earnings per share of $2.17, a bit below consensus due to about $3.9 billion in legal charges. Excluding those charges, Post expects operating margins to hold firm near 35.7%, showing the company’s solid cost control.

Search, Cloud, and AI Drive Confidence

Post said Alphabet should deliver another strong quarter for search, with paid click growth staying steady. He believes this performance shows that AI tools are not yet hurting search revenue, which may help reduce investor concerns about competition in the AI space.

He also expects management to highlight the growing use of Gemini, Alphabet’s main AI model, which is seeing more adoption across its products.

In addition, Post remains upbeat on Google Cloud, noting that recent customer wins could boost its backlog and support profit growth.

Is Google a Good Stock to Buy?

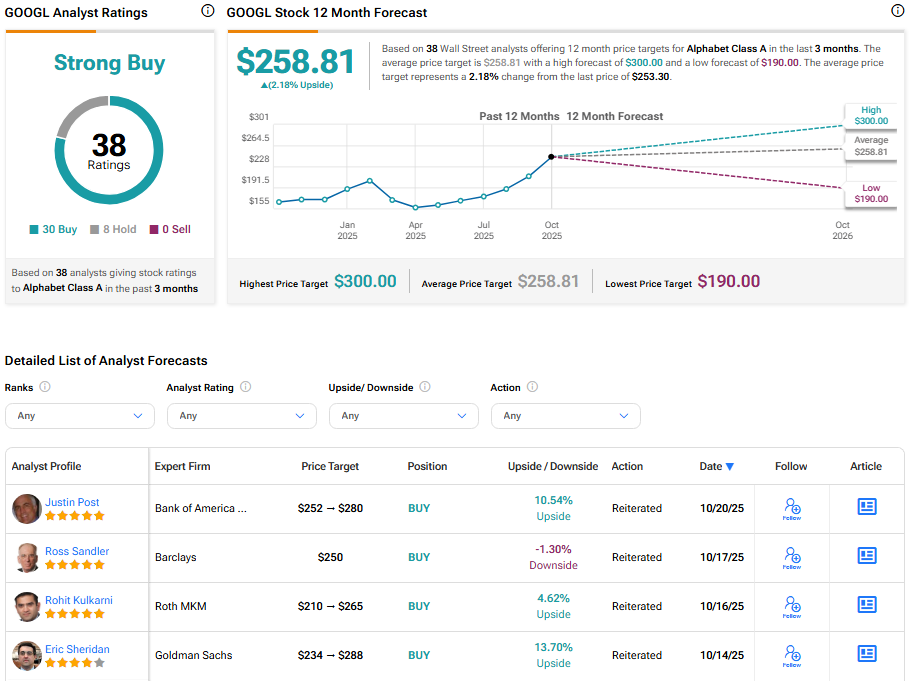

Alphabet stock has a consensus Strong Buy rating among 38 Wall Street analysts. That rating is based on 30 Buy and eight Hold recommendations assigned in the last three months. The average GOOGL price target of $258.81 implies 2.18% upside from current levels.