Sanmina (NASDAQ:SANM) stock jumped more than 20% today after being caught in the slipstream of AMD’s blockbuster partnership with OpenAI – a deal that sent the entire AI hardware supply chain into overdrive. As the excitement spread across the sector, investors quickly turned their attention to Sanmina’s own upcoming acquisition of ZT Systems’ manufacturing business, realizing that the move could place the company squarely at the heart of the AI infrastructure boom powering hyperscale data centers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Bank of America analyst Ruplu Bhattacharya, Sanmina’s momentum is no accident. After meeting with CFO Jon Faust in New York, Bhattacharya said management remains confident that ZT Systems could add between $5 billion and $6 billion in annual net revenue once fully integrated – potentially doubling Sanmina’s top line within three years. The acquisition, expected to close by the end of 2025, advances Sanmina’s strategic focus in cloud and AI manufacturing.

ZT Systems specializes in assembling and testing data center racks for hyperscale customers – the same type of infrastructure driving OpenAI’s massive AI capacity buildout. As Bhattacharya noted, this move elevates Sanmina from a traditional contract manufacturer to a high-value partner in next-generation computing.

“SANM will be AMD’s preferred NPI partner,” the analyst wrote, explaining that the company will help AMD build, test, and prepare its GPU racks for production, gaining valuable experience that could later translate into long-term manufacturing deals with other AI chip leaders like Nvidia.

Still, the analyst remains measured, noting that while the ZT deal and AI exposure represent clear positives, the macro backdrop remains uncertain and integration risks persist. Management will need to synchronize back-end processes – from IT to finance – to ensure a smooth transition for both existing and new customers.

Bhattacharya expects the transaction to be accretive by around $1.00 per share in 2026, assuming no synergies and a 5% operating margin, with the potential for even greater upside if vertical integration improves profitability.

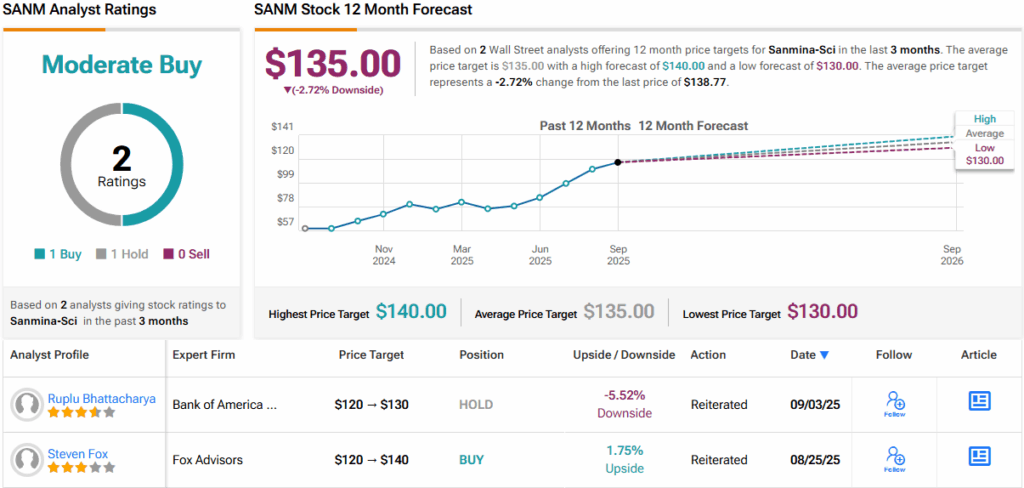

For now, Bhattacharya assigns Sanmina shares a Neutral rating and a $130 price target, implying about 5.5% downside from current levels. (To watch Bhattacharya’s track record, click here)

Overall, Sanmina has slipped under the radar a bit, with only two recent analyst reviews – one Buy and one Hold – making the Moderate Buy consensus unanimous. The shares currently trade at $141, and their $135 average price target points to a modest 3% downside. (See SANM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.