Riding government coattails may become an investment strategy in its own right, given the Trump administration’s growing influence on global markets. That may be the thinking for potential Lithium Americas (LAC) investors. The pre-revenue lithium developer, which is advancing the Thacker Pass project in Nevada, has gained strong momentum from recent regulatory tailwinds aimed at strengthening U.S. lithium production—now regarded as a strategic national security priority.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

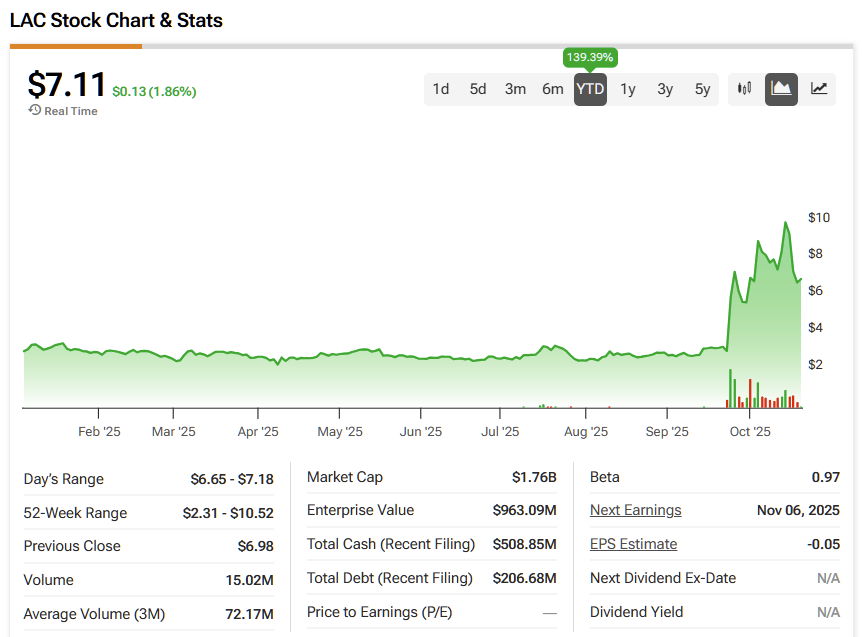

The stock has more than doubled year-to-date, with most rallies occurring over the past three weeks following media reports on September 23 suggesting that the U.S. government may seek an equity stake in the lithium producer.

Backed by funding from the Department of Energy and General Motors (GM), Lithium Americas appears on course to begin commercializing the Thacker Pass by 2027. However, I maintain a Neutral outlook on the stock, as the recent surge seems to have priced in much of the optimism, leaving shares trading near fair value in the near term.

Ample Funding For Phase 1 Completion

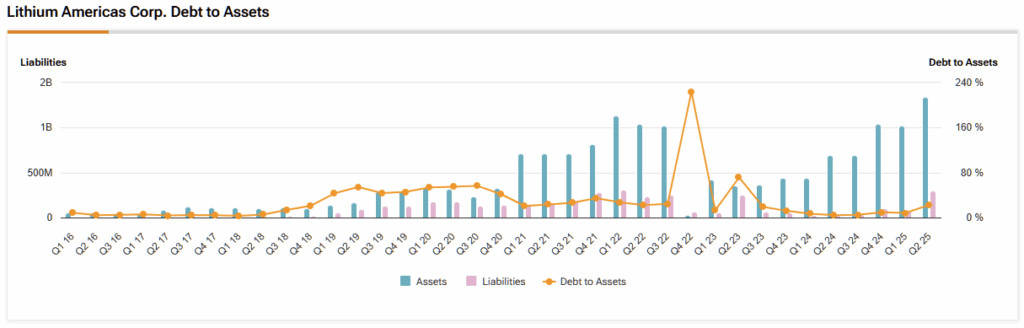

Securing funding to carry out expensive development efforts is often the biggest barrier to commercialization for a pre-revenue mining company. However, Lithium Americas does not seem to struggle with this problem, thanks to securing funding from several different sources.

First, Lithium Americas has secured $2.23 billion from the DOE. Per the updated loan agreement, the U.S. government will receive a 5% equity stake (through warrants) in the company in exchange for these funds and a 5% economic stake in the Thacker Pass joint venture.

The first part of the loan disbursement for $435 million is expected in Q4 this year. The updated terms also provide more flexibility for Lithium Americas, including a deferral of $182 million in debt service during the first five years of the loan term. In addition, the new terms allow the company to sell any unsold lithium production to third-party customers (originally, Phase 1 production was to be sold only to General Motors as part of a JV agreement).

In addition to government funding, Lithium Americas raised $625 million last year by entering into a joint venture with General Motors. The automaker received a 38% asset-level interest in the Thacker Pass project as part of the deal. Partnering with one of the biggest automakers in the world has not only boosted the funding availability for Lithium Americas but also boosted its investment appeal, given that it significantly reduces the commercialization risks, as General Motors has agreed to purchase lithium products from the company.

Lithium Americas has also received an investment of $250 million from Orion Resource Partners. According to company filings, Phase 1 of the Thacker Pass project is expected to incur CapEx of around $2.9 billion, and the company has already secured funding to cover this.

