Irvine, CA-based fitness franchisor Xponential Fitness (NYSE:XPOF) has seen its shares slide 56% over the past year. However, its upbeat Q4 revenue, coupled with plans to initiate a $100 million share buyback, has seen the shares jump 19% in the past five days. Despite the recent volatility, XPOF’s growth potential is piquing the interest of investors and financial analysts alike.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unfolding Xponential’s Journey

Xponential Fitness has garnered a reputation for curating unique brands under its umbrella, including Club Pilates, Pure Barre, CycleBar, StretchLab, Row House, YogaSix Rumble, AKT, and STRIDE. The company’s primary revenue generation stream is the income from franchising these brands.

By the end of 2023, the company successfully operated 3,062 open studios globally, increasing this number by 557 new studios within the year, or roughly an average of 1.5 new studios opened daily. The company has indicated that this momentum is set to continue into 2024.

Xponential Fitness’ most recent acquisition is a chain of clinics called Lindora that offers wellness treatments and access to weight-loss medications. This acquisition will allow the company to participate in the rising demand among Americans for longevity-focused treatments like IV vitamin drips, biological-age testing, and peptide injections.

Recent Financial Results

Xponential recently reported its fourth-quarter results. The company posted earnings of $0.08 per share, falling short of the consensus estimate of $0.18. However, the company’s revenue increased 26.6% year-over-year to about $90.2 million, outperforming analysts’ expectations of $81.71 million.

The top line gained from higher-than-anticipated equipment and merchandise sales to franchisees. However, the company’s operating margin and EPS fell shy of Wall Street’s predictions due to lower-than-expected high-margin franchise revenue.

Meanwhile, the company announced a new two-year $100 million share repurchase program, using surplus operating cash to buy back shares. XPOF shares saw a significant boost following the announcement, soaring 26.6%.

Is Xponential Fitness a Buy?

XPOF trades towards the lower end of the 52-week range of $8.30 to $33.58, with bullish technical indicators – above the 20-day moving average price of $10.91 and a 50-day moving average price of $11.42. Interestingly, XPOF stock trades below the historical 5-year average (52.66x) on an EV-to-EBITDA basis (14.37x), so it may represent a value at this level.

Xponential continues to elicit optimistic forecasts from multiple research firms. Citigroup’s James Hardiman has reiterated his Buy recommendation, with a slight reduction in price target to $21 from $23. He views the company positively, citing its potential for recovery and impressive revenue growth.

Similarly, Lake Street’s Ryan Meyers also lowered the price target to $32 from $41 but maintained a Buy rating on XPOF stock, emphasizing “high conviction” in Xponential on the back of its solid Q4 results.

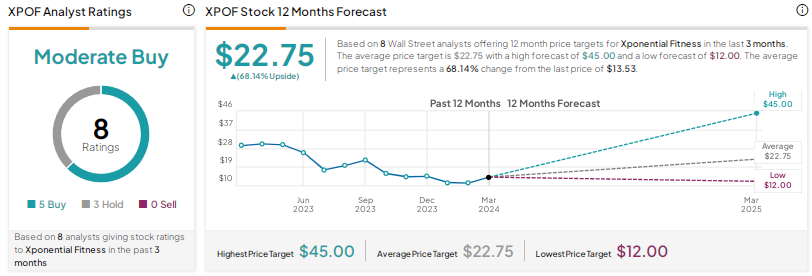

Based on five Buys and three Holds, XPonential Fitness earns Wall Street’s Moderate Buy consensus rating. The average price target of $22.75 indicates a 68.1% upside from current levels.

The Long Game

Xponential Fitness has demonstrated success in adding divergent health and wellness brands to its repertoire. XPOF’s future growth trajectory is tethered to its ability to accrue and efficiently manage this diversified portfolio and its inherent capacity to align with wellness trends and market demand.

Given that most analysts have a Buy recommendation and and the stock is trading towards the lower end of its 52-week range, XPOF presents a potential value proposition for investors willing to play the long game and look past recent volatility.