What’s the right price for a top brand struggling to grow, especially if its turnaround is moving in slow motion? In the case of Starbucks (SBUX)—which fits this scenario well—it requires paying an overly rich multiple, based on the belief that a revamped C-suite and a “back to basics” strategy can bring the leading coffee shop brand back to growth. The weak price performance this year, down 5.5%, clearly reflects the market’s skepticism about paying a high price for inconsistent growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The turnaround may be slow, but the fact that it’s happening at all is a positive sign. All the same, given the execution risks inherent in the thesis and the absence of clearer signs that comparable sales consistency is finally becoming a trend, I find it risky to pay an extended multiple for a story that requires a high margin of safety. For that reason, I maintain a Hold rating for SBUX.

Top-Line Swings and Margin Squeeze

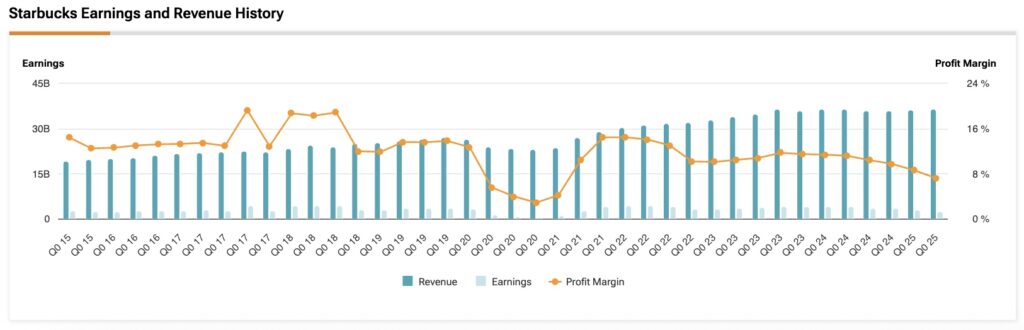

Over the past five years, Starbucks’ share performance has been quite erratic, largely following the swings in its top-line growth. It went from a sharp drop during the pandemic to a strong post-pandemic recovery, then stabilized for a while—until 2024, which was essentially a year of flat growth, with less than 1% increase.

To recap briefly, last year Starbucks experienced a decline in U.S. traffic, with comparable transactions (i.e., the number of receipts processed, which closely tracks traffic) down 5%, resulting in a 2% drop in comparable store sales. Internationally, comparable sales declined 4%, with China experiencing an 8% drop, partly due to a similar decrease in average ticket size. Most of these declines were attributed to a challenging macroeconomic environment, with high inflation affecting U.S. consumer spending and slower economic growth in China taking its toll, primarily due to temporary headwinds.

That said, a few structural challenges also played a role. Intensified competition—both in the U.S. and especially in China—and operational complexity (menu bloat) hurt Starbucks’ performance, forcing the company to rely on heavy discounts and an unfavorable sales mix to boost traffic.

These pricing pressures, combined with rising input costs—Arabica coffee prices jumped 31.9% over the last twelve months, spiking more than 40% between November and March this year—along with higher logistics and labor expenses, put pressure on COGS and squeezed margins. As a result, Starbucks’ net income margin dropped sharply, from 11.4% in 2023 to 10.4% in 2024, and now sits at 7.2% over the last twelve months.

The Back to Starbucks Plan Shows Early Results

In September last year, former Chipotle (CMG) CEO Brian Niccol took over as CEO of Starbucks, replacing Laxman Narasimhan due to pressure from activist investors like Elliott Investment Management and the need for leadership more closely aligned with the specific challenges Starbucks was facing—declining customer traffic and intensifying competition, especially in China. With that, he launched the “Back to Starbucks” turnaround plan.

Essentially, the plan aimed to return to the company’s roots, with relatively uncomplicated initiatives: simplifying the menu, reopening mobile-only stores, streamlining wait times, and, above all, shifting marketing from discounts to emphasizing brand storytelling and coffee expertise. I interpret this as an attempt to move Starbucks away from a “fast-food” model and toward a premium coffee shop experience.

The first three quarters of 2025, reflecting the early stages of the Back to Starbucks strategy, got off to a slow start. In Q1, global comparable store sales fell 4%, with traffic down 6%. In Q2, there was some relief, with comparable store sales declining just 1% and traffic down 2%. In Q3, there was no sequential improvement—global comparable store sales dropped 2%, and traffic also fell 2%—but the indicators were already less dire than the previous year.

The catch is that this improvement in comparable store sales has come at the expense of operating income, due to investments in labor and store renovations. Looking at the last twelve months, operating income has already declined by 30% compared to 2024. In the most recent quarter, Q3, Starbucks reported a 45% year-over-year decrease in operating income, from $1.4 billion to $918.7 million, with operating margin dropping from 21.0% to 13.3%.

High Multiples and the Case for Caution

One of the key points supporting Starbucks’ valuation is that, beyond its global leadership in coffee shops and strong brand, its stores are highly profitable, with solid operating margins, strong capital turnover, and a globally replicable model. The metric that best captures these moats is return on invested capital (ROIC), where Starbucks has maintained around 20% over the last five years, although it currently sits at 16.4%, down from 20% in late 2024.

