Spruce Biosciences (SPRB) stock has soared 72% in pre-market trading on Tuesday, after gaining more than 1,300% on Monday. The surge came after the company announced that the U.S. FDA (Food and Drug Administration) granted its rare-disease drug a breakthrough therapy designation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Spruce Biosciences is a late-stage biopharmaceutical company focused on developing therapies for rare endocrine disorders. The company is developing a treatment for Sanfilippo Syndrome Type B, a rare genetic disorder that damages the brain and nervous system.

What’s Happening with Spruce Biosciences?

The FDA granted breakthrough therapy designation for Spruce’s experimental treatment tralesinidase alfa (TA-ERT), designed to treat Sanfilippo Syndrome Type B.

Through the breakthrough designation, the FDA offers drugmakers added guidance to speed up development. This decision was backed by long-term clinical data showing that cerebrospinal fluid heparan sulfate (CSF HS-NRE) levels returned to normal.

The approval also allows Spruce Biosciences to use a key biomarker in cerebrospinal fluid to measure the drug’s effectiveness, which could help the company gain faster approval.

What’s Next for Investors?

Following this development, Spruce Bio shares reached an all-time high, just weeks after the company resumed trading on the Nasdaq. Earlier in April, the SPRB stock was delisted from Nasdaq for not meeting the minimum bid price requirement. Later on, trading of its common stock resumed on August 5.

Looking ahead, the company’s regulatory pathway is a key factor for investors to watch. Additionally, investors should be mindful of stock volatility. SPRB has already experienced substantial gains, and as the company moves from early-stage trials toward potential commercialization, sharp price swings are likely.

Overall, the stock’s performance will remain closely tied to clinical results and regulatory developments, making it a high-risk, high-reward opportunity for those watching the biotech closely.

Is SPRB a Good Stock to Buy?

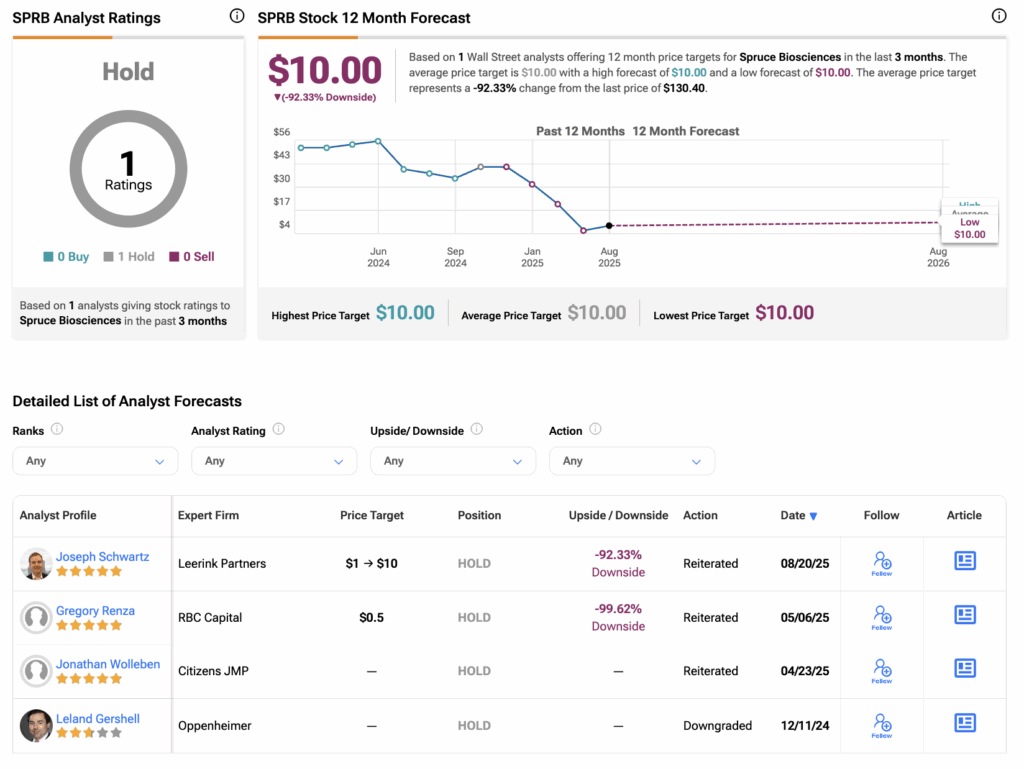

Turning to Wall Street, analysts have a Hold consensus rating on SPRB stock based on one Hold recommendation assigned in the past three months. Furthermore, the average Spruce Biosciences’ price target of $10.0 per share implies 92.23% downside risk.