Semiconductor and software giant Broadcom (AVGO) surged nearly 10% on Monday after announcing a massive deal with OpenAI, and it’s precisely why I’m on the sidelines. This strategic collaboration to deploy 10 gigawatts of custom AI accelerators, followed by a new AI networking chip announcement on Tuesday, cements Broadcom’s role as an AI infrastructure leader and may dramatically expand its revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yet, this well-deserved rally appears to have already priced in much of the near-term optimism. I believe investors should temper their excitement, as significant questions about customer funding and execution linger, making the risk/reward profile less compelling for new money. For now, I am assigning Broadcom stock a Hold rating.

Broadcom’s OpenAI Deal Moves the Revenue Needle

The OpenAI partnership is a monumental win for Broadcom. The scale is staggering. The 10-gigawatt agreement is notably larger than a similar six-gigawatt deal OpenAI recently signed with Advanced Micro Devices (AMD). To put this in perspective, Nvidia (NVDA) has previously stated that every gigawatt of data center AI compute represents a $40 to $50 billion opportunity for its business.

Applying a similar, albeit discounted, framework to Broadcom’s custom chip business, the numbers could be staggering. Analyst estimates from firms like Melius Research suggest this deal could be worth at least $40 billion annually to Broadcom starting in the second half of 2026.

Another projection from Mizuho Securities analyst Vijay Rakesh values the multi-year agreement at $150-$200 billion in total revenue. If these forecasts are even close to accurate, the OpenAI deal could effectively double Broadcom’s current annual revenue run-rate, which currently stands close to $60 billion. The OpenAI collaboration positions Broadcom for explosive top-line growth over the next three years, making it a dominant force in the AI infrastructure landscape alongside Nvidia and, potentially, AMD.

Broadcom’s Growing Clout in Custom AI Chips

The latest OpenAI deal is further validation of Broadcom’s strategic focus. The company is a leader in designing Application-Specific Integrated Circuits (ASICs). Unlike general-purpose chips from competitors, ASICs are custom-built for a specific customer’s needs, designed for superior performance and power efficiency for targeted tasks like AI training. This makes Broadcom a lower-cost, highly efficient option for hyperscalers and large tech companies looking to optimize their AI infrastructure.

Broadcom’s ASIC development deals aren’t limited to OpenAI. It has inked ASIC deals with Meta Platforms (META) and long-standing and successful custom ASIC relationships with Apple (AAPL) and Alphabet (GOOGL).

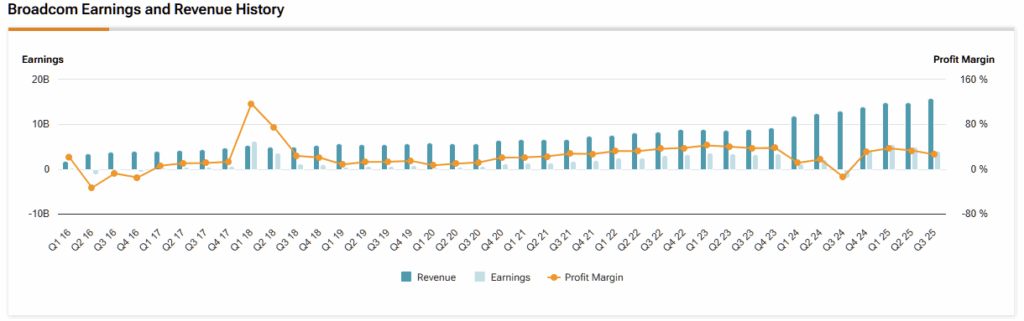

This diversified approach to custom silicon, combined with Broadcom’s market-leading networking and connectivity solutions, creates a powerful product portfolio that touches nearly every part of the modern AI-ready data center. And Broadcom has thus enjoyed strong growth across its revenue segments during the past three to five years.

Margin and Funding Concerns Dominate Bearish Attention

However, immense opportunity often comes with commensurate risk. The first concern is profitability. While the OpenAI deal is most likely accretive to earnings and cash flow, it could simultaneously shrink Broadcom’s corporate margins.

Custom ASIC projects, especially those where the customer, like OpenAI, leads the design, can carry lower gross margins than Broadcom’s high-margin software and legacy semiconductor businesses. The company recently navigated a period of GAAP margin compression following its massive acquisition of VMware, seeing operating margins drop from 45.9% in 2023 to 29.1% in 2024 before recovering to 39% recently. Executing on a deal of the 10-gigawatt scale could put renewed pressure on these hard-won gains, even as absolute profits rise.

The second, and more pressing, concern is customer funding. How will OpenAI pay for all this infrastructure? The ChatGPT maker is on a deal-making spree in 2025, committing to tens of billions in infrastructure spending with partners including Broadcom, AMD, Nvidia, and Oracle (ORCL).

While OpenAI is growing rapidly, targeting $13 billion in revenue this year, it is still burning significant billions in cash, a common trait for a growth-stage company. OpenAI recently raised $40 billion in a SoftBank-led (SFTBY) financing round. Still, the originally not-for-profit start-up faces legal hurdles as it tries to raise capital from growth-focused investors.

