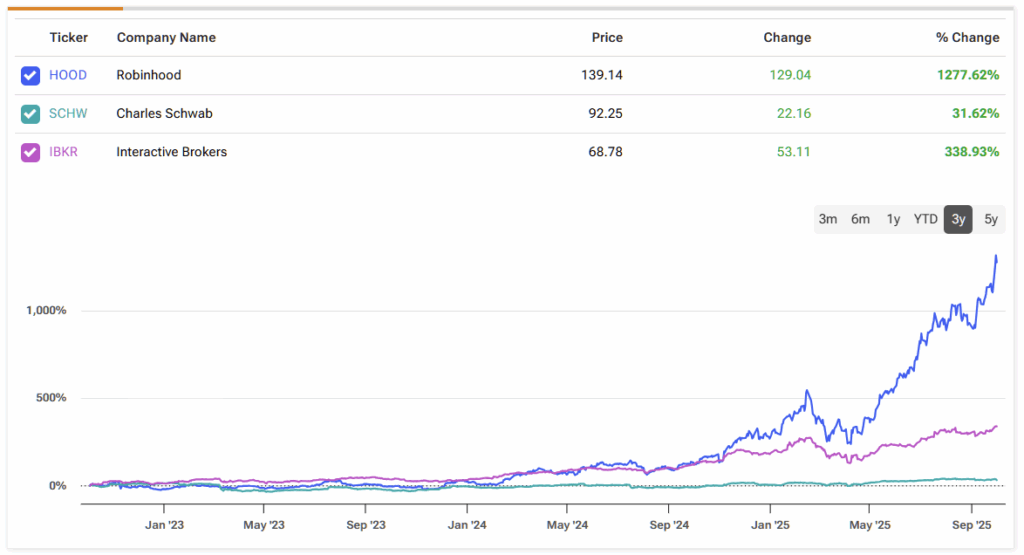

Within the financial services platform space, no other company has been able to capture the surge in bullish retail trading flows into equities and crypto as effectively as Robinhood Markets (HOOD)—especially this year. Momentum has been nothing short of massive, with the stock up more than 520% over the past twelve months and 250% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After several quarters of sharply higher trading activity and broader revenue diversification—driven mainly by its premium subscription service, Robinhood Gold, and new products such as retirement accounts, cash management, and a crypto wallet—the stock has been re-rated, with analysts steadily revising their short-, mid-, and long-term estimates upward.

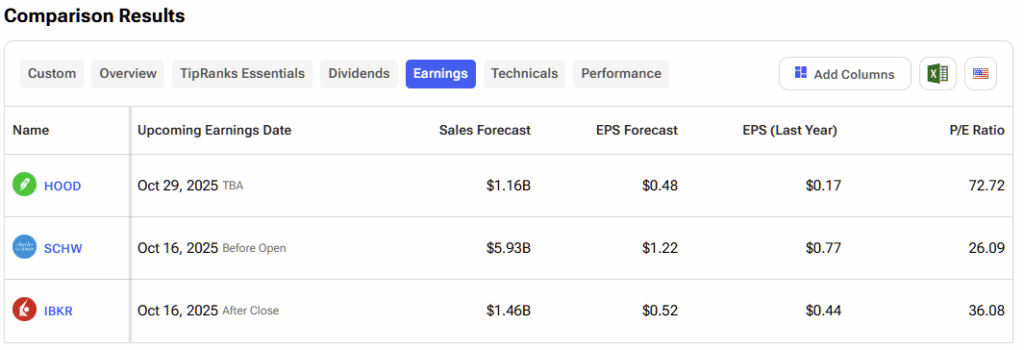

That said, while the investment case has become more fundamentally de-risked, valuations tell a different story. At 75x forward earnings, Robinhood trades at nearly double Interactive Brokers (IBKR) and more than three times that of Charles Schwab (SCHW). The valuation gap is challenging to fully justify, even though HOOD’s growth profile supports paying a premium.

Nevertheless, as long as equity markets continue to hit fresh highs on the back of AI enthusiasm and falling rate expectations, and demand for crypto remains strong, I don’t see momentum in HOOD fading anytime soon—regardless of how stretched the multiples are. In retail broking, volatility is king, so this year’s Trump-powered market turmoil has only rung the cash register for Robinhood.

For that reason, I’m staying stoutly Bullish on HOOD in the short to medium term, particularly heading into its late October earnings. But I remain cautious about holding it passively for the long run—at these lofty valuations, sharp pullbacks during periods of weaker retail trading activity seem almost inevitable.

Sky High Expectations Leave Room for Corrections

With Robinhood trading priced for perfection, there’s arguably little room for anything short of impressive numbers, as analysts have consistently raised their future expectations.

For example, the latest figures published by Robinhood for September showed a fairly steady balance between funded customer growth (10% year-over-year) and daily average revenue trades, which grew 32%, 33%, and 100% YoY in equities, options, and crypto, respectively—indicating strengthening monetization.

Looking ahead to the third quarter, to be reported on October 29, EPS and revenue expectations have been revised upward by 14.5% and 6.9%, respectively, now pointing to EPS of $0.46 (an impressive 180% YoY growth) and revenues of $1.16 billion (82.6% YoY growth).

On an annualized basis, analysts now expect 2025 revenues to be 2% higher than projected a month ago, reaching $4.14 billion (40.4% YoY growth), while EPS is estimated at $1.70 (8.9% YoY growth), about 6% above last month’s expectations.

