Rani Therapeutics (RANI) stock rocketed higher on Friday after the clinical-stage biotherapeutics company announced the results of an oversubscribed private placement. The company reached a securities purchase agreement with certain institutional and accredited investors, including its Executive Chairman Mir Imran and new investor Samsara, for the purchase of RANI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under the terms of this securities purchase agreement, Rani Therapeutics will sell 42,633,337 shares of RANI stock for 48 cents per share alongside 82,366,667 pre-funded warrants. Additionally, each share and pre-funded warrant will come with one warrant to purchase a share of RANI stock. These warrants have an exercise price of 48 cents, can be immediately exercised, and will expire five years after issuance.

Rani Therapeutics expects gross proceeds of $60.3 million from this private placement. The company expects to use the net proceeds of this private placement to continue the advancement of its pipeline using the RaniPill platform.

Rani Therapeutics Stock Movement Today

Rani Therapeutics stock was up 150.58% in pre-market trading on Friday, following a 3.98% dip yesterday. The shares have fallen 65.63% year-to-date and 82.43% over the past 12 months. With today’s news came heavy trading, as some 70 million shares changed hands, compared to a three-month daily average of about 318,000 units.

Is Rani Therapeutics Stock a Buy, Sell, or Hold?

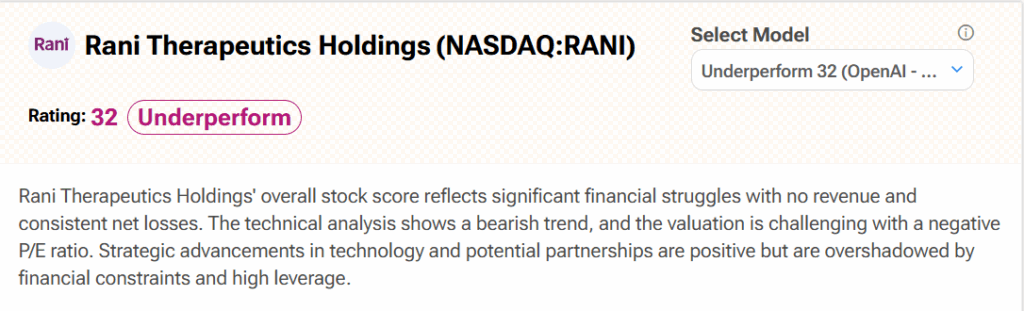

Turning to Wall Street, analyst coverage of Rani Therapeutics is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates RANI stock an Underperform (32) with no price target. It cites “significant financial struggles with no revenue and consistent net losses” as reasons for this stance.