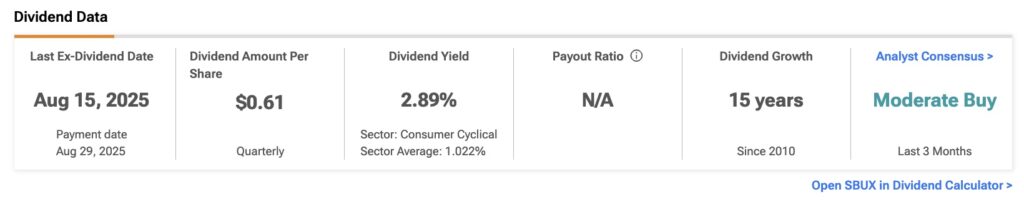

Still, considering that SBUX has a moderate beta and a very low-leverage capital structure, a weighted average cost of capital of ~7.6% is reasonable, given the 10-year U.S. Treasury yield at ~4%. This suggests that, even in ongoing turnaround mode, Starbucks remains a high-return business for shareholders, well above its cost of capital, providing a cushion to safely deliver a 2.9% dividend yield and repurchase approximately $6.6 billion in shares over the last three years.

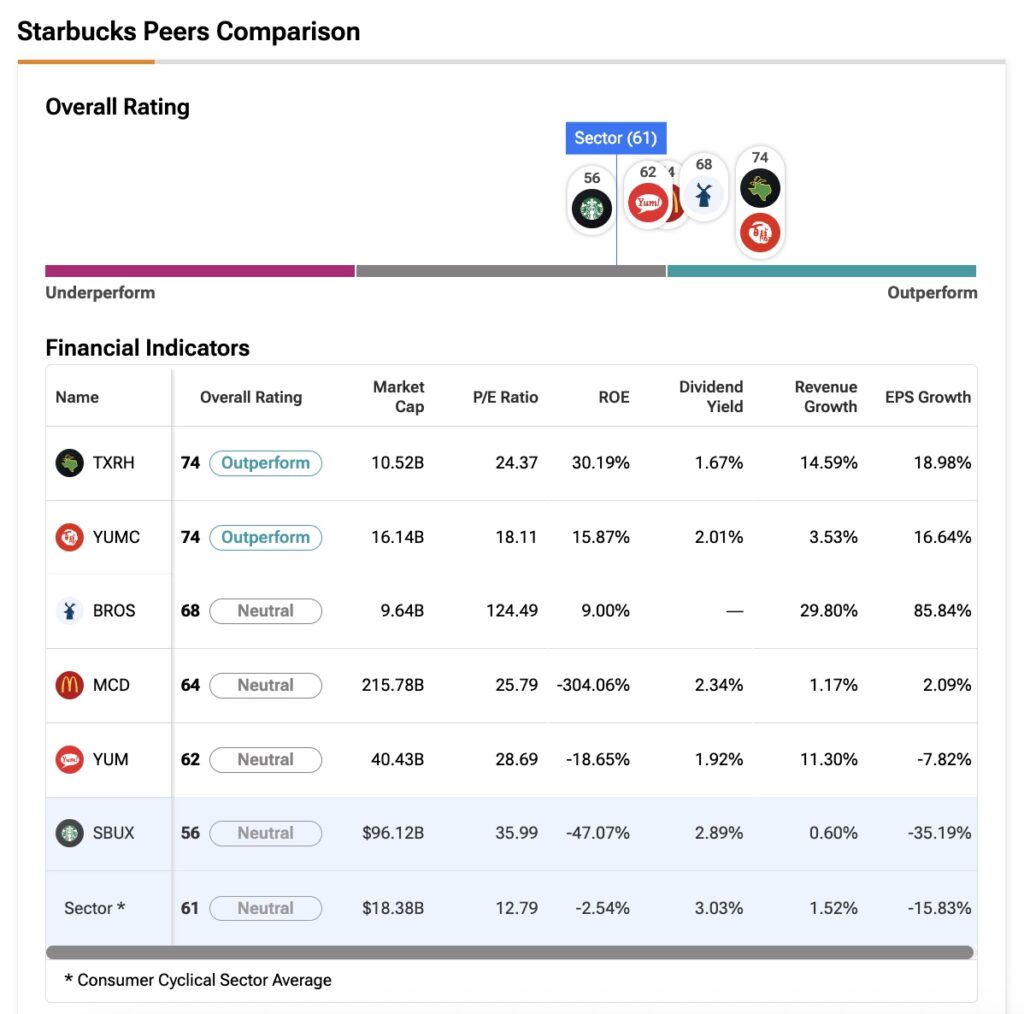

What stands out, however, is that SBUX is currently trading at 36x earnings and 42.7x free cash flow, implying a considerable premium versus three-year averages of 30.2x and 36.4x, respectively, and the sector average of 12.8x. Notably, in July, just before reporting Q3 earnings, Starbucks shares hit a 41.8x earnings multiple, the highest level in the past three years—arguably driven by growing optimism around a potential successful turnaround rather than any relevant improvement in financials.

In short, while Starbucks’ business arguably deserves a premium, paying well above recent averages for a company that has yet to deliver a consistent turnaround is risky. I would like to see more sustained progress in the bottom line before feeling confident buying at these multiples.

Is SBUX a Buy, Hold, or Sell?

Wall Street analysts are mostly bullish on SBUX, though some skepticism remains. Of the 22 analysts covering the stock over the past three months, 14 rate it a Buy, six say Hold, and two recommend Sell. The average price target is $102.10 per share, implying a potential upside of more than 21% from the current share price over the coming year.

Waiting for Proof of Sustainable Growth

Undeniably, Starbucks has made modest progress with its “Back to Starbucks” plan, already showing improvements in comparable sales and traffic. However, this progress is coming at the expense of the bottom line in the short to medium term. I believe that the stocks of companies undergoing a major turnaround do not deserve the same multiples as those of businesses with stable growth, and paying high multiples in anticipation of a successful turnaround carries significant risk.

At its current valuation, Starbucks’ multiple leaves little room for error, and continued slippage could be costly. Even though the company delivers solid returns to shareholders, I am not comfortable paying the sizable premium that SBUX currently commands. That said, I would assign a Hold rating for now, pending more compelling evidence of sustained comparable store sales growth—preferably without sacrificing profitability.