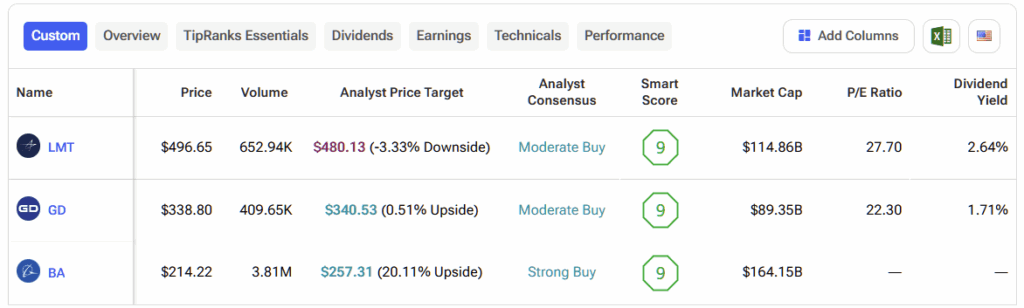

Markets have been quick to separate leaders from laggards this year, and aerospace & defense has clearly emerged at the front of the pack. The backdrop is straightforward: global military spending hit a record $2.7 trillion last year, and NATO is pressing its members to boost defense budgets significantly over the next decade—a tailwind for major players like Lockheed Martin (LMT), General Dynamics (GD), and Boeing (BA).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

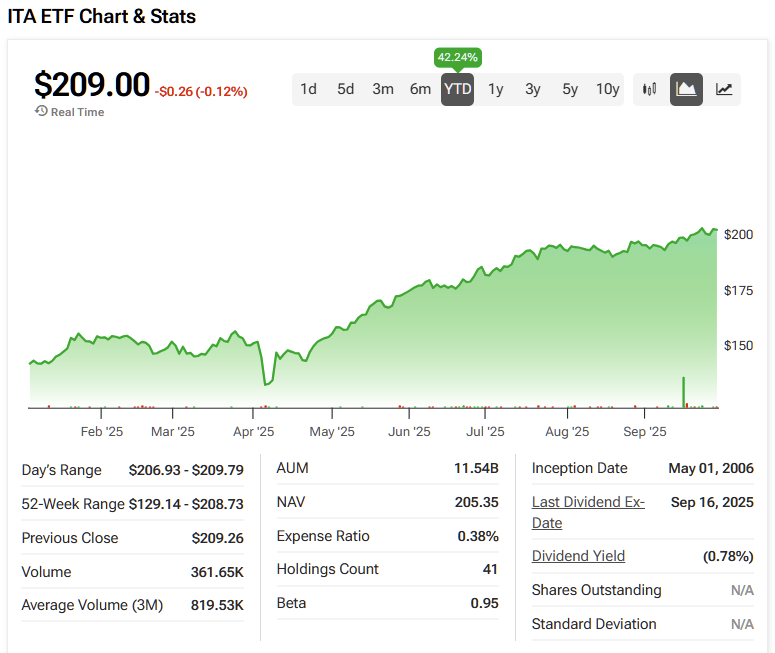

eflecting that momentum, the iShares U.S. Aerospace & Defense ETF (ITA) has surged about 42% year-to-date, far outpacing the S&P 500’s (SPX) mid-teens gain.

In this environment, LMT, GD, and BA have catalysts fueling their ascent, including clarity on a fresh F-35 order for LMT, a Gulfstream delivery up-cycle and a submarine backlog for GD, and early signs of operational normalization (along with a new narrow-body narrative) at BA. For these reasons, I am Bullish on all three stocks as the U.S. administration adds further runway to their operations.

Lockheed Martin (NYSE:LMT)

Lockheed has finally “definitized” F-35 Lots 18–19, nearly 300 jets, locking in pricing below inflation on a per-aircraft basis and deliveries that are set to kick off in 2026. That removes months of speculation about timing and economics and, frankly, gives investors a concrete yardstick for Aeronautics volume through the end of the decade.

