Opendoor (NASDAQ:OPEN) stock staged a strong rebound today, jumping 16% after yesterday’s steep decline. What began as a bounce is now shaping into a full-blown rally, with shares climbing another 10% in after-hours trading as new drivers keep buyers piling in, lifting the stock back to the $9 mark.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fueling the move was an upbeat snapshot of the housing market. Data from the U.S. Census Bureau and the Department of Housing and Urban Development showed that sales of new single-family homes in August surged 20.5% from July and 15.4% compared to the same period last year. For Opendoor, a business built on transaction volumes, that kind of growth points to real potential for revenue tailwinds after a year marked by weakness in the housing market.

Adding to the upside, a new 13G filing from Jane Street Group revealed the firm now holds 44 million shares of Opendoor, representing 5.9% of the company’s outstanding shares. When a heavyweight like Jane Street takes a sizable stake, it often reassures smaller investors that institutional money sees opportunity.

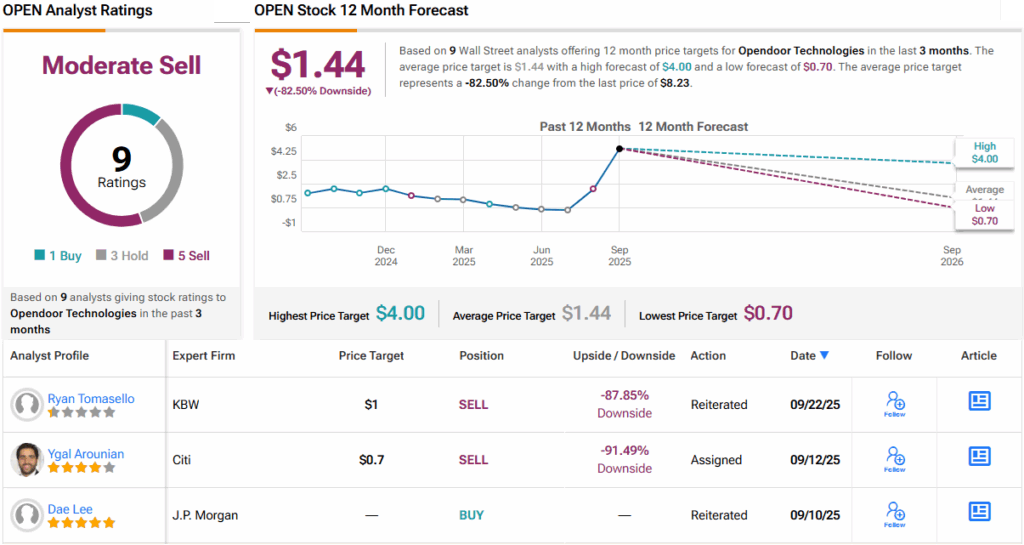

Yet, despite the bullish tone, skepticism hasn’t disappeared. KBW analyst Ryan Tomasello remains firmly in the Opendoor bear camp, sticking with a Sell rating and a $1 price target, an outlook that implies an 88% plunge from current levels heading into next year. (To watch Tomasello’s track record, click here)

“While Opendoor should benefit from evolving demographics that favor digital housing platforms, we recommend investors take a ‘wait and see’ approach given numerous risks that, in our view, outweigh the opportunities near term. In particular, we are cautious on the road to stabilized profitability that will be highly dependent on adjacent services monetization. Further, well-entrenched incumbents are increasingly making progress on a more vertically integrated housing transaction,” Tomasello opined.

That perspective echoes the broader sentiment. Overall, most analysts remain skeptical about Opendoor’s staying power. The stock has a Moderate Sell consensus rating, based on a single Buy, 3 Holds, and 5 Sells. And the average price target, at just $1.44, suggests the Street largely sees the current rally as unsustainable, with an 82.5% drop still in the cards. (See OPEN stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.