Most businesses—like most investors—understand the value of diversification. But sometimes, circumstances may concentrate value with one customer, or even one region. That’s what happened to chip stock Nvidia (NASDAQ:NVDA), as an SEC filing recently revealed that a large part of its revenue can be traced back to one country: Singapore. The news had little impact on investors, as Nvidia was up fractionally in Friday afternoon’s trading, but perhaps it should be more of a concern.

The SEC report in question revealed that around 15% of the $2.7 billion Nvidia brought in last quarter can be traced back to Singapore. Singapore isn’t what anyone would call a big place, nor widely-known for its technological advancement. So why does it need so many chips from Nvidia? Jarick Seet with Maybank Securities advanced one notion: data centers. Data centers and cloud service providers were certainly one option, along with assembly projects that required chips in order to complete. Meanwhile, former Temasek executive Sang Shin noted much the same thing: Singapore is a highly-stable region in Asia, which made it excellent territory for setting up data centers.

Spreading Out into New Chips

While this news isn’t exactly bad news for Nvidia, it still may be a point of concern to keep an eye on. If something were to happen to a region that creates demand sufficient for 15% of your revenue, then it’s vital to keep track of that region and ensure nothing happens to hurt that demand flow. Granted, Nvidia has worked hard to diversify, branching out from gaming chips to data centers and, of course, artificial intelligence. But it’s still something to consider. After all, recent reports suggest that pricing on the new RTX 4090 chip has been on the rise for the last few months, and now, as one report called it, has “…officially gone berserk.” Moreover, supply problems are also showing up, and these increasingly pricey chips are also tough to find.

Is NVDA a Buy Right Now?

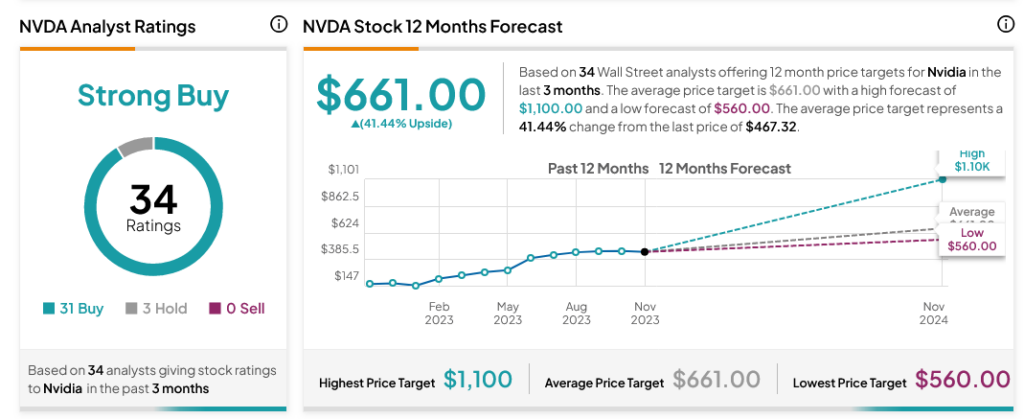

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 31 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 177.45% rally in its share price over the past year, the average NVDA price target of $661 per share implies 41.44% upside potential.