Layer on an $11 billion CH-53K package for Sikorsky and ongoing hypersonics work (CPS momentum, ARRW procurement lines showing faint signs of life), and you’ve got a backlog that is set to produce excellent cash flows over the medium term.

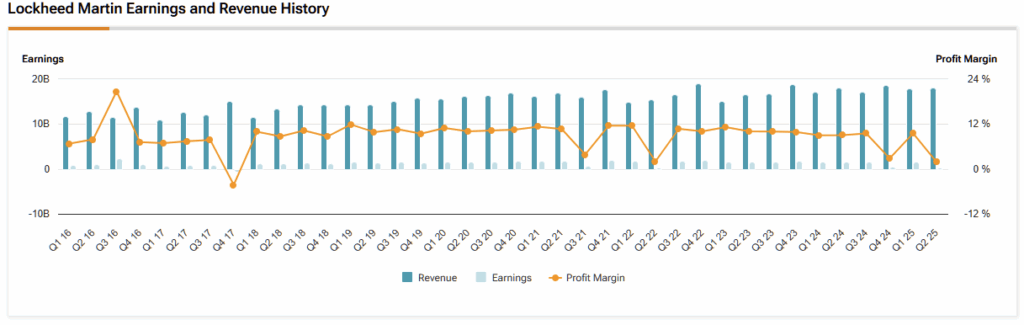

Yes, Q2 was messy, with program losses tied to a classified effort, and the well-telegraphed TR-3 drag on F-35 deliveries made the P&L look worse than the demand picture. Nevertheless, management still cited higher F-35 production volumes within Aeronautics, and the pipeline of sustainment work (see Poland) serves as a reminder that this franchise generates cash well beyond airframe shipments.

So, if what you wanted was a catalyst, you’ve just received two, including a substantial order book with pricing clarity and a clear runway to work through TR-3. In the meantime, LMT stock is trading at 22.5x forward EPS, in line with the sector’s average.

