Shares of quantum computing company IonQ (IONQ) trended lower in Friday’s trading session after the company announced a $2 billion equity offering. The deal includes 16.5 million shares of common stock and pre-funded warrants to buy 5,005,400 additional shares, both priced at $93 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Company Raises $2 Billion for Expansion

IonQ said the offer price was a 20% premium to its October 9 closing price, showing solid investor demand. The deal also includes seven-year warrants to buy 43,010,800 shares at $155 per share.

CEO Niccolò de Masi called it the largest single institutional investment in quantum history. He said the new capital will help the company grow globally and speed up commercialization of its quantum systems.

The new funding gives IonQ a stronger cash position and supports its plan to grow across the U.S., Europe, and Asia. However, investors reacted cautiously to the potential share dilution from such a large equity sale. The added shares will raise the total share count, which may pressure the stock’s value in the short term.

IonQ Stock Movement

IonQ stock fell more than 8% in Friday’s pre-market trading, but later recovered about 2% in after-hours. The shares are up 69% year-to-date and have surged 551% over the past 12 months, reflecting growing investor interest in quantum computing.

Is IONQ Stock a Good Buy Right Now?

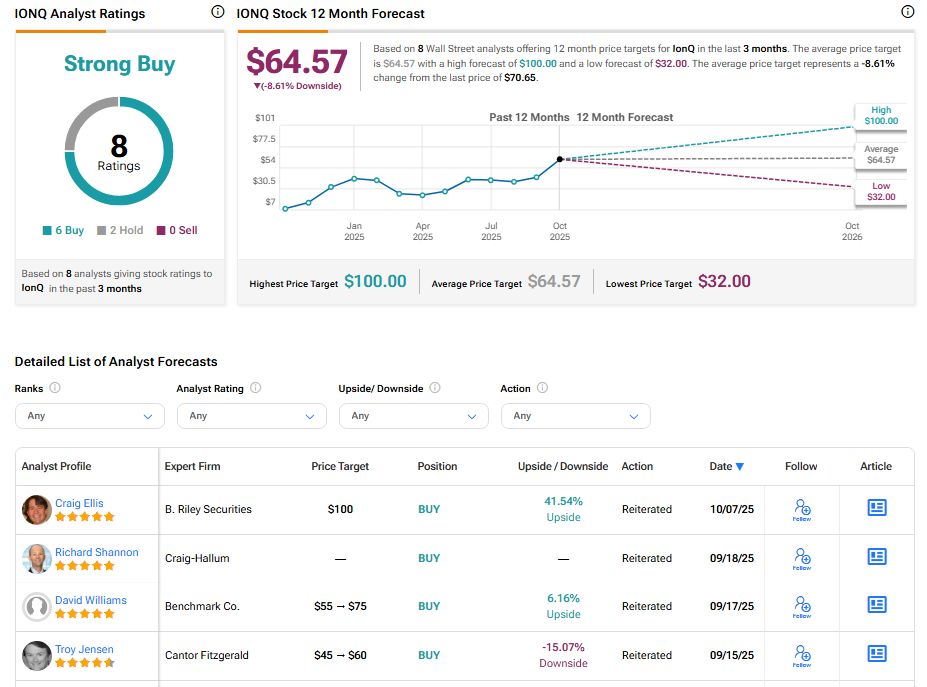

On TipRanks, IONQ stock has a Moderate Buy consensus rating based on six Buys and two Hold ratings. The average IonQ price target of $64.57 implies 8.61% downside potential from current levels.