Quantum Computing (QUBT) shares slipped in pre-market trading today after the company announced a major financing move involving institutional investors. The deal includes the sale of about 37.18 million shares in a private placement, which is expected to close around October 8, 2025.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Company Raises $750 Million to Fund Expansion

The company said it expects to raise about $750 million in gross proceeds from the offering. Once completed, Quantum Computing’s cash balance is projected to reach around $1.55 billion.

Though the new funding gives Quantum Computing a stronger cash base, investors reacted negatively to the share dilution that comes with such a large equity sale. The new shares will increase the company’s total share count, which can weigh on existing shareholders’ value in the short term.

Quantum Computing plans to use the funds to boost production, bring its products to market, and explore new acquisitions. It also aims to grow its sales and engineering teams as part of its broader strategy to scale its quantum optics and photonics business.

Quantum Computing Stock Movement

Quantum Computing stock is down more than 10% in today’s pre-market trading, following a 23% rally on Friday. The shares have gained 48.76% year-to-date and 3,324.2% over the past 12 months.

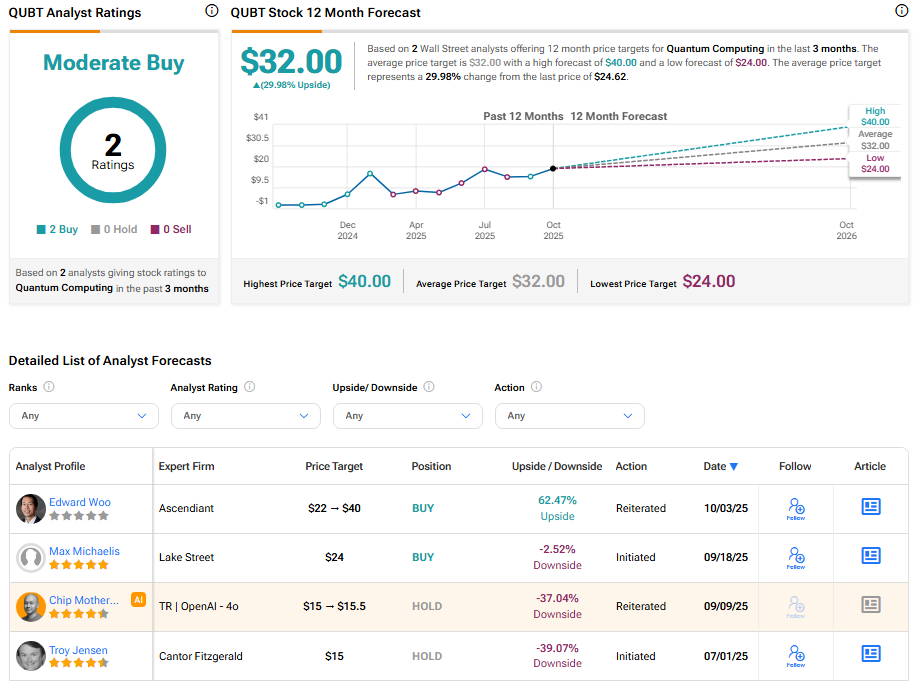

Is QUBT Stock a Buy, Hold, or Sell?

On TipRanks, QUBT stock has a Moderate Buy consensus rating based on two unanimous Buy ratings. The average Quantum Computing price target of $32 implies 29.98% downside potential from current levels.