XORTX Therapeutics (XRTX) stock rallied on Friday after the biopharmaceutical company announced an agreement to acquire a Renal Anti-Fibrotic Therapeutic Program from Vectus Biosystems Limited ($AU:(VBS). This program includes VB4-P5, a novel new chemical entity currently in the pre-Investigational New Drug stage of development. The deal also includes intellectual property, regulatory documentation, and manufacturing data associated with VB4-P5.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

VB4-P5 is a candidate in development for the treatment of rare and prevalent forms of kidney disease. XORTX Therapeutics noted that chronic kidney disease affects 14% of adults globally. That includes 35 million to 37 million in the U.S. Early data from investigations of VB4-P5 show it has the potential to inhibit and possibly reverse kidney fibrosis.

XORTX Therapeutics CEO Dr. Allen Davidoff said, “The opportunity to acquire the VB4-P5 program was highly compelling. This program is underpinned by a novel, patented small molecule with robust global patent protection and strong preclinical evidence. It is directly aligned with our strategic focus on developing innovative therapies for progressive kidney disease, and it builds upon our mission to bring new classes of treatments to patients suffering from rare renal disorders.”

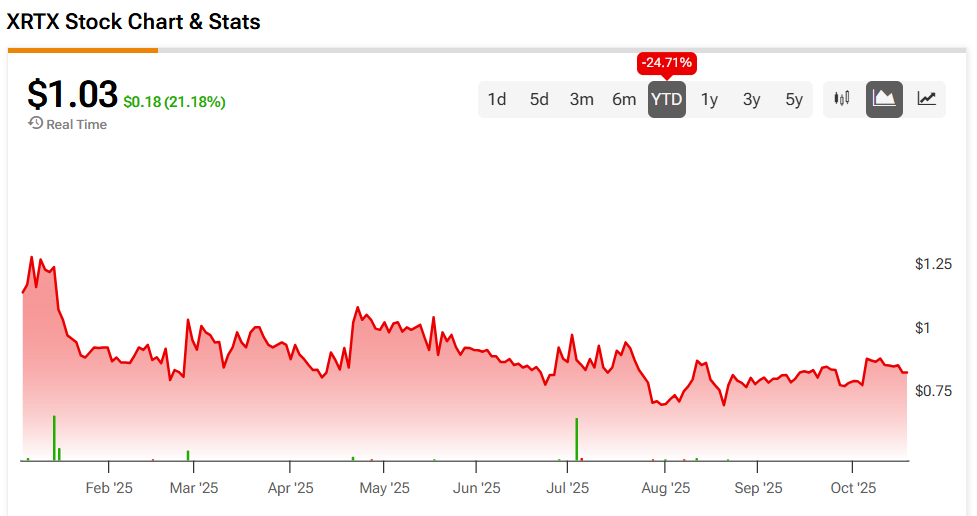

XORTX Therapeutics Stock Movement Today

XORTX Therapeutics stock was up 21.18% on Friday but remained down 24.71% year-to-date. The shares have also decreased 54.79% over the past 12 months.

Today’s news excited investors and triggered heavy trading of XRTX stock. This had some 7 million shares traded as of this writing, compared to a three-month daily average of about 44,000 units.

It’s unclear the effect this news will have on Vectus Biosystems Limited stock, as the Australian Securities Exchange is currently closed. Investors will have to wait until Monday to see what this deal means for VBS shares.