Super League Enterprise (SLE) stock rocketed higher on Tuesday after the esports leagues and events management company announced a private placement to raise funds from accredited investors. The private placement is being led by a $10 million strategic equity investment from Evo Fund. Investors will note that Evo Fund is a sponsor of digital asset treasury companies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Super League Enterprise said that it expects to raise between $12 million and $20 million from the private placement. It also expects the private placement to close sometime after its Annual General Meeting of Stockholders in October. Once complete, the funding from the private placement will remove its debt, strengthen its balance sheet, and allow the company to regain Nasdaq compliance by meeting equity listing requirements.

Matt Edelman, President and CEO of Super League Enterprise, said, “Together with the recent reductions in our cost structure, this transaction will set us firmly on a path to creating durable, long-term value for our shareholders as a gaming media company poised to enter the crypto economy.”

Super League Enterprise Stock Movement Today

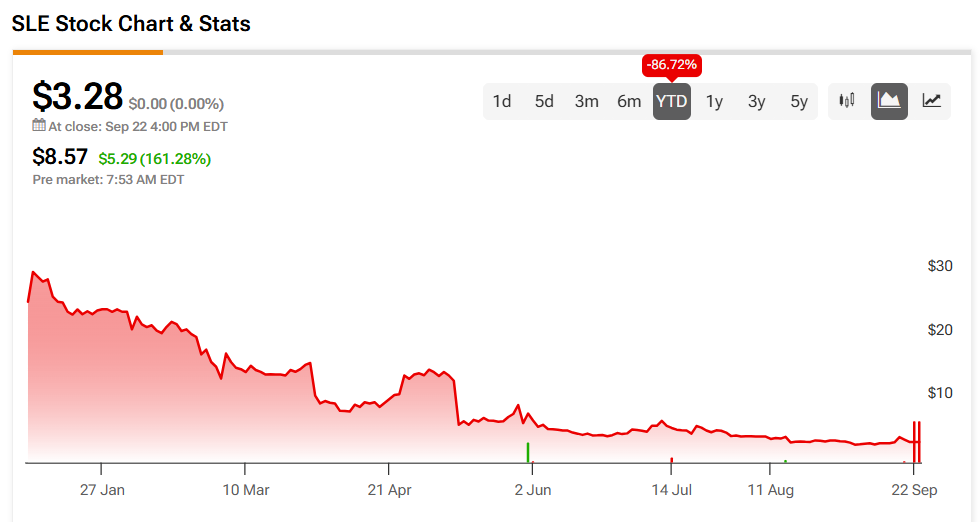

Super League Enterprise stock was up 161.28% in pre-market trading on Tuesday but was still down 86.72% year-to-date. The shares have also fallen 87.39% over the past 12 months. Today’s news came with heavy trading, as more than 12 million shares changed hands, compared to a three-month daily average of about 103,000 units.

Is Super League Enterprise Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Super League Enterprise is Moderate Buy, based on a single Buy rating over the past three months. With that comes an SLE stock price target of $3.50, representing a potential 6.71% upside for the shares.