Therefore, the sheer scale of OpenAI’s commitments, including $60 billion annual payments to Oracle, raises valid questions about the start-up’s capacity to fund multi-billion-dollar deals. This is before ironing out its governance issues, including an Elon Musk lawsuit set for a hearing in 2026, which may stifle capital-raising efforts. If OpenAI’s revenue growth slows or funding becomes constrained, the execution risk for Broadcom’s landmark deal increases substantially. OpenAI’s governance issues may shake the foundation of Broadcom’s new revenue stream.

Broadcom’s Steep Valuation Demands Perfect Execution

Even before Monday’s pop, Broadcom’s stock was not cheap. The rally added a staggering $145.6 billion to its market capitalization in a single day, indicating that investors have high expectations.

The stock now trades at a forward Price-to-Earnings (P/E) ratio of approximately 83x. Its forward Price-to-Earnings-to-Growth (PEG) ratio, which factors in growth expectations, sits at 1.8, also suggesting a rich valuation.

Broadcom’s valuation is significantly steeper than peers, including Nvidia (forward P/E of 42.8, forward PEG ratio 1.2) and Taiwan Semiconductor (TSM) (forward P/E 30.8, forward PEG 1.3). For an expensive, large-cap growth stock like Broadcom to justify its premium, execution needs to be flawless.

Given the funding overhang from the key customer, the path to flawless execution looks challenging, more so as the competition, including open-source AI models, continues to close the performance gap against OpenAI offerings.

Is Broadcom a Buy or Sell?

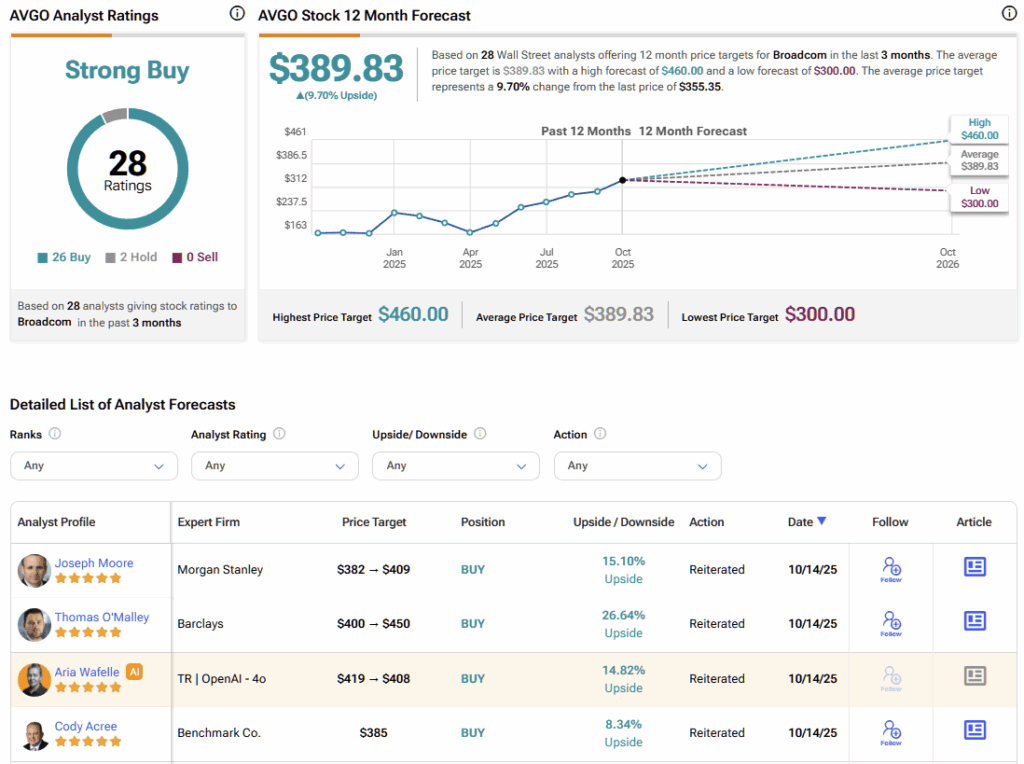

The Wall Street analyst community remains overwhelmingly bullish on Broadcom stock. The consensus is a Strong Buy rating based on 26 Buys and 2 Hold ratings over the past three months. The average analyst price target is $389.83, implying almost 10% upside potential over the next year.

This optimism is rooted in Broadcom’s impeccable execution history, its diversified AI portfolio, and the transformative potential of deals like the one with OpenAI. However, even in the face of overwhelming optimism, a degree of caution is still warranted.

Hold and Watch the Execution Unfold

Broadcom stands out as one of the world’s best-managed technology companies, with a formidable position in the AI ecosystem. Its partnership with OpenAI could meaningfully boost revenue and cash flow starting in late 2026, but the deal also carries funding-related uncertainties. Following the recent rally, AVGO’s valuation now looks stretched — pricing in an optimistic, best-case outcome in the near term.

Given the tangible risks of margin pressure and the growing questions around OpenAI’s ability to finance its ambitious commitments, a HOLD stance on Broadcom stock appears sensible. Current shareholders should maintain their positions for the long-term upside, while prospective buyers may find better entry opportunities once the market cools and OpenAI’s governance situation becomes clearer.