Under any other context, telehealth specialist Hims & Hers Health (HIMS) would probably be a public enterprise to avoid. It’s not that the underlying business is troubled; in fact, the dramatic rise of HIMS stock would suggest the opposite. Instead, the company may be too successful, thus raising fears among new speculators that they will be left holding the bag if the stock now fails to meet their high expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

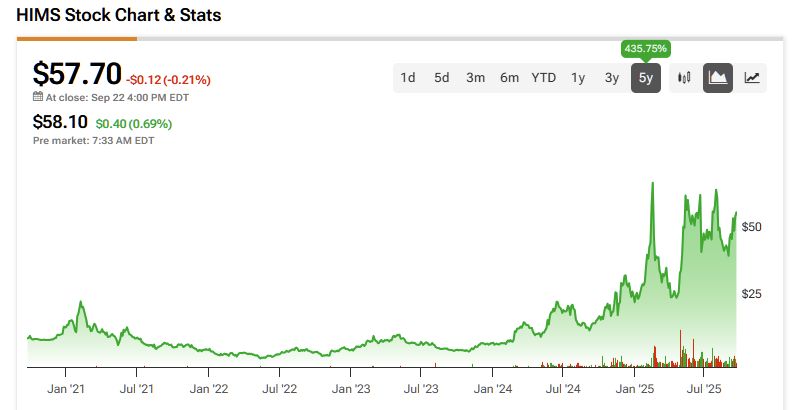

In the trailing month, HIMS stock has gained roughly 32% — a remarkable performance. Over the trailing half-year period, the security has soared 66%. Since the beginning of the year, HIMS delivered an astounding return of over 139%. While the price action tends to be incredibly choppy, HIMS’ apparent rebounding ability has attracted scores of bullish speculators.

What’s even more startling is that fundamentally poor news doesn’t seem to materially change the trajectory. For example, Hims & Hers recently received a letter from the U.S. Food and Drug Administration (FDA) stating that the company’s compounded semaglutide products feature “false or misleading” claims regarding weight-loss efficacy. While HIMS stock suffered an initial blow from the letter’s disclosure, it was ultimately no worse for wear, as the stock gained over 5% last week.

So, if fears of excessive speculation and outright negative news can’t stop HIMS stock, is there any reason to bet against it? Some traders have undoubtedly taken on that wager — and I’m afraid they risk learning a very painful lesson. I’m staying Bullish and I’ll explain why…

Blistering Short Interest a Warning Sign for HIMS Stock

Currently, the short interest of HIMS stock stands at a staggering 37.78% of its float. In other words, of the shares available for trading, almost 40% of this pool is tied to short transactions. To be clear, a high short interest doesn’t necessarily mean that the underlying participants are bearish. Some of the shorts could be tied to hedging or market-making activities.

However, what is always true about a short position is that it’s a credit-based mechanism. Ultimately, the creditor must be made whole. That’s what makes securities with extremely high short interest dangerous — for the bears.

Unlike a retail trader who initiates a position by buying to open, a short trader sells to open. The securities that are dumped in the open market are essentially borrowed on credit. Again, this means that irrespective of whatever happens to the stock, the lending creditor (broker) must eventually receive back the borrowed shares.

For short traders to profit, the target security must fall in value. If it does, the bearish speculators can buy back the shares on a discount (relative to the original selling price) and return them to the creditor. Obviously, the remainder is pocketed as profit. However, if the security moves in the “wrong” direction (as in up), short traders risk owing an ever-rising liability.

Prudent speculators will cut their losses early. Stubborn shorts risk blowing up their portfolios if the target security continues its ascent. That’s because for short traders to exit their positions, they must buy to close. That’s the fuel behind the so-called short squeeze.

What’s most problematic is that for naked short positions, tail risk — or the threat of an obligatory payment when the underwritten risk is realized in the extreme ends of the distribution — could theoretically extend to infinity.

Of course, margin calls usually come in before the liability becomes completely out of hand. Still, the threat of uncapped exposure is what makes inciting a short squeeze so compelling for the bulls on the opposite side of the trade.

HIMS to $100? Why It’s Not a Far-Fetched Possibility

What’s really fascinating about HIMS stock is not just the excessive short interest; rather, it’s the direct relationship between this metric and the price action. From February 2021 to early September 2025, the correlation coefficient between these two data points clocked in at 90.94%. Basically, as the HIMS share price increased, so too did short interest.

Given the sheer magnitude of short transactions, it’s likely that at least a good chunk of this pool is dedicated to bearish bets. After all, you’re talking about a security that has gained nearly 252% in the past 52 weeks. Amid questions about broader economic stability, a stock moving up this much would surely arouse deep skepticism.

Still, what’s really fascinating is that while short interest is rising, HIMS stock appears to be printing what is known in technical analysis as a bullish pennant formation. To use colloquial language, the bulls and bears engage in vigorous battles until the frontline gets frozen in a consolidation phase. However, at the end of the consolidation, technical analysts believe that the target security has a good chance of breaking out.

Admittedly, it’s a heuristic argument — but even heuristics can be profitable if enough people believe and act upon them. And that’s where the high short interest comes in. Because the shorts are tied to obligatory transactions, HIMS stock may enjoy tremendous pull.

Looking forward, it wouldn’t be surprising to see the bulls eventually challenge the $100 level. It’s simply a natural, or what’s known as a “psychological” significant price target, representing a milestone transition from a double-digit price tag to triple digits.