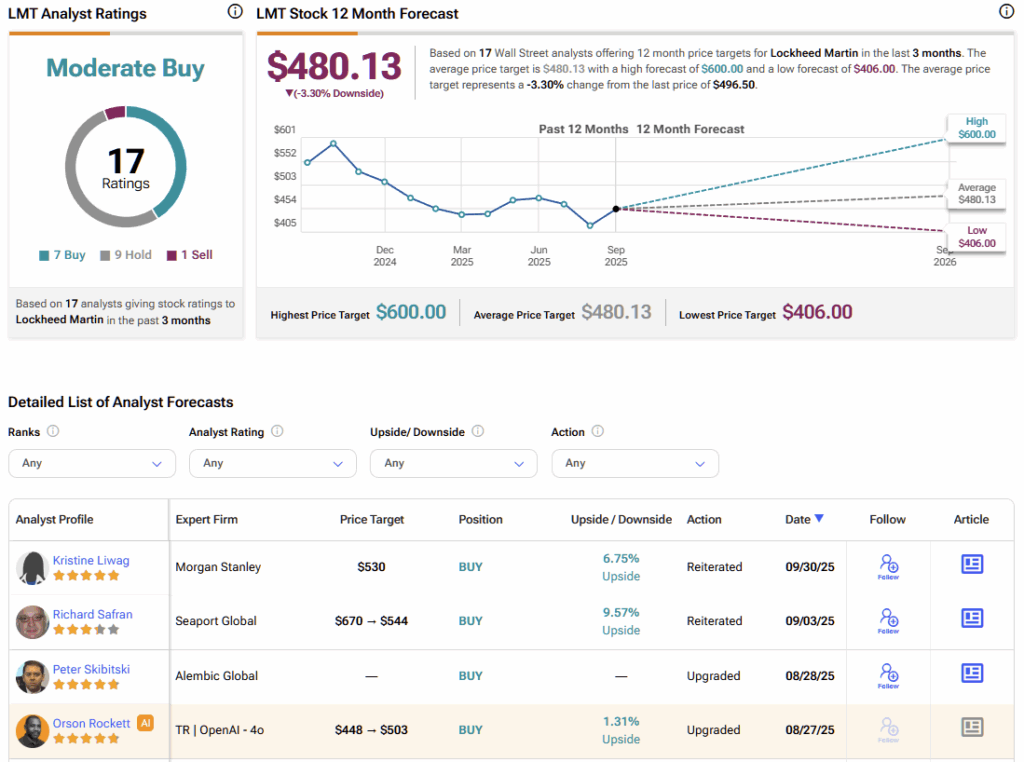

Is Lockheed Martin Stock a Buy, Hold, or Sell?

Analyst sentiment seems bullish on Lockheed Martin at first glance, with the stock carrying a Moderate Buy consensus rating, based on seven Buy, nine Hold, and one Sell ratings assigned over the past three months. However, LMT’s average stock price target of $480.13 implies ~4% downside over the next twelve months, suggesting Wall Street believes the stock is already priced to perfection.

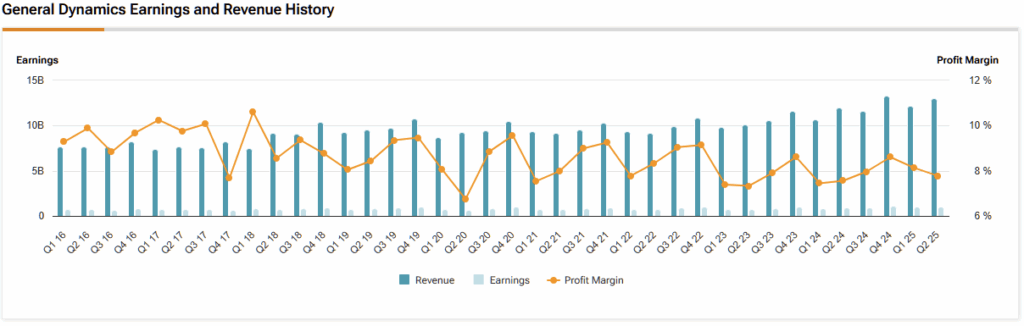

General Dynamics (NYSE:GD)

After a long runway of promises, Gulfstream’s execution is landing. The G700s are in motion, the G800 is certified and shipping, and orders versus deliveries have remained favorable, keeping a positive sentiment in recent months. That mix juices margins as completions flow and retrofit noise fades. Management’s Q2 color pointed to healthy demand at the top of the cabin market, the kind of “show me” quarter that actually showed something.

Then there’s Marine Systems, with its Columbia and Virginia programs putting real muscle behind backlog and revenue growth, thanks to long-lead funding and award momentum that keeps production solid. Q2 revenue rose nearly 9% with operating leverage intact. The marine segment was the standout, helping to push shares higher on the print.

So net-net: you’re getting a business-jet up-cycle tied to deliveries you can track and a submarine franchise with visibility that politicians practically underwrite. Finally, at about 21.8x forward EPS, GD stock is trading slightly below the sector’s average multiple of 22.5.