Clearly, as U.S. markets and cryptocurrencies continue in a prolonged bull run (even though crypto activity has temporarily paused), Robinhood—rapidly expanding into prediction markets beyond just stocks, options, and crypto—has captured new revenue streams while increasing engagement and diversification, giving investors reason to raise their expectations.

The Limits of Robinhood’s Moat

However, even though the current environment justifies upwardly revised short- and mid-term expectations, I remain concerned about the long-term outlook given Robinhood’s business model. Based on the latest Q2 figures, Robinhood’s revenue mix is roughly 54% transaction-based (including equities, options, and crypto), 36% net interest (interest on customer balances, margin loans, etc.), and 9% other (primarily subscription fees, such as Robinhood Gold).

Although the growth in diversifying revenue through Gold subscriptions is notable—rising from 1.42 million subscribers at the start of 2024 to 3.19 million this year—the business remains highly dependent on trading volumes. During bear markets, or when retail investors become more risk-averse or simply lose interest, volumes drop, and the company’s main revenue pillar tends to collapse.

To put the fragility of Robinhood’s mix into perspective, the company most recently reported 26.7 million funded customers and $279 billion in AUC (Assets Under Custody), which works out to an AUC per client of ~$10,500—essentially the average value each client holds on the platform. By comparison, Interactive Brokers reported $713.2 billion in ending client equity across 3.87 million clients, which equates to roughly $184,000 per client, primarily from professional investors.

This more resilient, high-value customer base acts as a moat—something Robinhood still lacks. Other peers with such clients tend to perform less erratically in bear markets, as seen in 2022 when IBKR lost 9% of its market value while Robinhood lost more than half.

Is HOOD a Buy, Hold, or Sell?

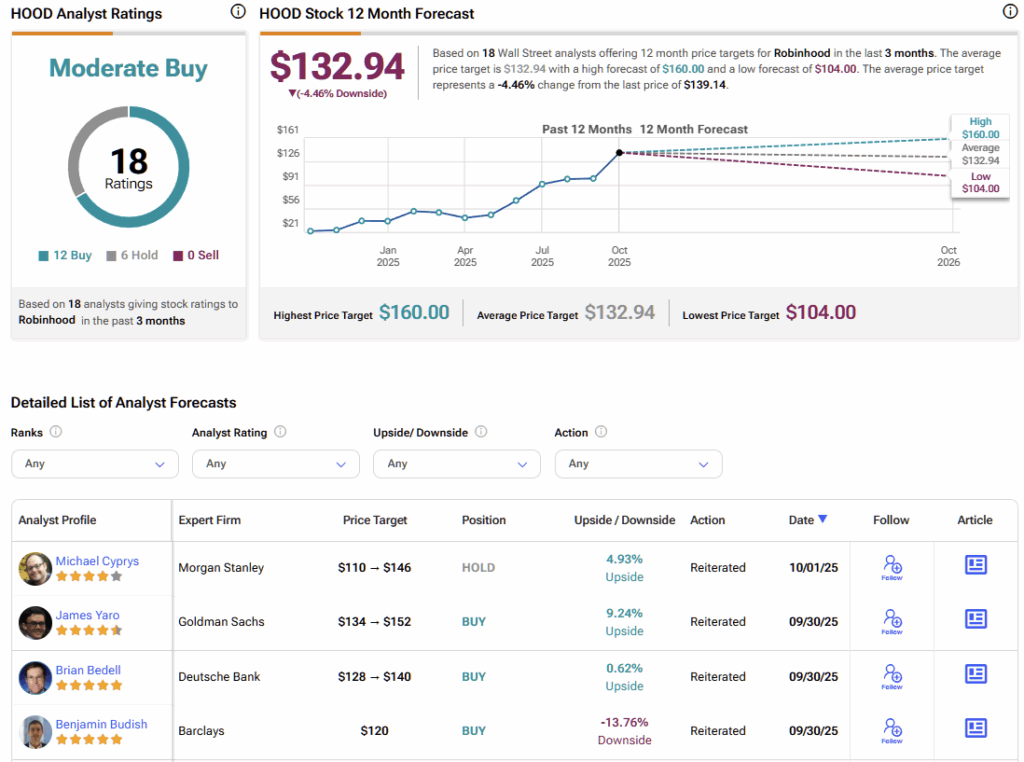

The consensus among Wall Street analysts remains bullish, though some moderation may be warranted. Of the 18 ratings on HOOD, twelve are Buy, and the remaining six are Hold. HOOD’s average stock price target currently sits at $132.94, implying a potential downside of ~4.5% from the latest share price.

Short-Term Bullish, Long-Term Caution

It’s hard to bet against rapidly expanding brokerage platforms that are benefiting from trading volume tailwinds in a bull market. Then there’s also the strong possibility of even plumper profits, if and when markets eventually correct. As they say in trading circles, markets rise like stairs and fall like elevators. Robinhood’s reach among retail investors, combined with clear improvements in its revenue mix, positions the company to continuously revise expectations upward—likely to continue as long as volatility in equities and cryptos persists.

From a short- to mid-term perspective, especially with the Fed likely to turn more dovish later this year, the trend suggests Robinhood’s momentum will remain bullish, despite trading at eye-watering valuation multiples.

My concern, however, lies in the long term, because HOOD carries implicit leverage to bullish retail flows, which can evaporate quickly once enthusiasm fades. For now, I maintain a Buy rating, not believing it’s time to take my foot off the accelerator, but I remain cautious long term, as HOOD isn’t a stock suited for a “buy and forget” approach.