Investment firm Tigress Financial Partners has begun coverage of cybersecurity firm Palo Alto Networks (PANW) with a Buy rating and a 12-month price target of $245 per share. Indeed, five-star analyst Ivan Feinseth believes that the company’s growing focus on AI-powered security, its all-in-one platform, and strong performance in subscription-based services will keep driving revenue growth. He also sees Palo Alto as a top choice for long-term investors looking for exposure to the cybersecurity sector.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, Feinseth pointed to the company’s latest quarterly results, which showed strong revenue growth and rising demand for its next-generation security offerings. Furthermore, he said that the mix of Palo Alto’s AI-driven platform, its push into cloud security, and recent acquisitions is helping the company improve margins and gain market share. All of this, he explained, is leading to faster business growth and stronger overall performance.

The analyst also noted that Palo Alto is in a great position to benefit from the increasing global need for cybersecurity. In fact, this demand is being driven by more frequent and advanced cyberattacks, along with the rise of AI, new government regulations, and the need for secure systems in industries like finance and defense. Lastly, Feinseth added that the company’s smart spending, which has been achieved through focused R&D, strategic deals, and strong cash flow, will continue to support its long-term growth potential.

Is PANW Stock a Good Buy?

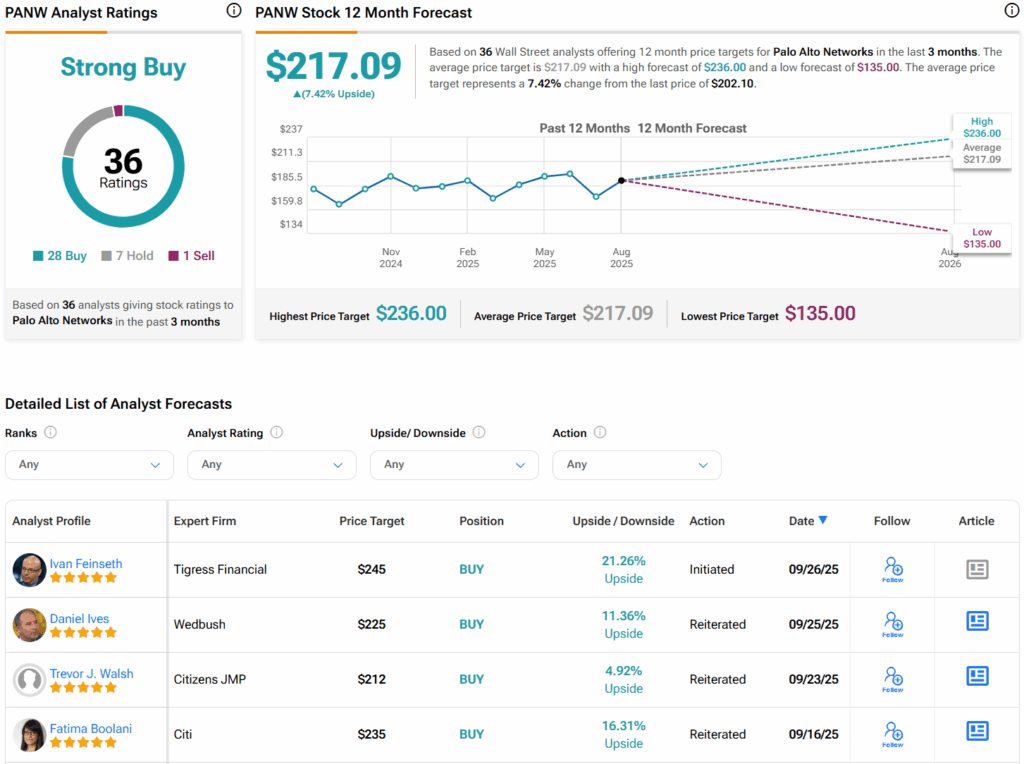

Turning to Wall Street, analysts have a Strong Buy consensus rating on PANW stock based on 28 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average PANW price target of $217.09 per share implies 7.4% upside potential.