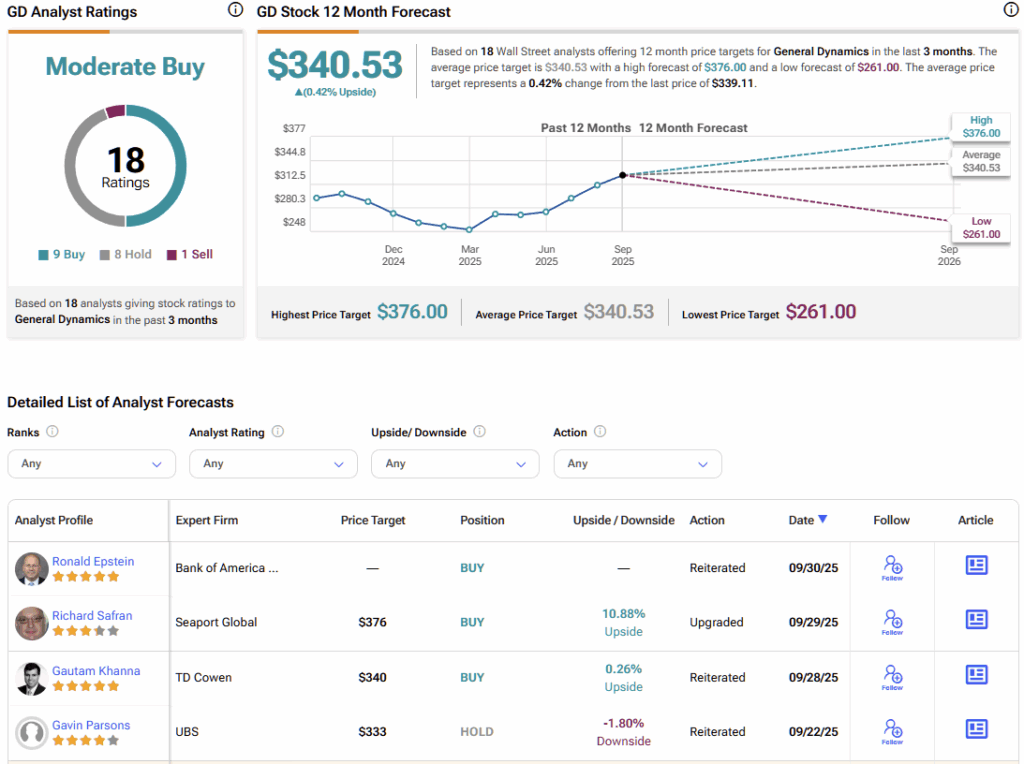

Is General Dynamics Stock a Good Buy?

On Wall Street, GD stock features a Moderate Buy consensus rating, based on nine Buy, eight Hold, and one Sell ratings. However, GD’s average stock price target of $340.53 implies no upside potential over the next 12 months, suggesting Wall Street believes shares are already fully priced here as well.

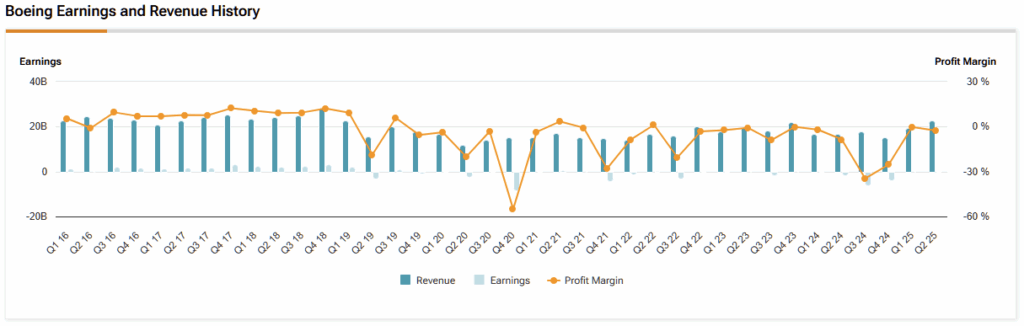

Boeing (NYSE:BA)

Boeing’s second quarter wasn’t a victory lap, as losses persisted. Nevertheless, the pieces finally looked in place, with 150 commercial deliveries, 737 output stabilized around the FAA’s 38-per-month cap, backlog north of $600 billion, and modest operating cash stabilization. The CEO’s playbook has revolved around cultural rehabilitation first, rate discipline second, and growth later. That discipline is paying off in fewer nasty surprises and a gradually improving delivery cadence.