Thacker Pass Repositions LAC Among Its Peers

For any global miner, long-term profitability hinges on the quality of its assets, the cost of extraction, and the economic life of those resources. By these standards, Lithium Americas’ Thacker Pass project ranks among the world’s premier lithium deposits. With an estimated 85-year mine life, the project offers substantial longevity—positioning the company to benefit from rising lithium demand fueled by the accelerating adoption of electric vehicles and the growth of the energy storage sector.

Beyond its exceptional longevity, Thacker Pass is expected to be among the most cost-efficient lithium operations worldwide, significantly enhancing its profitability potential. According to company filings, the all-in sustaining cost (AISC) of lithium production is projected at $7,508 per ton of LCE, positioning it near the lowest-cost producers globally. Even during the current lithium price downturn—when spot prices bottomed around $9,000 per ton—the project would likely have remained profitable.

Moreover, the project’s modular, five-phase development plan could eventually bring total production capacity to 160,000 tons annually, placing Lithium Americas among the world’s largest lithium producers once fully operational.

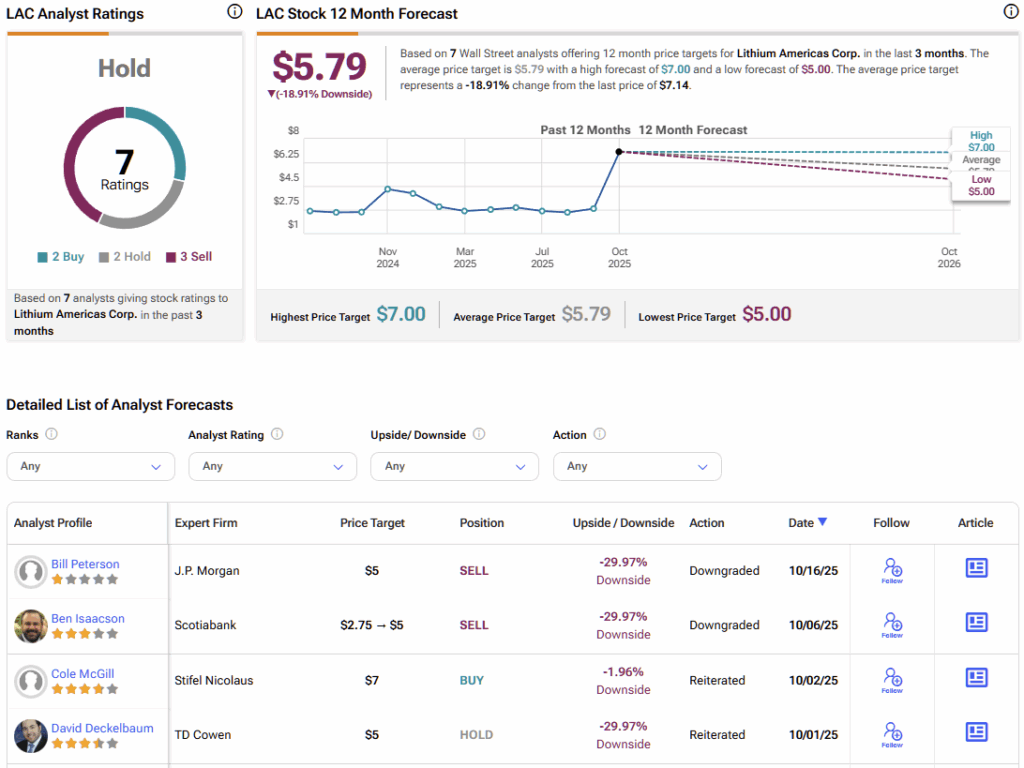

Is LAC a Good Stock to Buy?

The recent surge in Lithium Americas’ stock price has likely pushed the company into overvalued territory, at least by Wall Street’s current estimates. According to seven analysts, LAC stock carries an average price target of $5.79, implying roughly 19% downside from current levels.

I share the view that Lithium Americas no longer appears undervalued. As a pre-revenue company, there remains considerable execution risk ahead. Despite generating no revenue, Lithium Americas already commands a market capitalization of nearly $2 billion, and mechanical completion of Thacker Pass Phase 1 is not expected until 2027, leaving ample time for potential setbacks.

Meanwhile, the electric vehicle (EV) industry is facing a slowdown, which could temporarily dampen government investment and sector momentum. Nonetheless, from a long-term perspective, Lithium Americas remains well-positioned to benefit from the sustained growth of the global lithium market.

After a Big Rally, Lithium Americas Looks Overvalued

Lithium Americas has secured adequate funding to advance the first phase of the Thacker Pass project, while its joint venture with General Motors has significantly de-risked commercialization efforts. The company’s ownership stake in this long-life, low-cost lithium asset positions it to potentially generate strong economic returns over time—provided development proceeds as planned.

With all that considered, while there is much to like about Lithium Americas’ long-term prospects, I maintain a Neutral stance on the stock at current levels. The recent rally appears to have eroded the margin of safety, making it difficult to justify new exposure to a pre-revenue company in the near term.