EV maker Tesla’s (TSLA) new lower-cost versions of the Model Y SUV and Model 3 sedan are entering a difficult market in Europe, where competition is much stronger than in the U.S., according to Reuters. As a matter of fact, the $39,990 Model Y Standard and $36,990 Model 3 will compete with many electric vehicles already priced under $30,000 from European and Chinese brands. In contrast, the U.S. market has far fewer options in that price range, with only the Nissan (NSANY) Leaf currently available below $30,000.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla has seen its European market share drop to around 1.5% since 2023, when the Model Y was the region’s best-selling car. Analysts say this decline is partly due to Tesla’s aging vehicle lineup and some backlash toward Elon Musk’s political views. The company hopes that the cheaper models will boost sales after global deliveries fell in 2024 and are expected to drop another 10% this year. Still, the end of the $7,500 EV tax credit could slow overall demand in the coming months.

Separately, in China, Tesla’s new cars are still priced significantly higher than local models, which dominate the market. Meanwhile, Europe’s EV competition continues to grow, as Volkswagen (VWAGY) recently announced plans for an EV under €25,000. Although Tesla’s updated Model Y helped improve sales in some European countries in September, analysts warn that its limited lineup may hold it back. Experts say the cheaper Teslas will help, but likely won’t make a major impact unless prices drop closer to €30,000.

What Is the Prediction for Tesla Stock?

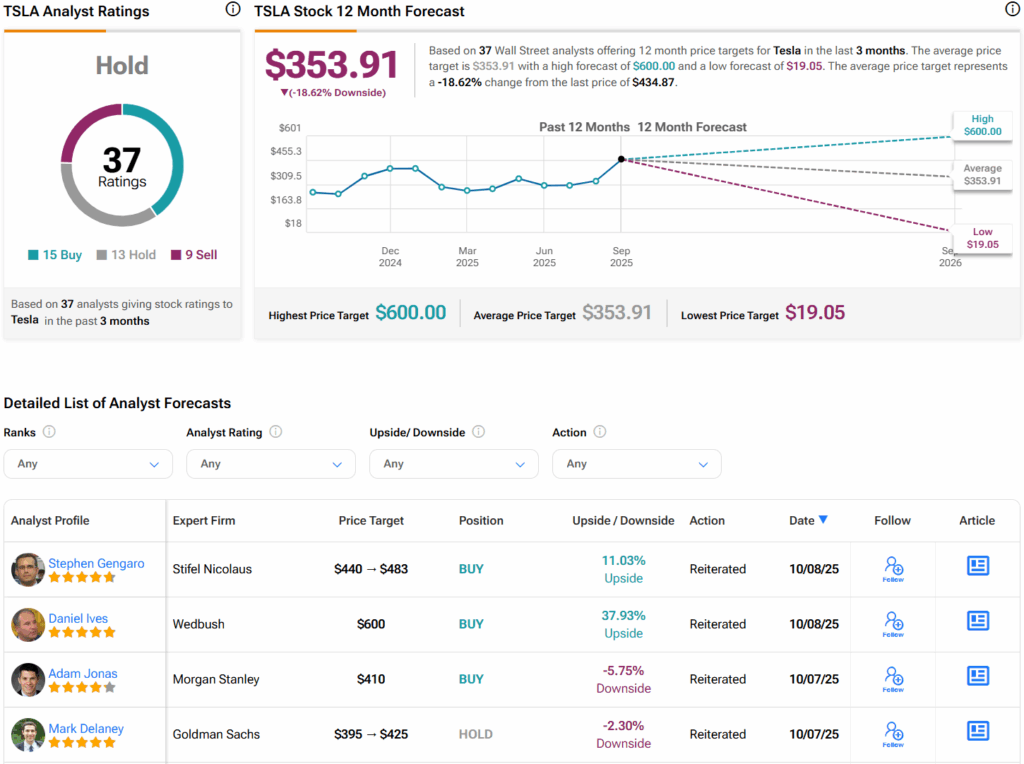

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 15 Buys, 13 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $353.91 per share implies 18.6% downside risk.