What lifted sentiment? Early normalization signals, including the FAA reinstating limited cert authority and reassessing processes, but the cap hasn’t budged. Yesterday’s news of early work on a 737 successor also added a fresh, medium-term narrative beyond “fix today’s line, please.” So, the upside is still execution-dependent, but the equity finally has catalysts you can model, such as delegation, rate steps, and a new-airplane option value, rather than just headlines to duck. At 22.9x forward earnings, BA stock isn’t trading far from its sector peers.

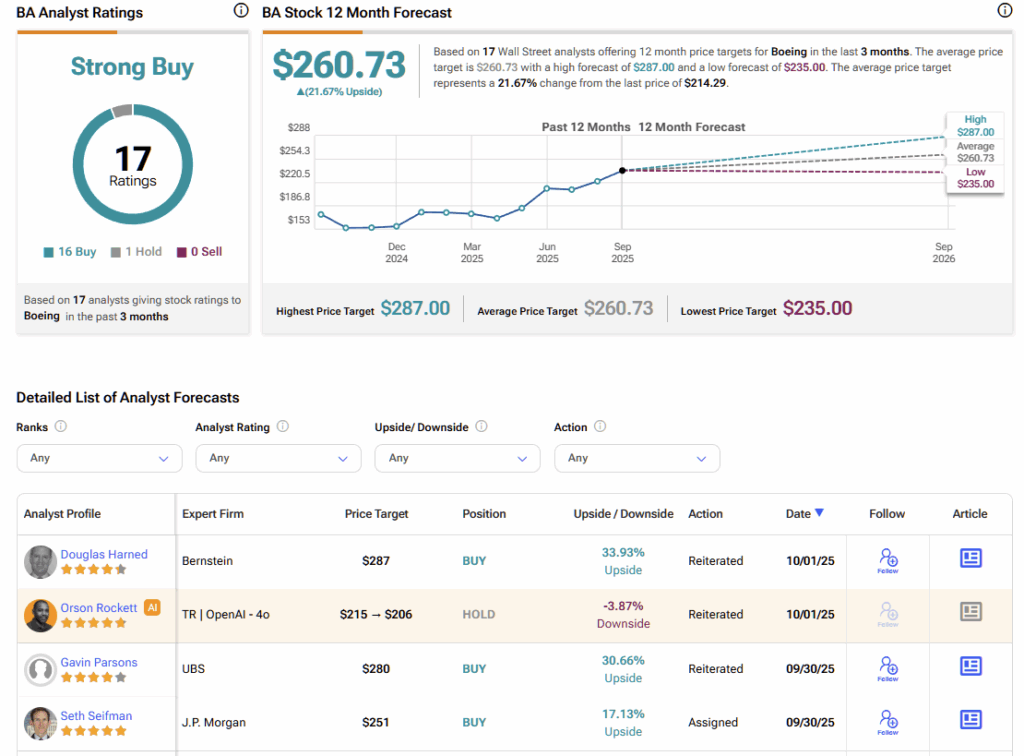

Is Boeing a Buy, Hold, or Sell?

Boeing is now covered by 17 Wall Street analysts, and sentiment is extremely bullish. The stock carries a Strong Buy consensus driven by 16 Buy and one Hold ratings. Notably, no analyst rates the stock a Sell. In the meantime, Boeing’s average stock price target of $260.73 indicates ~21% upside potential over the next twelve months.

Aerospace Rides the Rising Tide of Defense Spending

Defense spending is driving the sector forward, rewarding companies that have near-term catalysts in play. For Lockheed Martin, the F-35 program and wins in rotary and hypersonics provide visibility well into 2026 and beyond, even as management works through TR-3 disruptions. General Dynamics offers a cleaner execution story, with momentum in business jets and a strengthening submarine backlog.

Boeing remains the turnaround name—still under the FAA’s watch but steadily moving toward operational normalization while hinting at a next-generation narrow-body that could redefine the competitive landscape. Each stock carries a different risk profile, yet all share the same powerful tailwinds of rising defense budgets and reinforced backlogs.