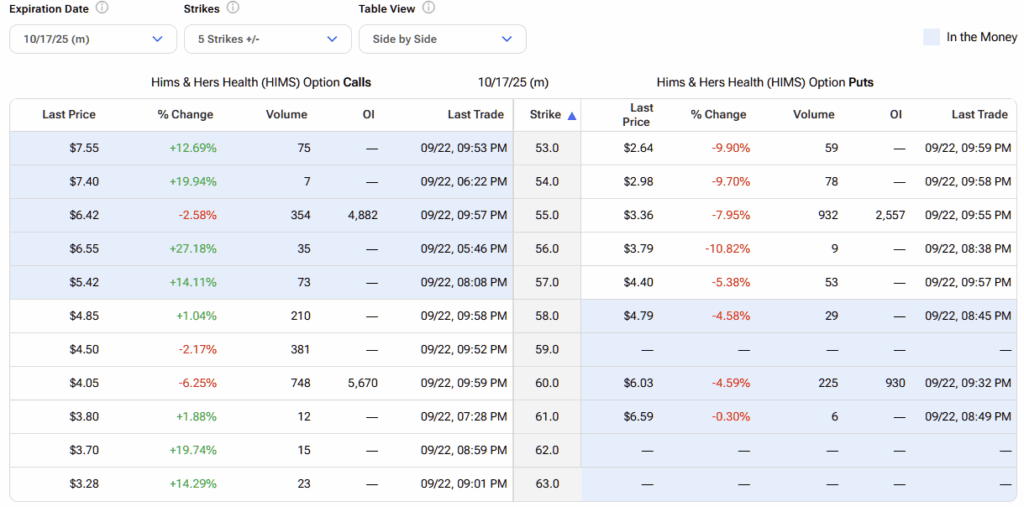

For traders, I see two ideas for HIMS stock. First, the simplest idea is to consider buying the $65 call expiring June 18 outright. As things stand, the premium for this option is $15 per contract (or $1,500 in total), meaning that HIMS would need to hit $80 (based purely on intrinsic value) to break even. While ambitious, if the stock reaches $100, this option would be very lucrative.

Second, a more intricate idea is to consider the 60/65 bull call spread expiring October 17 of this year. Under this capped-risk, capped-reward transaction, if HIMS stock rises through the second-leg strike price of $65 at expiration, the maximum payout is currently over 199%.

Is HIMS a Good Stock to Buy?

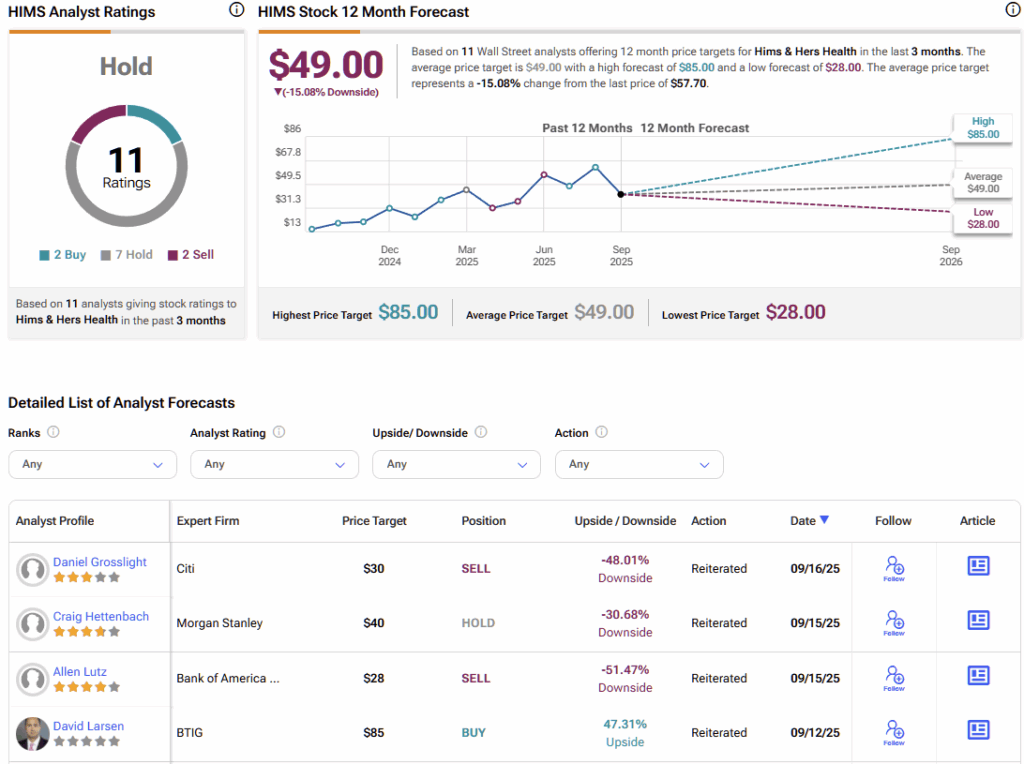

Turning to Wall Street, HIMS stock has a Hold consensus rating based on two Buys, seven Holds, and two Sell ratings. The average HIMS price target is $49, implying ~15% downside risk over the coming twelve months.

Contrarianism is a Powerful Upside Risk for HIMS Stock

While Hims & Hers Health’s remarkable ascent has more than its fair share of critics, betting against HIMS stock could be hazardous to your portfolio. Due to the extremely high short interest, the underlying obligation suggests that unexpected bullishness could potentially trigger a short squeeze. If so, the move could be explosive, meaning that HIMS should be on the radars of opportunistic options-savvy traders.